Unity Software Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | March 19, 2024 12:30pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Unity Software.

Looking at options history for Unity Software (NYSE:U) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $605,820 and 4, calls, for a total amount of $166,557.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $22.5 to $47.0 for Unity Software over the recent three months.

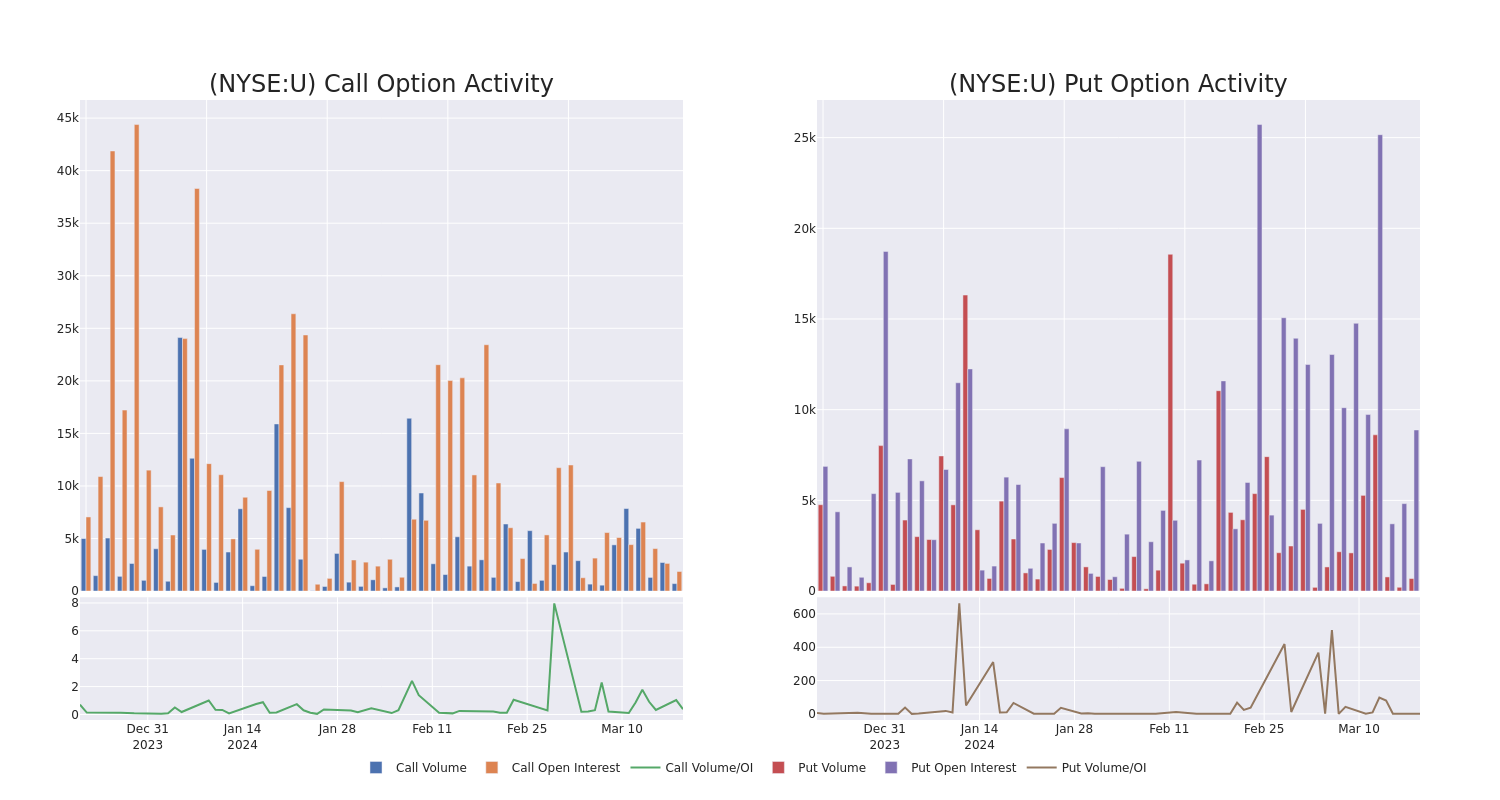

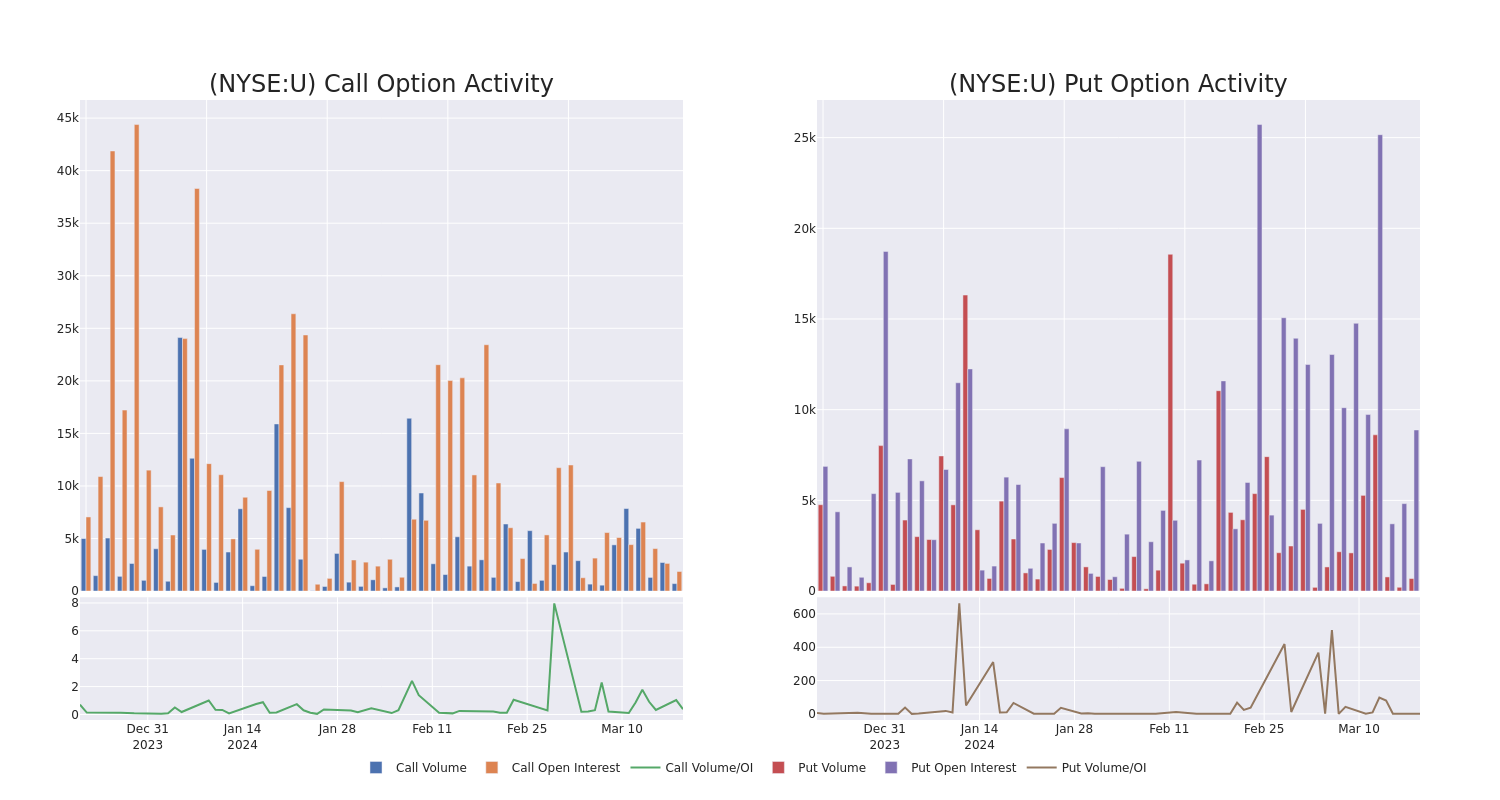

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Unity Software's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Unity Software's significant trades, within a strike price range of $22.5 to $47.0, over the past month.

Unity Software Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| U |

PUT |

TRADE |

BEARISH |

01/17/25 |

$22.50 |

$355.0K |

5.7K |

18 |

| U |

PUT |

TRADE |

BEARISH |

09/20/24 |

$25.00 |

$187.5K |

892 |

500 |

| U |

CALL |

SWEEP |

BULLISH |

07/19/24 |

$28.00 |

$55.4K |

93 |

225 |

| U |

CALL |

TRADE |

BEARISH |

01/16/26 |

$40.00 |

$42.7K |

1.5K |

193 |

| U |

PUT |

TRADE |

BULLISH |

12/19/25 |

$45.00 |

$36.0K |

29 |

0 |

About Unity Software

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC, and Other Americas, of which key revenue is derived from the EMEA region. The products are used in the gaming industry, architecture and construction sector, animation industry, and designing sector.

Current Position of Unity Software

- With a trading volume of 3,281,385, the price of U is down by -0.23%, reaching $26.01.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 50 days from now.

What The Experts Say On Unity Software

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $31.2.

- Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Unity Software with a target price of $31.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Unity Software with a target price of $28.

- An analyst from Piper Sandler upgraded its action to Neutral with a price target of $30.

- An analyst from Stifel persists with their Buy rating on Unity Software, maintaining a target price of $35.

- An analyst from Stifel persists with their Buy rating on Unity Software, maintaining a target price of $32.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Unity Software options trades with real-time alerts from Benzinga Pro.

Posted In: U