Looking At JD.com's Recent Unusual Options Activity

Author: Benzinga Insights | March 12, 2024 10:01am

Deep-pocketed investors have adopted a bearish approach towards JD.com (NASDAQ:JD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in JD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for JD.com. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 69% bearish. Among these notable options, 7 are puts, totaling $289,368, and 6 are calls, amounting to $306,094.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $30.0 for JD.com over the last 3 months.

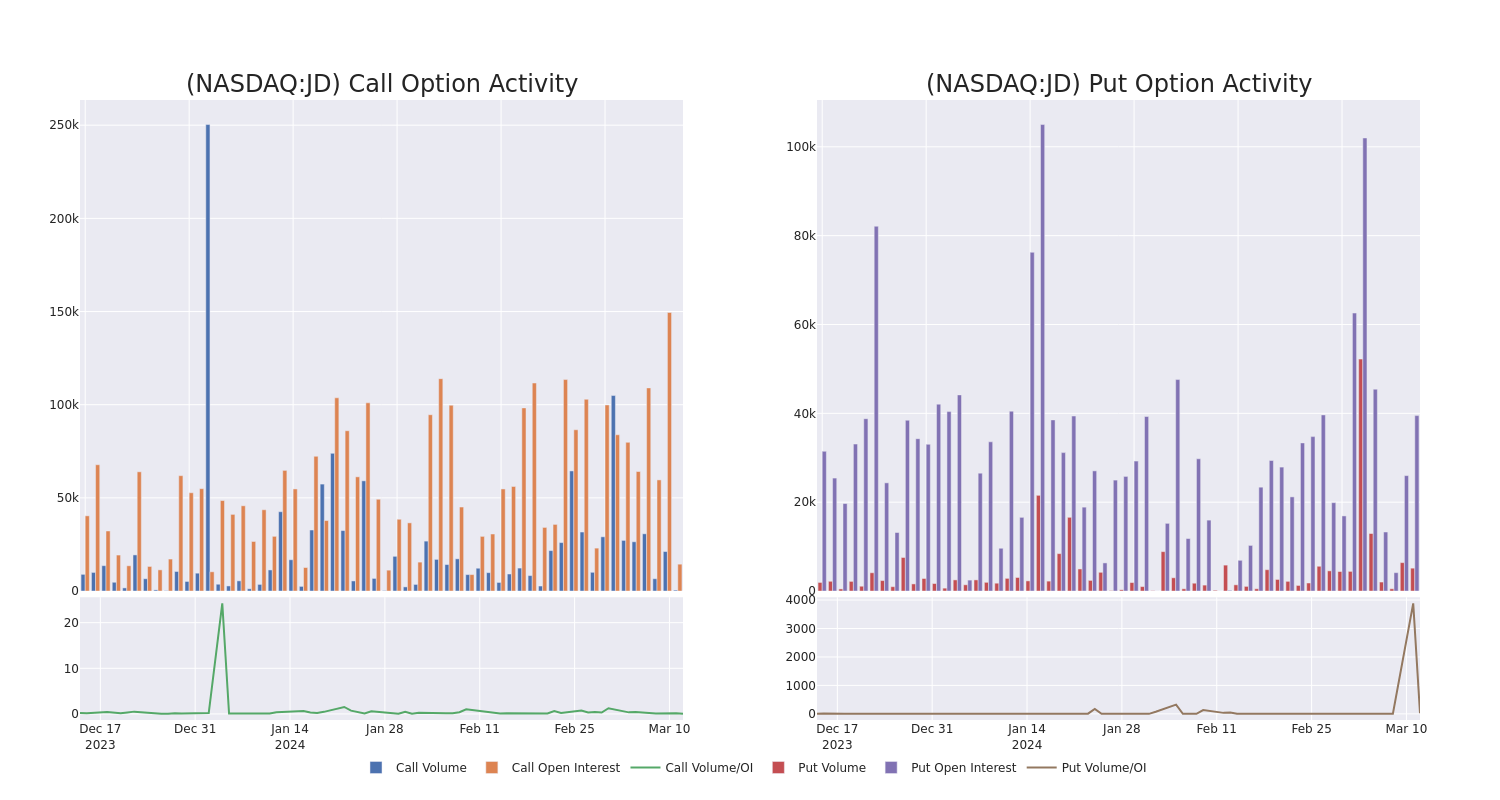

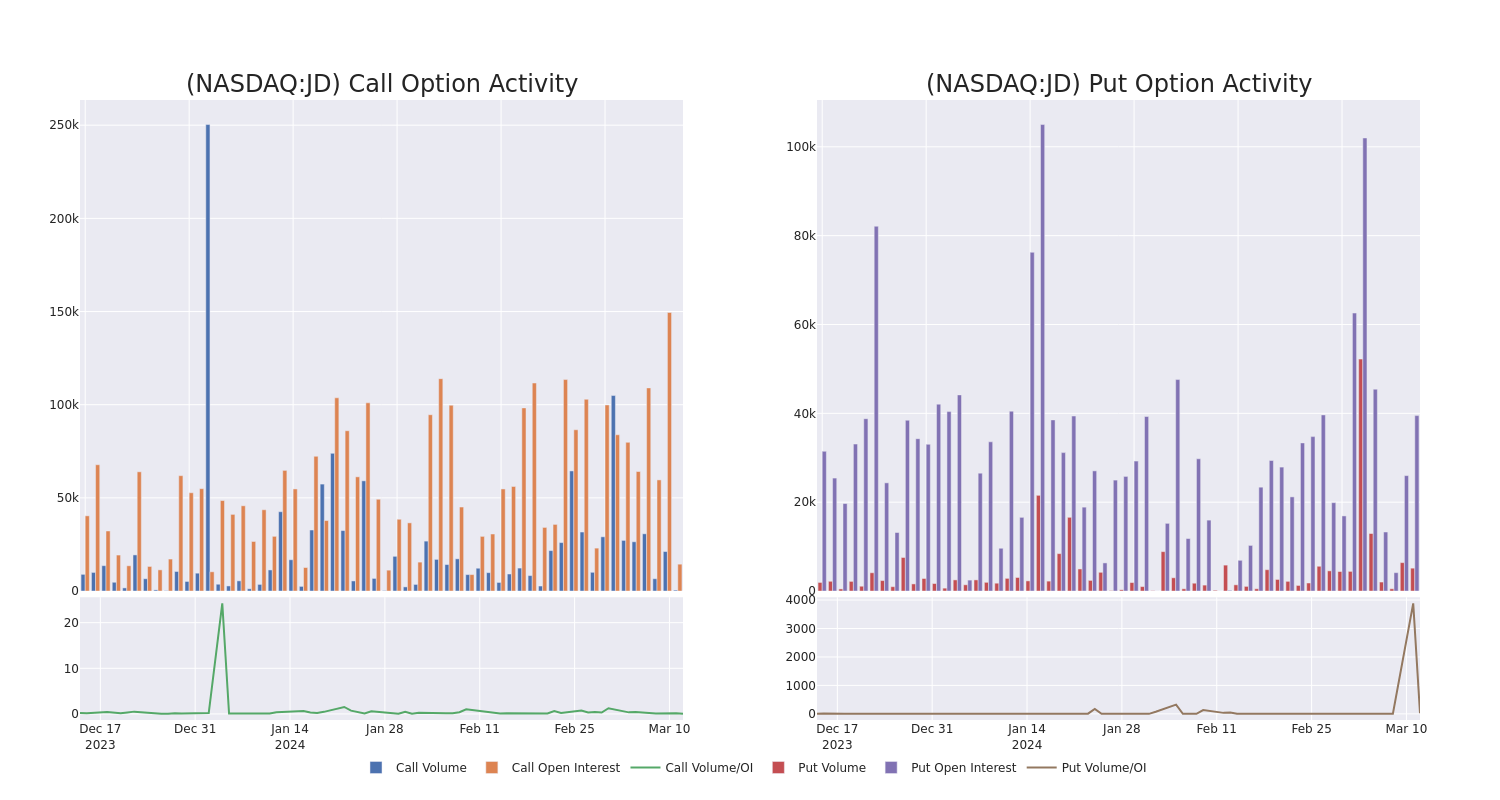

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JD.com's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com's whale activity within a strike price range from $15.0 to $30.0 in the last 30 days.

JD.com Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| JD |

PUT |

SWEEP |

NEUTRAL |

03/22/24 |

$27.00 |

$87.0K |

80 |

1.6K |

| JD |

CALL |

SWEEP |

BEARISH |

03/15/24 |

$26.00 |

$84.3K |

11.7K |

7 |

| JD |

CALL |

SWEEP |

BEARISH |

03/15/24 |

$24.50 |

$54.0K |

2.1K |

2 |

| JD |

CALL |

TRADE |

BULLISH |

03/15/24 |

$24.50 |

$52.0K |

2.1K |

405 |

| JD |

CALL |

TRADE |

BULLISH |

09/20/24 |

$17.50 |

$49.7K |

108 |

60 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

In light of the recent options history for JD.com, it's now appropriate to focus on the company itself. We aim to explore its current performance.

JD.com's Current Market Status

- Currently trading with a volume of 4,443,947, the JD's price is up by 3.03%, now at $26.86.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 58 days.

What Analysts Are Saying About JD.com

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $36.2.

- Consistent in their evaluation, an analyst from Benchmark keeps a Buy rating on JD.com with a target price of $55.

- Consistent in their evaluation, an analyst from Loop Capital keeps a Hold rating on JD.com with a target price of $26.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for JD.com, targeting a price of $28.

- An analyst from Mizuho persists with their Buy rating on JD.com, maintaining a target price of $33.

- An analyst from Barclays persists with their Overweight rating on JD.com, maintaining a target price of $39.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for JD.com, Benzinga Pro gives you real-time options trades alerts.

Posted In: JD