What the Options Market Tells Us About Netflix

Author: Benzinga Insights | March 20, 2024 02:45pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Netflix.

Looking at options history for Netflix (NASDAQ:NFLX) we detected 71 trades.

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 63% with bearish.

From the overall spotted trades, 32 are puts, for a total amount of $1,611,304 and 39, calls, for a total amount of $2,200,030.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $5.0 and $1100.0 for Netflix, spanning the last three months.

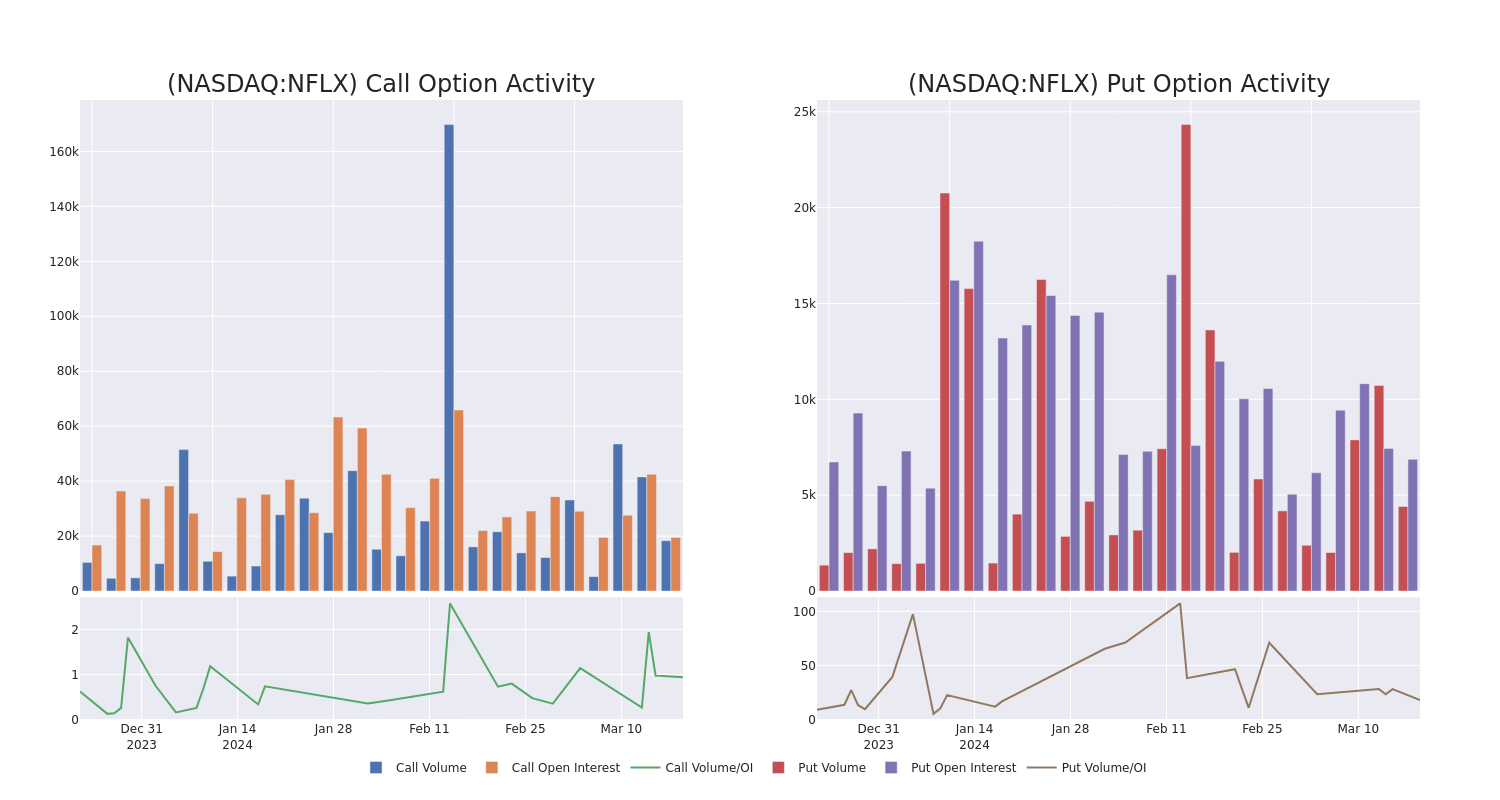

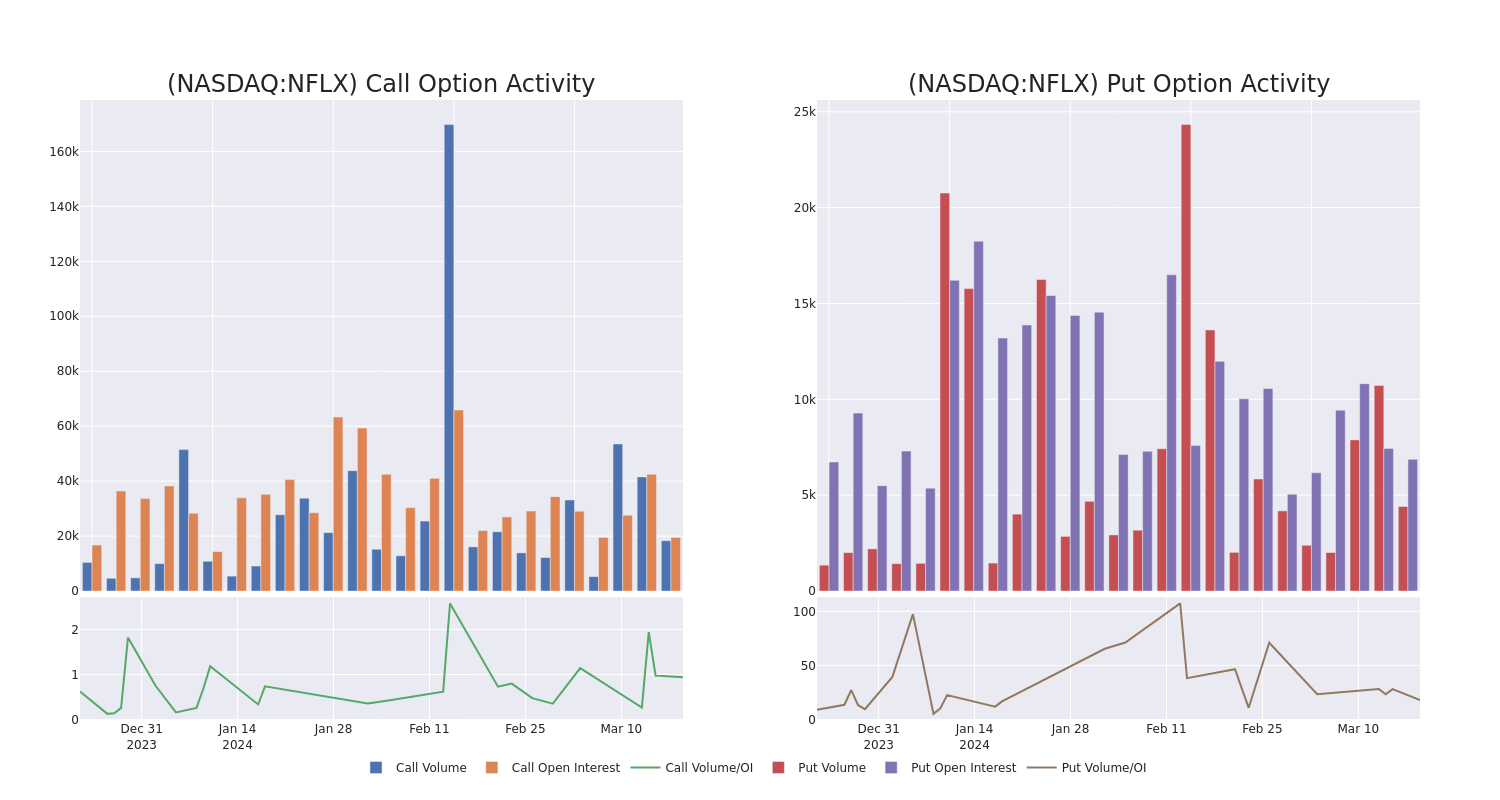

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Netflix's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Netflix's whale trades within a strike price range from $5.0 to $1100.0 in the last 30 days.

Netflix 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NFLX |

CALL |

SWEEP |

BEARISH |

04/19/24 |

$380.00 |

$192.9K |

24 |

8 |

| NFLX |

CALL |

TRADE |

BEARISH |

05/17/24 |

$610.00 |

$168.9K |

1.0K |

28 |

| NFLX |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$500.00 |

$162.0K |

2.1K |

1 |

| NFLX |

CALL |

TRADE |

BULLISH |

03/28/24 |

$650.00 |

$108.2K |

10.0K |

2.2K |

| NFLX |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$560.00 |

$108.1K |

347 |

28 |

About Netflix

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with almost 250 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Where Is Netflix Standing Right Now?

- With a volume of 1,100,635, the price of NFLX is down -0.15% at $619.81.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 29 days.

Expert Opinions on Netflix

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $694.0.

- An analyst from Keybanc persists with their Overweight rating on Netflix, maintaining a target price of $705.

- An analyst from Evercore ISI Group persists with their Outperform rating on Netflix, maintaining a target price of $640.

- An analyst from Oppenheimer persists with their Outperform rating on Netflix, maintaining a target price of $725.

- Maintaining their stance, an analyst from Loop Capital continues to hold a Buy rating for Netflix, targeting a price of $700.

- An analyst from Jefferies has decided to maintain their Buy rating on Netflix, which currently sits at a price target of $700.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Netflix, Benzinga Pro gives you real-time options trades alerts.

Posted In: NFLX