Check Out What Whales Are Doing With Verizon Communications

Author: Benzinga Insights | March 14, 2024 10:31am

Financial giants have made a conspicuous bearish move on Verizon Communications. Our analysis of options history for Verizon Communications (NYSE:VZ) revealed 8 unusual trades.

Delving into the details, we found 12% of traders were bullish, while 87% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $582,287, and 5 were calls, valued at $418,254.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $34.0 to $55.0 for Verizon Communications over the recent three months.

Analyzing Volume & Open Interest

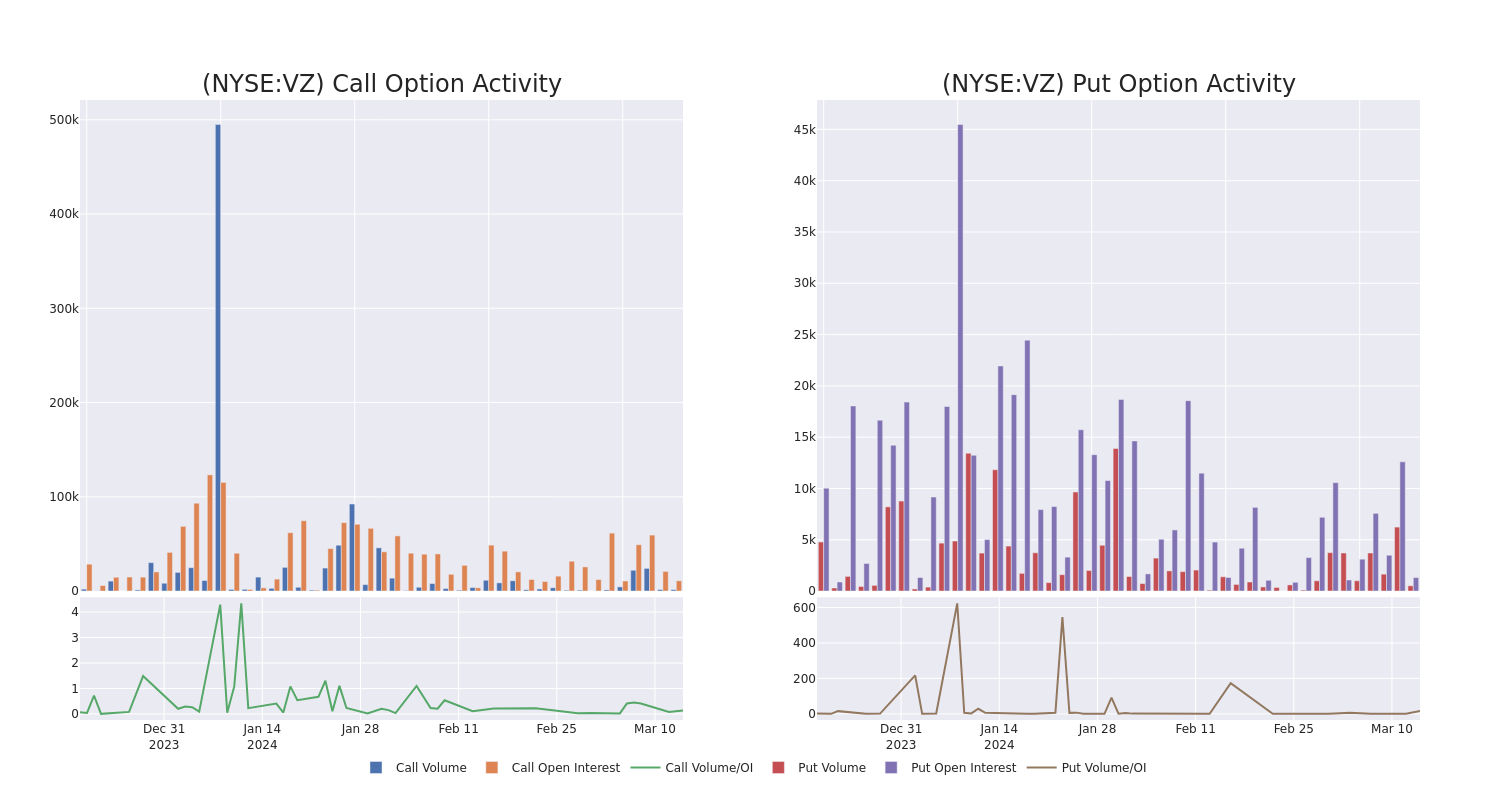

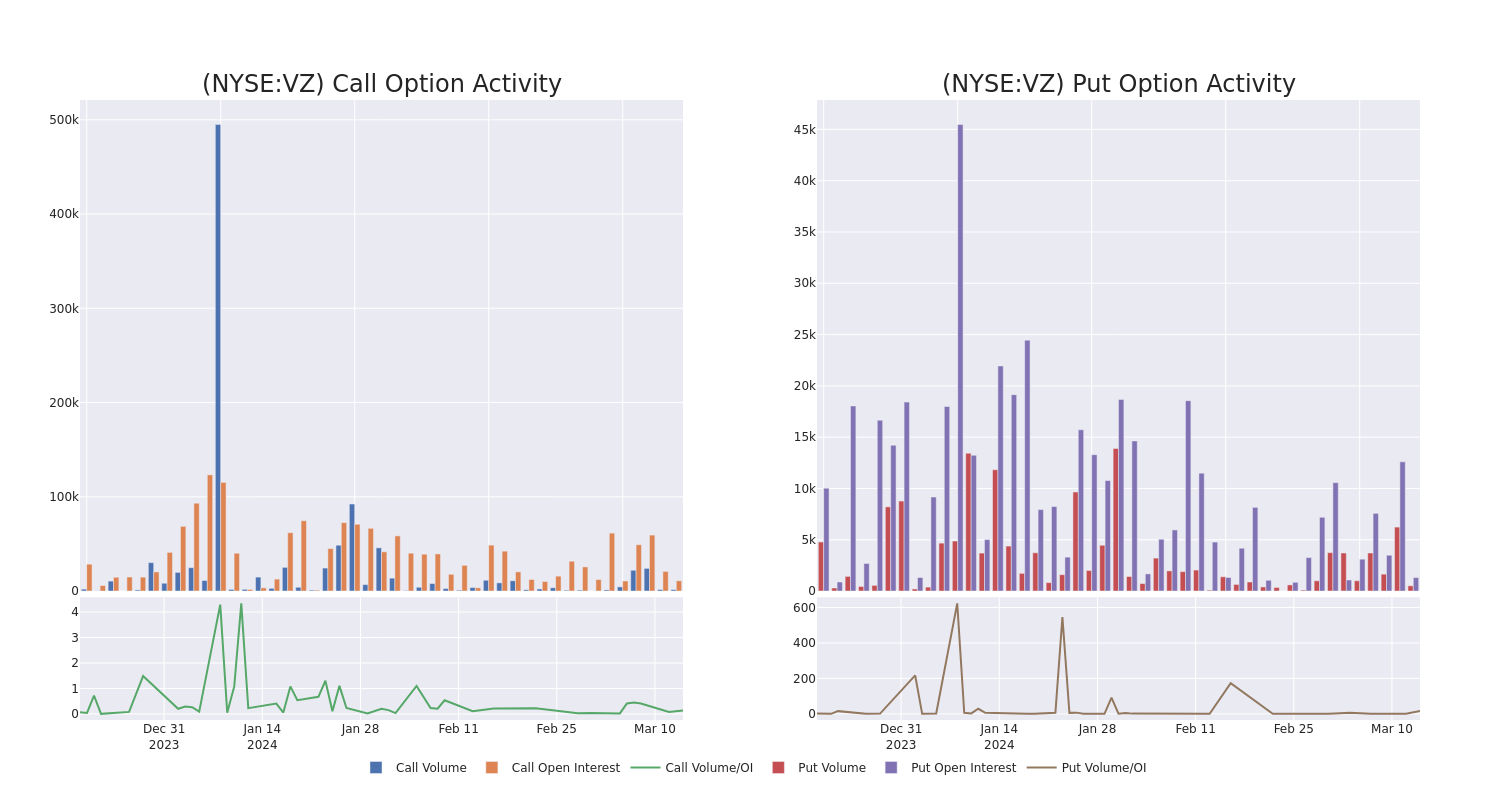

In today's trading context, the average open interest for options of Verizon Communications stands at 2032.33, with a total volume reaching 1,999.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Verizon Communications, situated within the strike price corridor from $34.0 to $55.0, throughout the last 30 days.

Verizon Communications Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| VZ |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$55.00 |

$457.2K |

18 |

296 |

| VZ |

CALL |

SWEEP |

BEARISH |

04/19/24 |

$34.00 |

$224.0K |

1.2K |

0 |

| VZ |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$50.00 |

$90.0K |

817 |

1 |

| VZ |

CALL |

SWEEP |

BEARISH |

04/19/24 |

$36.00 |

$72.1K |

3.9K |

185 |

| VZ |

CALL |

TRADE |

BEARISH |

04/19/24 |

$38.00 |

$63.0K |

5.7K |

404 |

About Verizon Communications

Wireless services account for about 70% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 21 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest U.S. wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 25 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks.

Where Is Verizon Communications Standing Right Now?

- With a trading volume of 2,766,435, the price of VZ is down by -0.65%, reaching $40.0.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 39 days from now.

What The Experts Say On Verizon Communications

In the last month, 1 experts released ratings on this stock with an average target price of $36.0.

- An analyst from RBC Capital has decided to maintain their Sector Perform rating on Verizon Communications, which currently sits at a price target of $36.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Verizon Communications with Benzinga Pro for real-time alerts.

Posted In: VZ