Unpacking the Latest Options Trading Trends in Iovance Biotherapeutics

Author: Benzinga Insights | March 13, 2024 12:16pm

Investors with a lot of money to spend have taken a bearish stance on Iovance Biotherapeutics (NASDAQ:IOVA).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with IOVA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Iovance Biotherapeutics.

This isn't normal.

The overall sentiment of these big-money traders is split between 37% bullish and 62%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $229,640, and 5 are calls, for a total amount of $318,670.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $30.0 for Iovance Biotherapeutics during the past quarter.

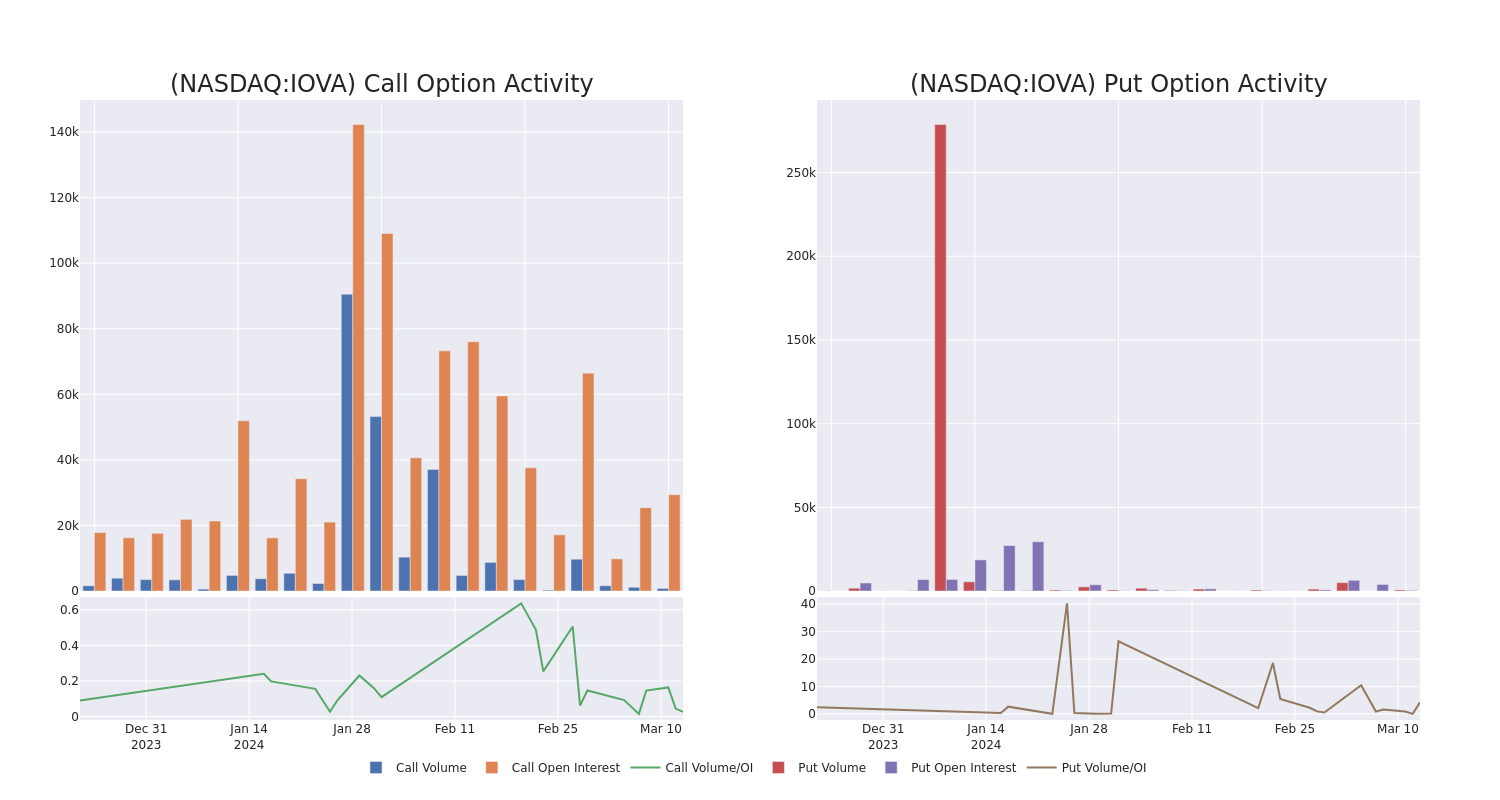

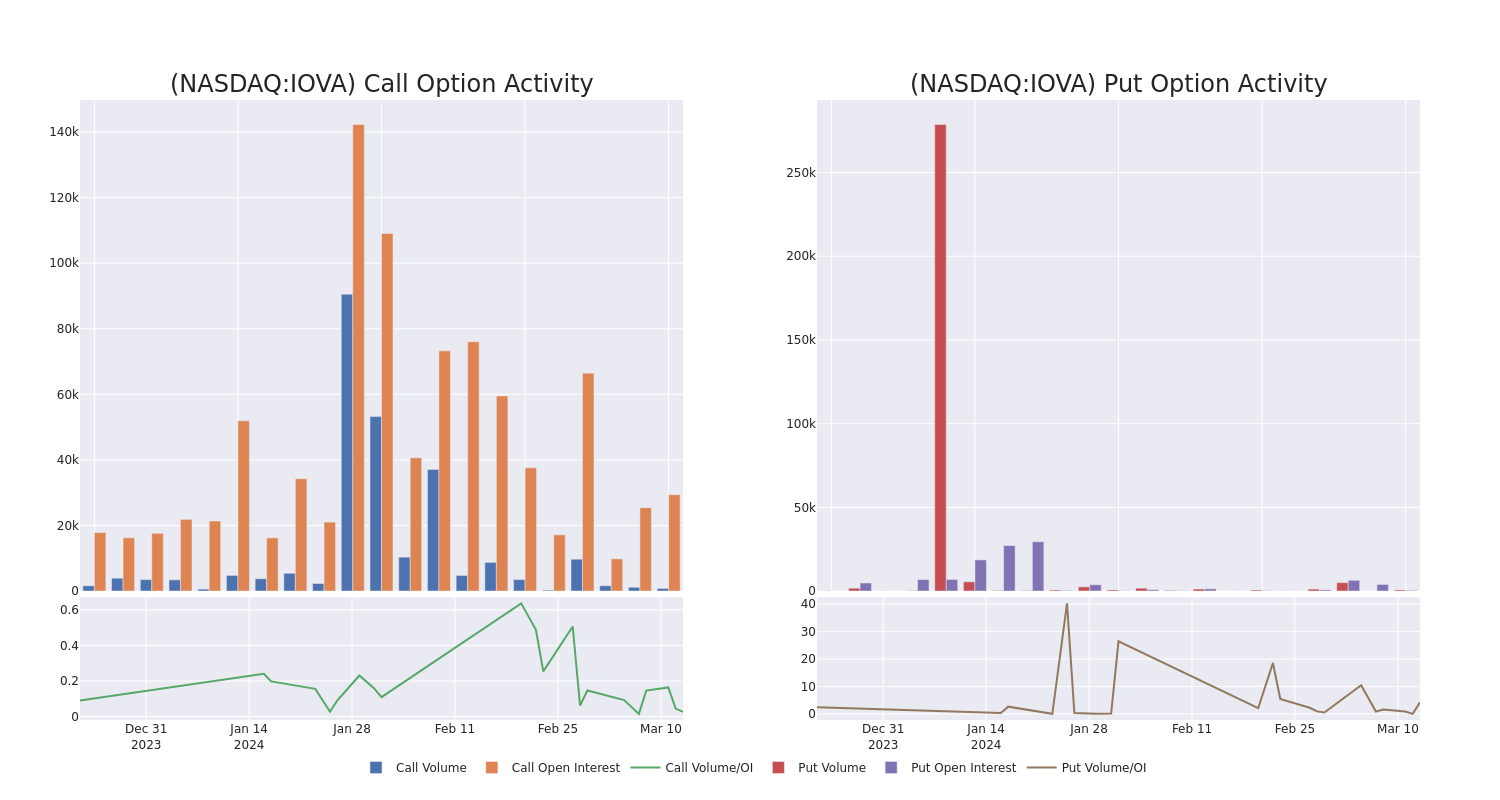

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Iovance Biotherapeutics's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Iovance Biotherapeutics's substantial trades, within a strike price spectrum from $7.5 to $30.0 over the preceding 30 days.

Iovance Biotherapeutics Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| IOVA |

CALL |

TRADE |

BEARISH |

06/21/24 |

$10.00 |

$165.0K |

2.9K |

301 |

| IOVA |

PUT |

SWEEP |

BULLISH |

01/17/25 |

$12.50 |

$126.1K |

279 |

435 |

| IOVA |

PUT |

SWEEP |

BULLISH |

09/20/24 |

$15.00 |

$71.0K |

121 |

203 |

| IOVA |

CALL |

TRADE |

BULLISH |

06/21/24 |

$17.50 |

$46.5K |

6.6K |

0 |

| IOVA |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$15.00 |

$37.9K |

6.6K |

399 |

About Iovance Biotherapeutics

