Unpacking the Latest Options Trading Trends in Altria Group

Author: Benzinga Insights | March 19, 2024 03:31pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Altria Group.

Looking at options history for Altria Group (NYSE:MO) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 57% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $410,143 and 6, calls, for a total amount of $304,794.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $37.5 and $47.5 for Altria Group, spanning the last three months.

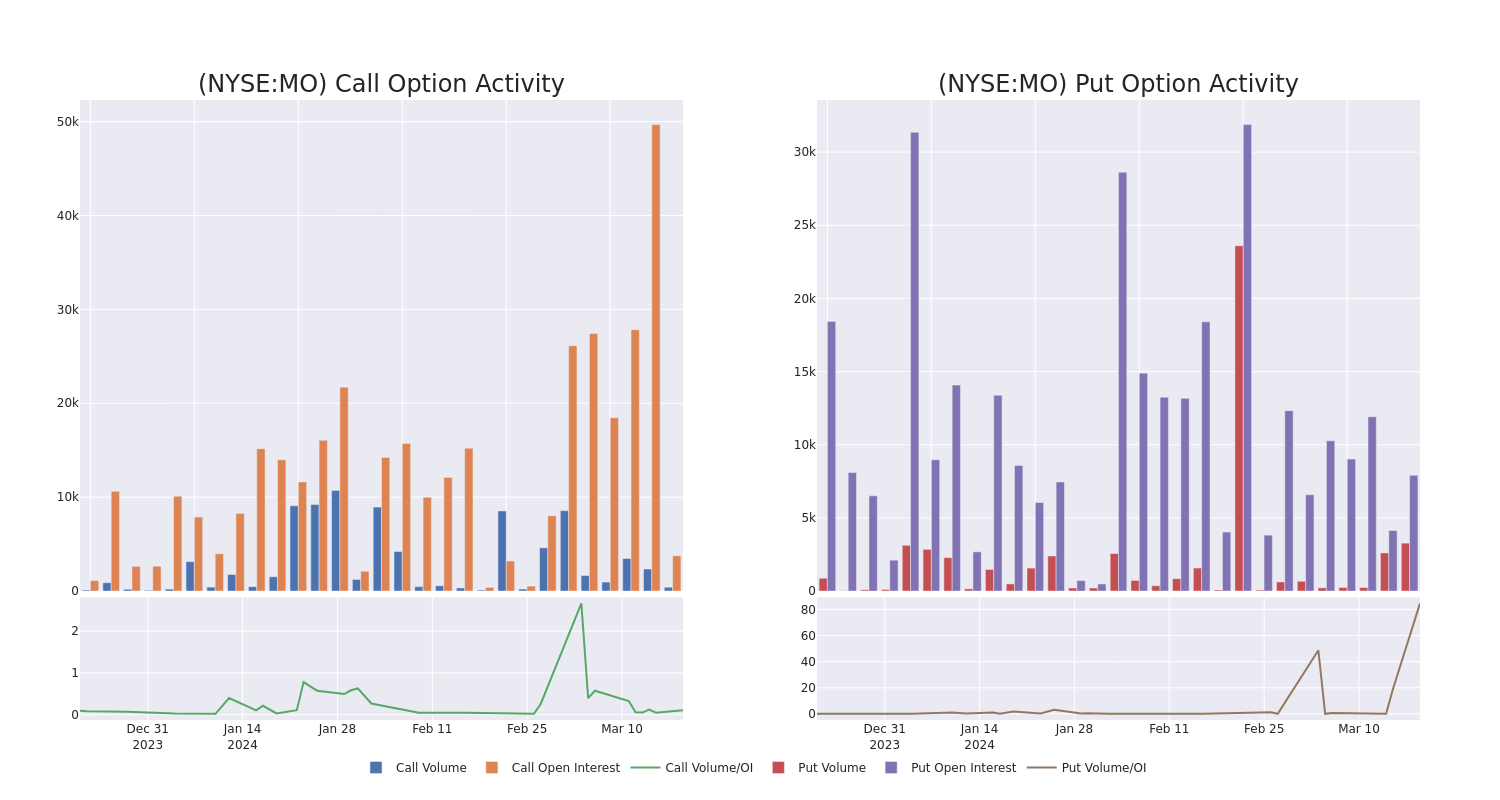

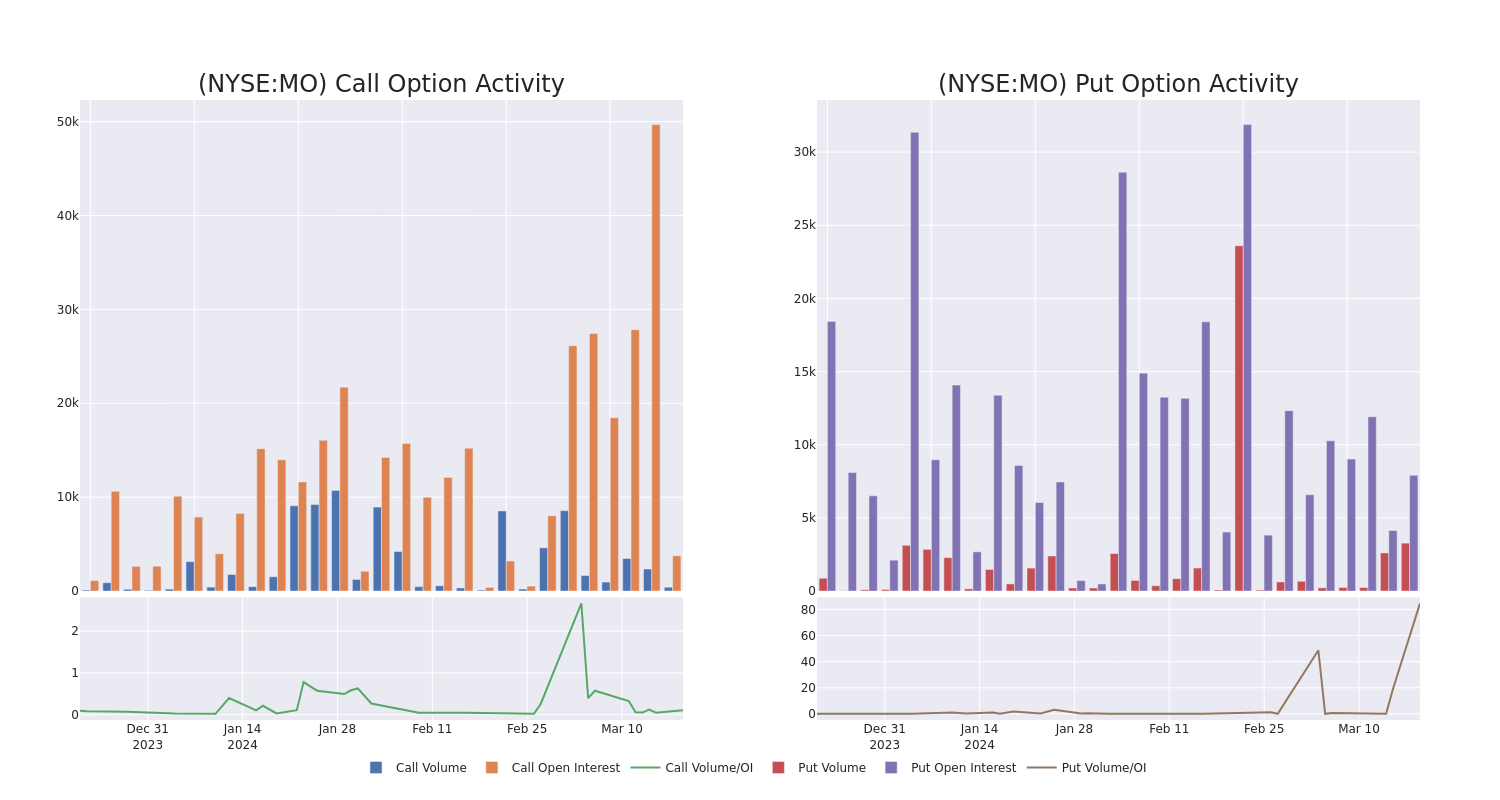

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Altria Group stands at 1458.62, with a total volume reaching 3,685.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Altria Group, situated within the strike price corridor from $37.5 to $47.5, throughout the last 30 days.

Altria Group Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MO |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$37.50 |

$96.5K |

2.8K |

267 |

| MO |

PUT |

TRADE |

BULLISH |

01/16/26 |

$47.50 |

$78.0K |

55 |

103 |

| MO |

PUT |

TRADE |

BULLISH |

01/16/26 |

$45.00 |

$62.0K |

120 |

697 |

| MO |

PUT |

TRADE |

BULLISH |

01/16/26 |

$45.00 |

$62.0K |

120 |

481 |

| MO |

PUT |

TRADE |

BULLISH |

01/16/26 |

$45.00 |

$62.0K |

120 |

69 |

About Altria Group

Altria comprises Philip Morris USA, U.S. Smokeless Tobacco, John Middleton, Horizon Innovations and Helix Innovations. It holds a 10% interest in the world's largest brewer, Anheuser-Busch InBev. Through its tobacco subsidiaries, Altria holds the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company's Marlboro brand is the leading cigarette brand in the U.S. with a 42% annual share in 2022. Altria holds a 42% stake in cannabis manufacturer Cronos, has acquired Njoy Holdings in 2023, and recently exited its strategic investment in Juul Labs.

After a thorough review of the options trading surrounding Altria Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Altria Group

- With a trading volume of 6,785,957, the price of MO is up by 0.11%, reaching $44.56.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 37 days from now.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Altria Group options trades with real-time alerts from Benzinga Pro.

Posted In: MO