Forecasting The Future: 7 Analyst Projections For Inari Medical

Author: Benzinga Insights | March 22, 2024 10:01am

Across the recent three months, 7 analysts have shared their insights on Inari Medical (NASDAQ:NARI), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

0 |

3 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

3 |

0 |

2 |

0 |

0 |

| 2M Ago |

1 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

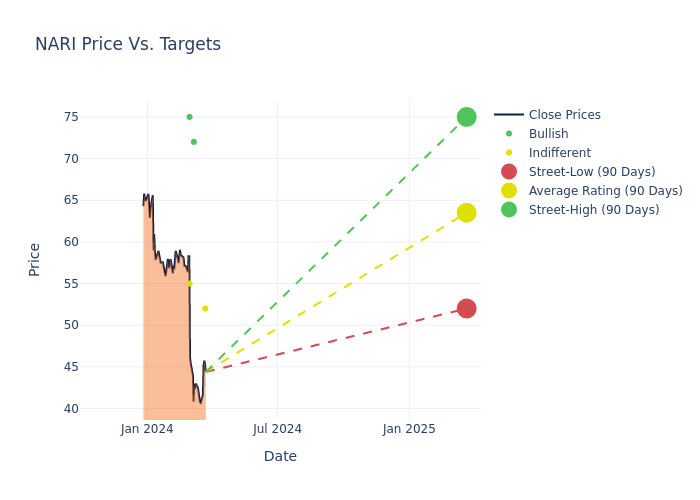

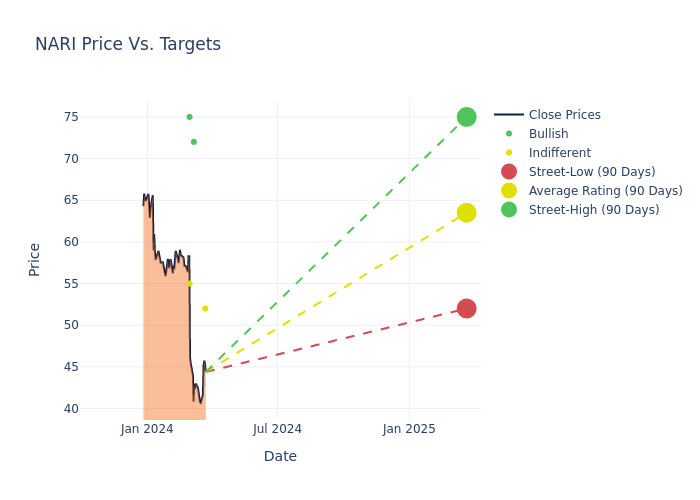

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $65.57, along with a high estimate of $75.00 and a low estimate of $52.00. Highlighting a 8.93% decrease, the current average has fallen from the previous average price target of $72.00.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Inari Medical. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Richard Newitter |

Truist Securities |

Lowers |

Hold |

$52.00 |

$61.00 |

| Mike Matson |

Needham |

Maintains |

Buy |

$72.00 |

- |

| Mike Matson |

Needham |

Maintains |

Buy |

$72.00 |

- |

| Richard Newitter |

Truist Securities |

Lowers |

Hold |

$61.00 |

$63.00 |

| Adam Maeder |

Piper Sandler |

Lowers |

Neutral |

$55.00 |

$85.00 |

| William Plovanic |

Canaccord Genuity |

Lowers |

Buy |

$75.00 |

$79.00 |

| Mike Matson |

Needham |

Announces |

Buy |

$72.00 |

- |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Inari Medical. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Inari Medical compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Inari Medical's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Inari Medical's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Inari Medical analyst ratings.

All You Need to Know About Inari Medical

Inari Medical Inc is a medical device company focused on developing products to treat patients suffering from Chronic Venous Disease. Its product portfolio includes; ClotTriever, for the removal of the clot from peripheral blood vessels and treats patients suffering from deep vein thrombosis. The FlowTriever System product is used for the treatment of pulmonary embolism, InThrill system to treat small vessel thrombosis, LimFlow system and others. Geographically, the company generates majority of its revenue from United States and rest from International markets.

Key Indicators: Inari Medical's Financial Health

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Inari Medical's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 22.57%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Inari Medical's net margin is impressive, surpassing industry averages. With a net margin of -3.53%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Inari Medical's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -1.02% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -0.76%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.07, Inari Medical adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: NARI