Iovance Biotherapeutics Inc is a clinical-stage biopharmaceutical company, pioneering a transformational approach to treating cancer by harnessing the human immune system's ability to recognize and destroy diverse cancer cells using therapies personalized for each patient. The company is preparing for potential U.S. regulatory approvals and commercialization of the first autologous T-cell therapy to address a solid tumor cancer. its objective is to be the leader in innovating, developing, and delivering tumor-infiltrating lymphocyte, or TIL, therapies for patients with solid tumor cancers.

In light of the recent options history for Iovance Biotherapeutics, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Iovance Biotherapeutics Standing Right Now?

- Trading volume stands at 1,859,372, with IOVA's price down by -0.27%, positioned at $14.68.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 55 days.

What Analysts Are Saying About Iovance Biotherapeutics

5 market experts have recently issued ratings for this stock, with a consensus target price of $24.6.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Iovance Biotherapeutics with a target price of $19.

- Consistent in their evaluation, an analyst from JMP Securities keeps a Market Outperform rating on Iovance Biotherapeutics with a target price of $25.

- Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Iovance Biotherapeutics, targeting a price of $26.

- In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $32.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Iovance Biotherapeutics, targeting a price of $21.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Iovance Biotherapeutics, Benzinga Pro gives you real-time options trades alerts.

Posted In: IOVA