ASML Faces Setback as Huawei Innovates Beyond EUV Restrictions with Breakthrough Patent

Author: Anusuya Lahiri | March 22, 2024 10:30am

Huawei Technologies Co and a confidential chipmaking partner in China have been advancing in semiconductor technology through patents for self-aligned quadruple patterning (SAQP), a method potentially circumventing the need for high-end lithography equipment barred by US export controls.

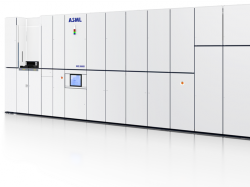

These developments, detailed in Chinese patent filings, could enable the production of advanced semiconductors without relying on extreme ultraviolet lithography (EUV) machines from ASML Holding NV (NASDAQ:ASML), the sole supplier forbidden from selling these machines to China. The ASML stock price declined after the update.

Quadruple patterning aims to enhance transistor density on silicon wafers, boosting chip performance, Bloomberg reports.

Also Read: Alibaba Unveils New Processor and Open-Source Laptop Based On RISC-V Processors

Huawei’s patent suggests this technology could increase circuit pattern design freedom, hinting at progress in creating more sophisticated chips.

State-backed SiCarrier, collaborating with Huawei, secured a patent that utilizes deep ultraviolet lithography (DUV) alongside SAQP for achieving benchmarks comparable to 5 nanometer (nm) chips, indicating a stride towards cost-effective manufacturing without EUV technology.

Huawei’s introduction of a smartphone powered by an advanced 7nm processor last year marked a significant achievement for China.

In November, Huawei outbid Nvidia Corp (NASDAQ:NVDA) for a significant artificial intelligence chip order from the Chinese tech giant Baidu Inc (NASDAQ:BIDU) as the U.S. sanctions kicked in.

Alibaba Group Holding Limited (NYSE:BABA) and peers reportedly planned to cut their orders for Nvidia chips significantly. Reports suggest that Chinese cloud companies, which procure almost 80% of their high-end AI chips from Nvidia, might reduce their orders by 50% – 60% over the next five years.

In 2023, China saw its imports of chipmaking machines soar by 14% to nearly $40 billion, a record since 2015, despite a 5.5% fall in overall imports.

Last year also saw a significant increase in China’s imports from the Netherlands in anticipation of impending export controls, notably affecting Semiconductor Manufacturing International Corp.

Imports of lithography equipment from the Netherlands surged by nearly 1,000% to $1.1 billion in December as companies rushed to buy equipment ahead of new Dutch restrictions.

Price Actions: ASML shares traded lower by 1.59% at $975.01 on the last check Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via ASML

Posted In: ASML BABA BIDU NVDA