Philip Morris Intl Unusual Options Activity For March 12

Author: Benzinga Insights | March 12, 2024 04:15pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Philip Morris Intl.

Looking at options history for Philip Morris Intl (NYSE:PM) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 22% of the investors opened trades with bullish expectations and 77% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $54,670 and 7, calls, for a total amount of $1,004,440.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $110.0 for Philip Morris Intl over the recent three months.

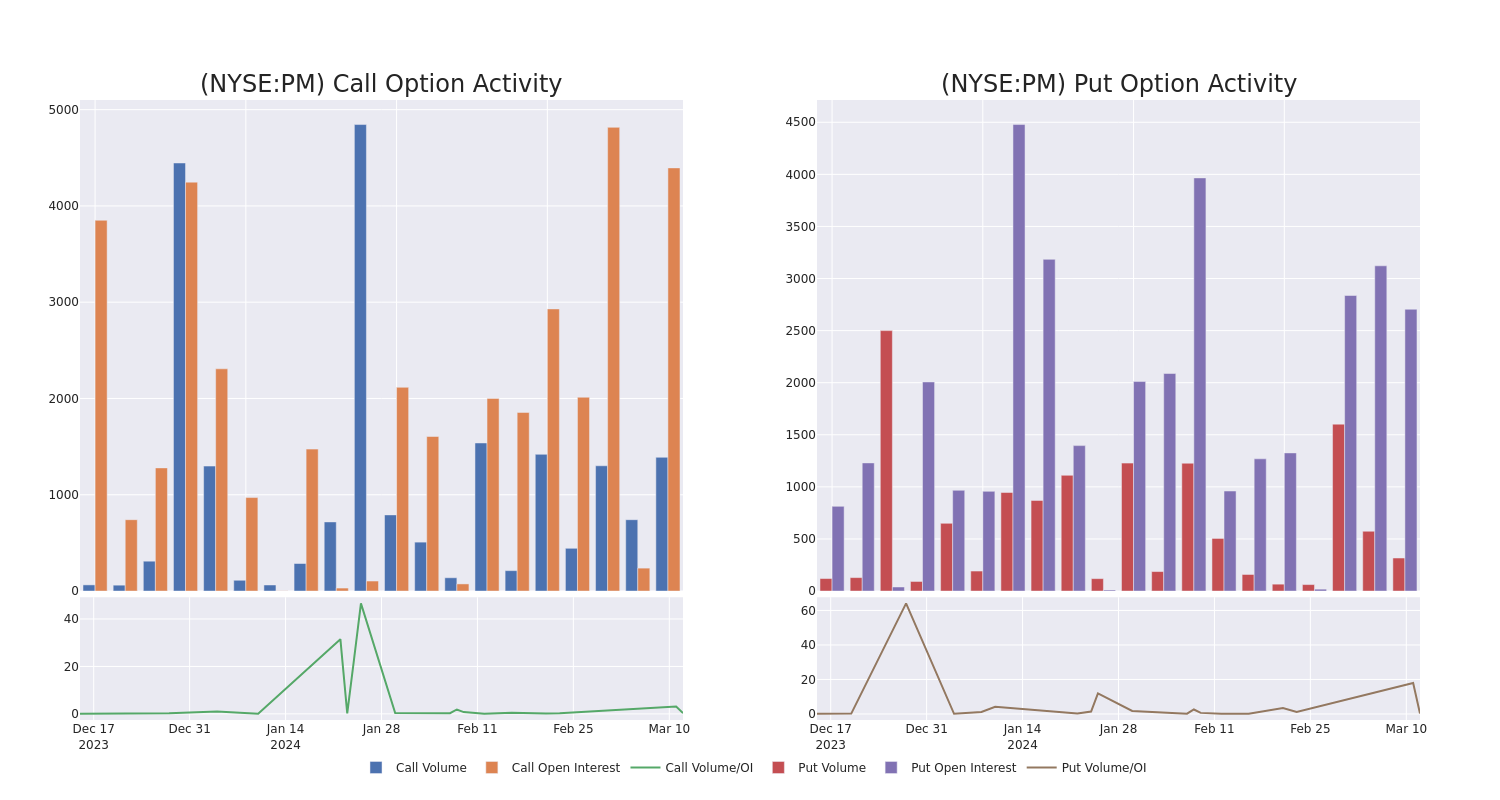

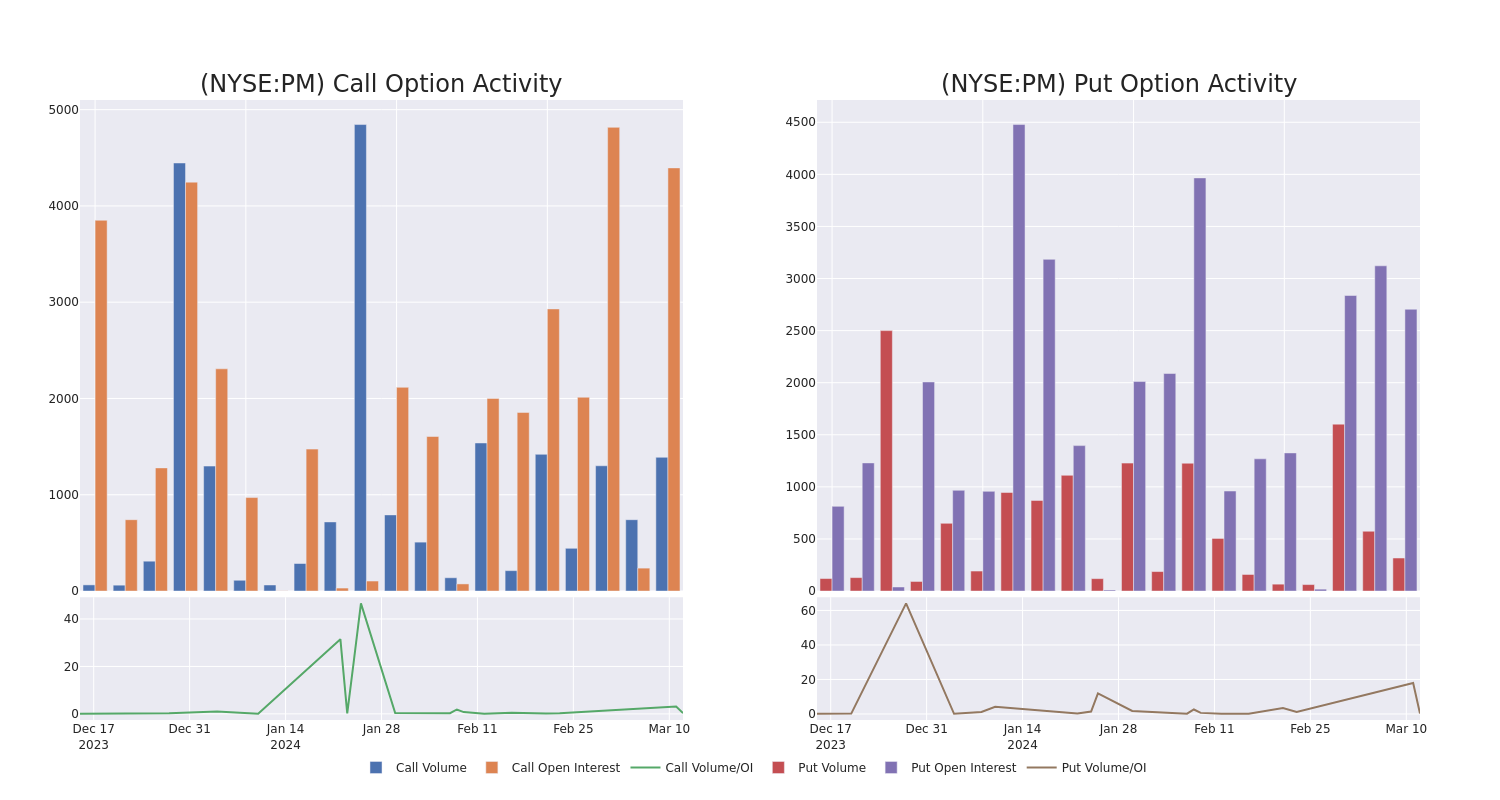

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Philip Morris Intl's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Philip Morris Intl's significant trades, within a strike price range of $60.0 to $110.0, over the past month.

Philip Morris Intl Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PM |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$90.00 |

$446.5K |

1.9K |

400 |

| PM |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$90.00 |

$339.0K |

1.9K |

400 |

| PM |

CALL |

TRADE |

BEARISH |

01/16/26 |

$100.00 |

$67.0K |

830 |

100 |

| PM |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$100.00 |

$57.0K |

1.2K |

151 |

| PM |

CALL |

TRADE |

BULLISH |

01/16/26 |

$110.00 |

$35.0K |

383 |

100 |

About Philip Morris Intl

Philip Morris International is an international tobacco company with a product portfolio primarily consisting of cigarettes and reduced-risk products, including heat-not-burn, vapor and oral nicotine products, which are sold in markets outside the United States. The company diversified away from cigarettes with the 2022 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches, primarily in the U.S. and Scandinavia. It diversified away from nicotine products with the acquisition of Vectura, a provider of innovative inhaled drug delivery solutions, in 2021.

After a thorough review of the options trading surrounding Philip Morris Intl, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Philip Morris Intl Standing Right Now?

- Currently trading with a volume of 4,609,697, the PM's price is up by 0.28%, now at $94.67.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 42 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Philip Morris Intl, Benzinga Pro gives you real-time options trades alerts.

Posted In: PM