What the Options Market Tells Us About Occidental Petroleum

Author: Benzinga Insights | March 18, 2024 12:00pm

Financial giants have made a conspicuous bullish move on Occidental Petroleum. Our analysis of options history for Occidental Petroleum (NYSE:OXY) revealed 22 unusual trades.

Delving into the details, we found 68% of traders were bullish, while 31% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $317,350, and 17 were calls, valued at $891,915.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $55.0 and $75.0 for Occidental Petroleum, spanning the last three months.

Insights into Volume & Open Interest

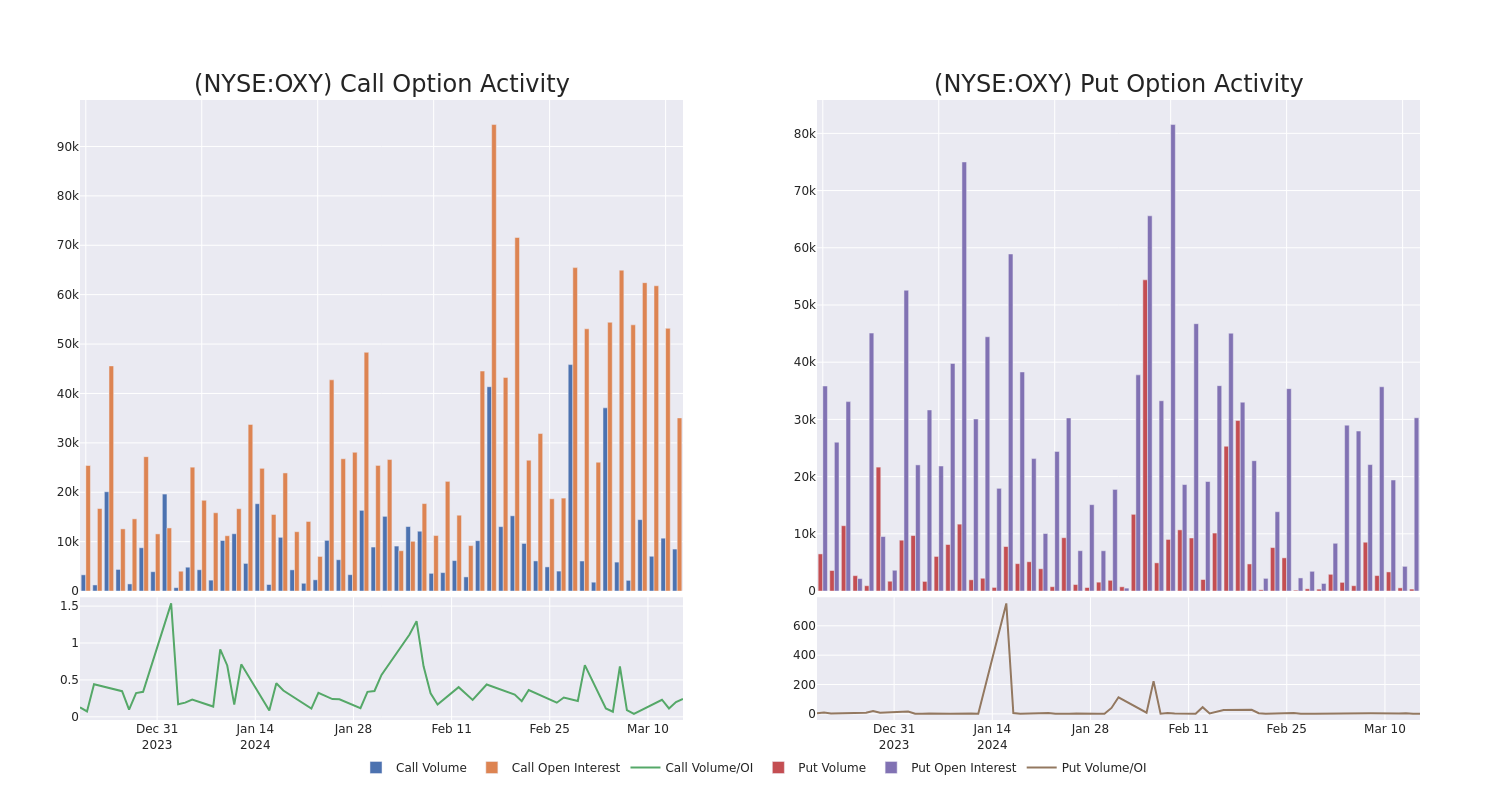

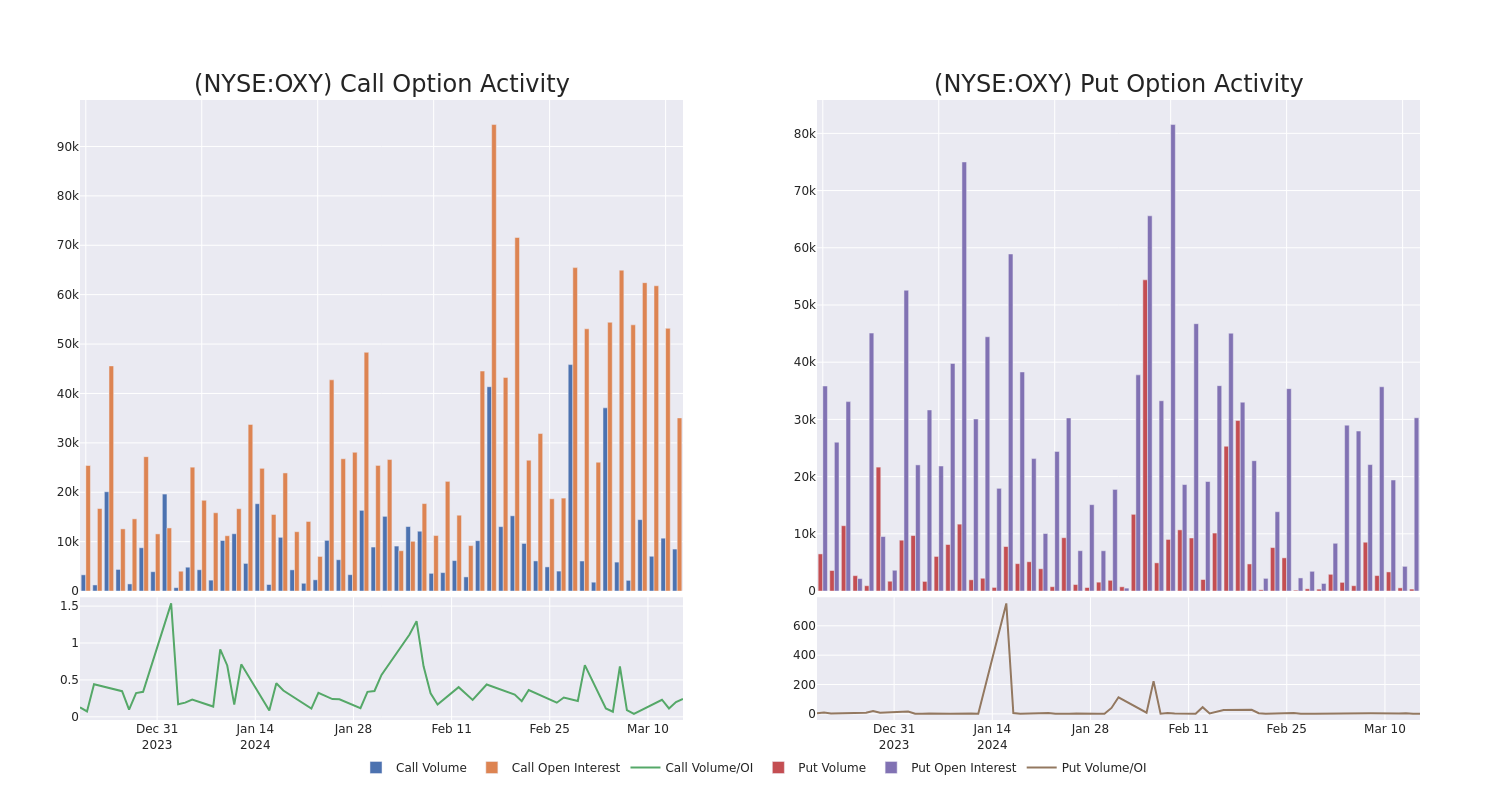

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Occidental Petroleum's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Occidental Petroleum's whale activity within a strike price range from $55.0 to $75.0 in the last 30 days.

Occidental Petroleum Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| OXY |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$63.00 |

$103.1K |

0 |

22 |

| OXY |

CALL |

TRADE |

BULLISH |

08/16/24 |

$62.50 |

$91.0K |

2.2K |

0 |

| OXY |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$70.00 |

$85.0K |

233 |

200 |

| OXY |

CALL |

SWEEP |

BULLISH |

06/20/25 |

$75.00 |

$82.0K |

1.6K |

1.3K |

| OXY |

CALL |

SWEEP |

BULLISH |

06/20/25 |

$75.00 |

$81.9K |

1.6K |

300 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4.0 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

Having examined the options trading patterns of Occidental Petroleum, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Occidental Petroleum Standing Right Now?

- Currently trading with a volume of 2,180,102, the OXY's price is up by 0.45%, now at $62.93.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 50 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Occidental Petroleum options trades with real-time alerts from Benzinga Pro.

Posted In: OXY