Unpacking the Latest Options Trading Trends in AT&T

Author: Benzinga Insights | March 11, 2024 02:45pm

Whales with a lot of money to spend have taken a noticeably bearish stance on AT&T.

Looking at options history for AT&T (NYSE:T) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 11% of the investors opened trades with bullish expectations and 88% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $159,327 and 5, calls, for a total amount of $517,450.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.0 to $20.0 for AT&T during the past quarter.

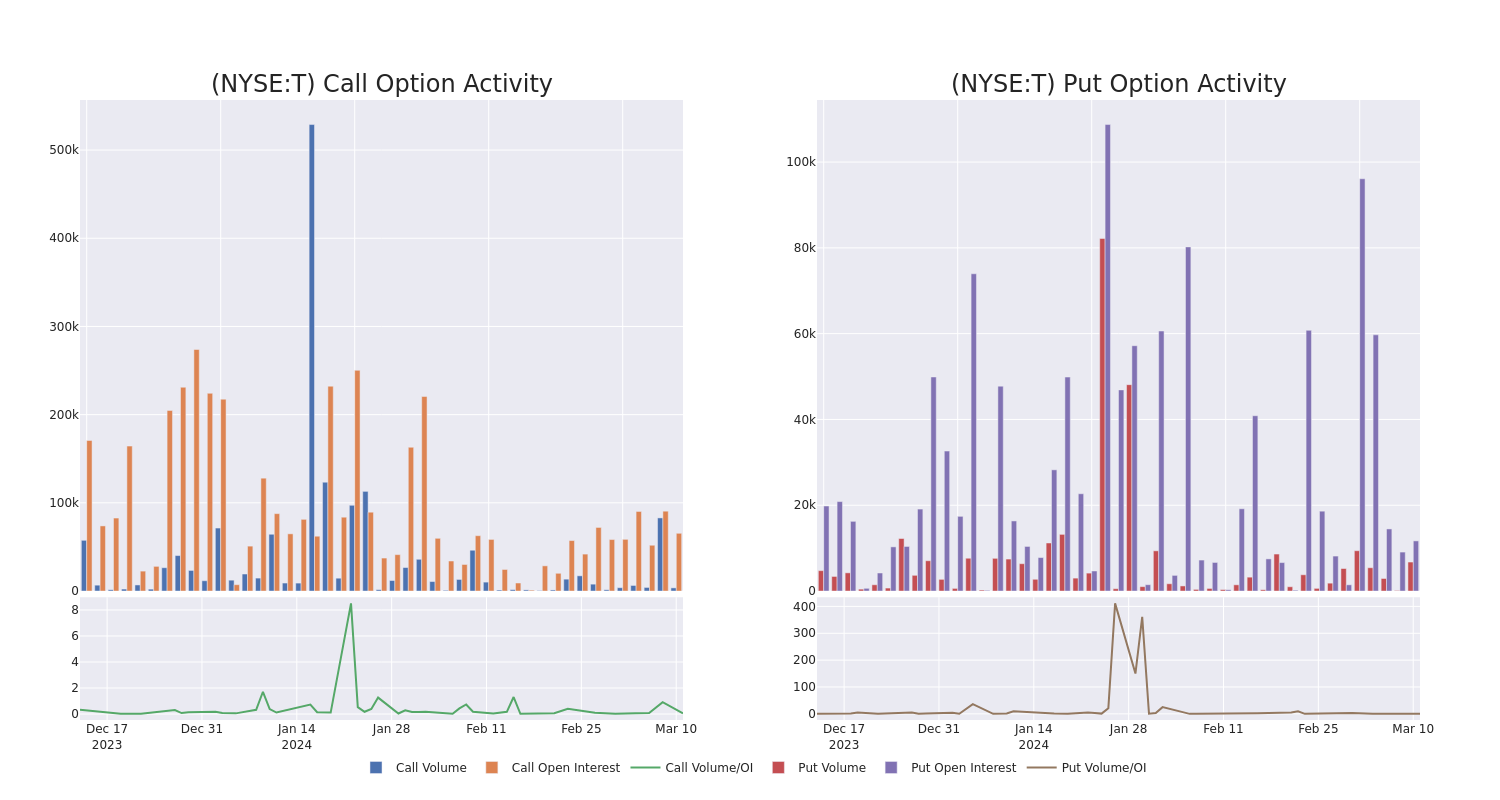

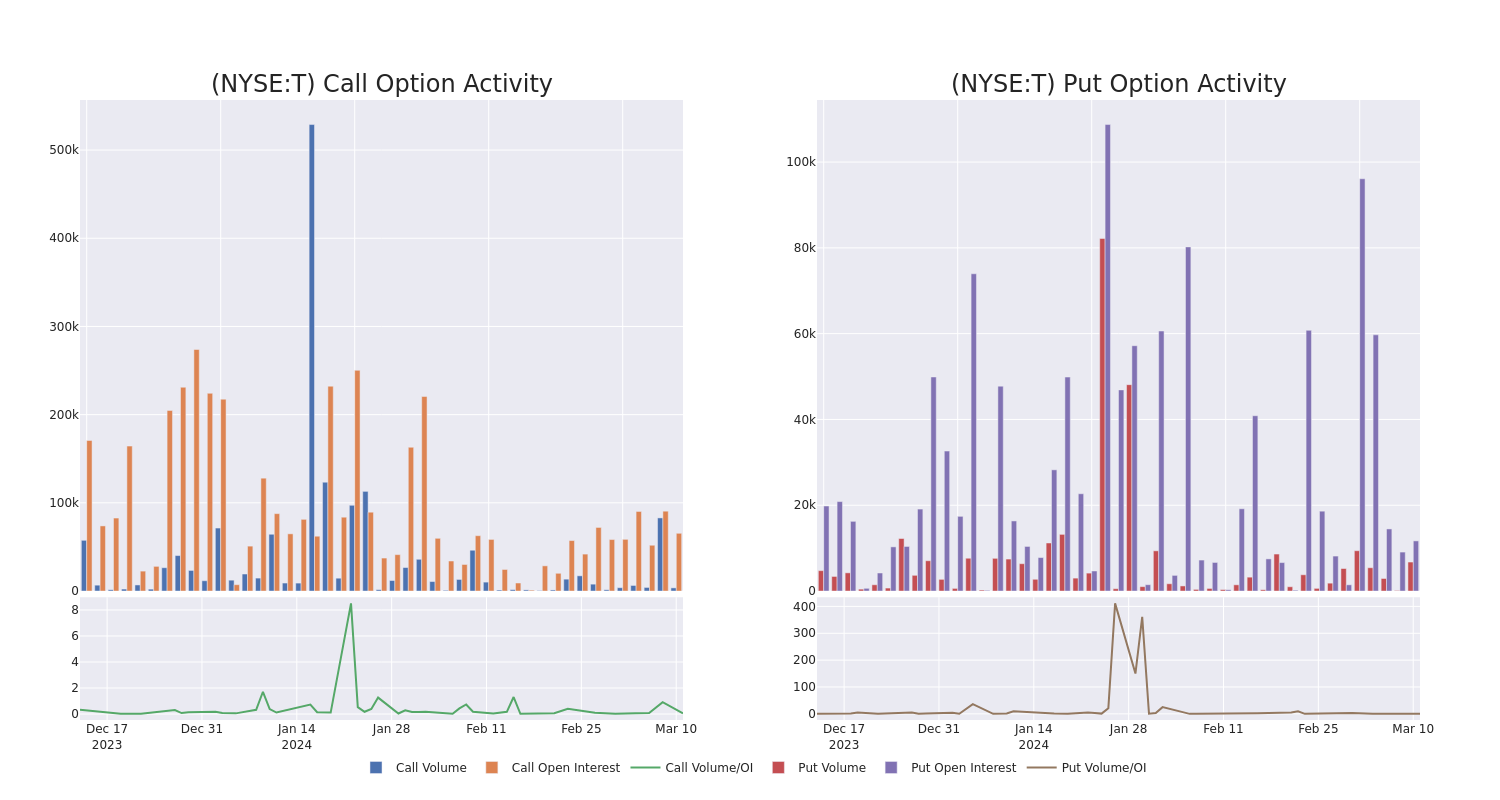

Volume & Open Interest Trends

In today's trading context, the average open interest for options of AT&T stands at 19292.0, with a total volume reaching 10,357.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in AT&T, situated within the strike price corridor from $12.0 to $20.0, throughout the last 30 days.

AT&T Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| T |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$12.00 |

$159.9K |

1.1K |

605 |

| T |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$12.00 |

$159.6K |

1.1K |

300 |

| T |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$12.00 |

$84.5K |

1.1K |

764 |

| T |

CALL |

SWEEP |

NEUTRAL |

07/19/24 |

$18.00 |

$59.7K |

64.3K |

1.0K |

| T |

CALL |

TRADE |

BEARISH |

01/16/26 |

$12.00 |

$53.5K |

1.1K |

864 |

About AT&T

The wireless business contributes about two thirds of AT&T's revenue following the spinoff of Warner Media. The firm is the third-largest U.S. wireless carrier, connecting 71 million postpaid and 17 million prepaid phone customers. Fixed-line enterprise services, which account for about 17% of revenue, include internet access, private networking, security, voice, and wholesale network capacity. Residential fixed-line services, about 11% of revenue, primarily consist of broadband internet access. AT&T also has a sizable presence in Mexico, serving 22 million customers, but this business only accounts for 3% of revenue. The firm still holds a 70% equity stake in satellite television provider DirecTV but does not consolidate this business in its financial statements.

Following our analysis of the options activities associated with AT&T, we pivot to a closer look at the company's own performance.

AT&T's Current Market Status

- With a volume of 18,161,222, the price of T is up 0.12% at $17.22.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 44 days.

What Analysts Are Saying About AT&T

In the last month, 1 experts released ratings on this stock with an average target price of $21.0.

- Showing optimism, an analyst from Wolfe Research upgrades its rating to Outperform with a revised price target of $21.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AT&T with Benzinga Pro for real-time alerts.

Posted In: T