Looking At Cloudflare's Recent Unusual Options Activity

Author: Benzinga Insights | March 11, 2024 12:46pm

Deep-pocketed investors have adopted a bullish approach towards Cloudflare (NYSE:NET), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NET usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Cloudflare. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 3 are puts, totaling $272,229, and 5 are calls, amounting to $136,835.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $105.0 for Cloudflare during the past quarter.

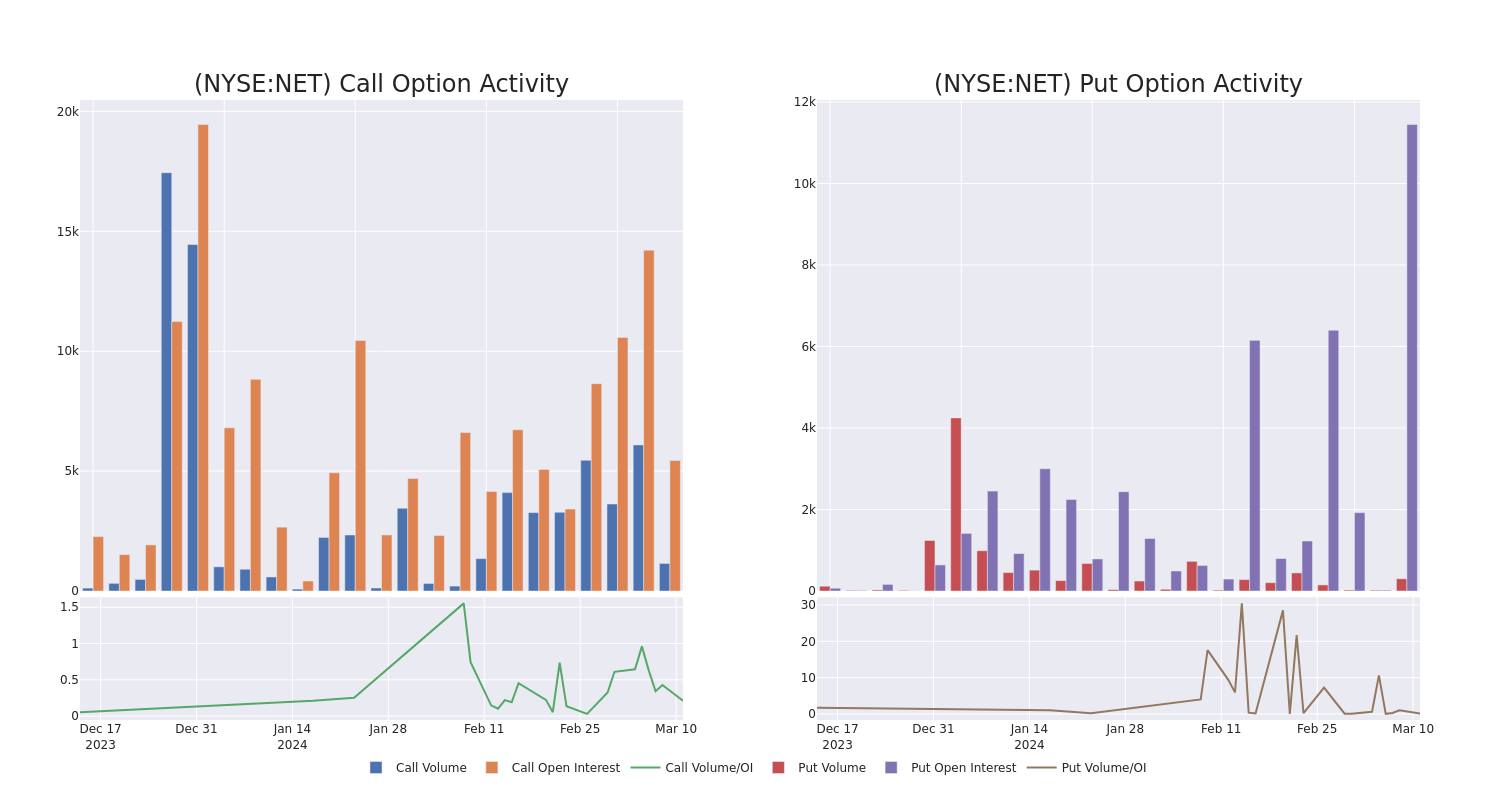

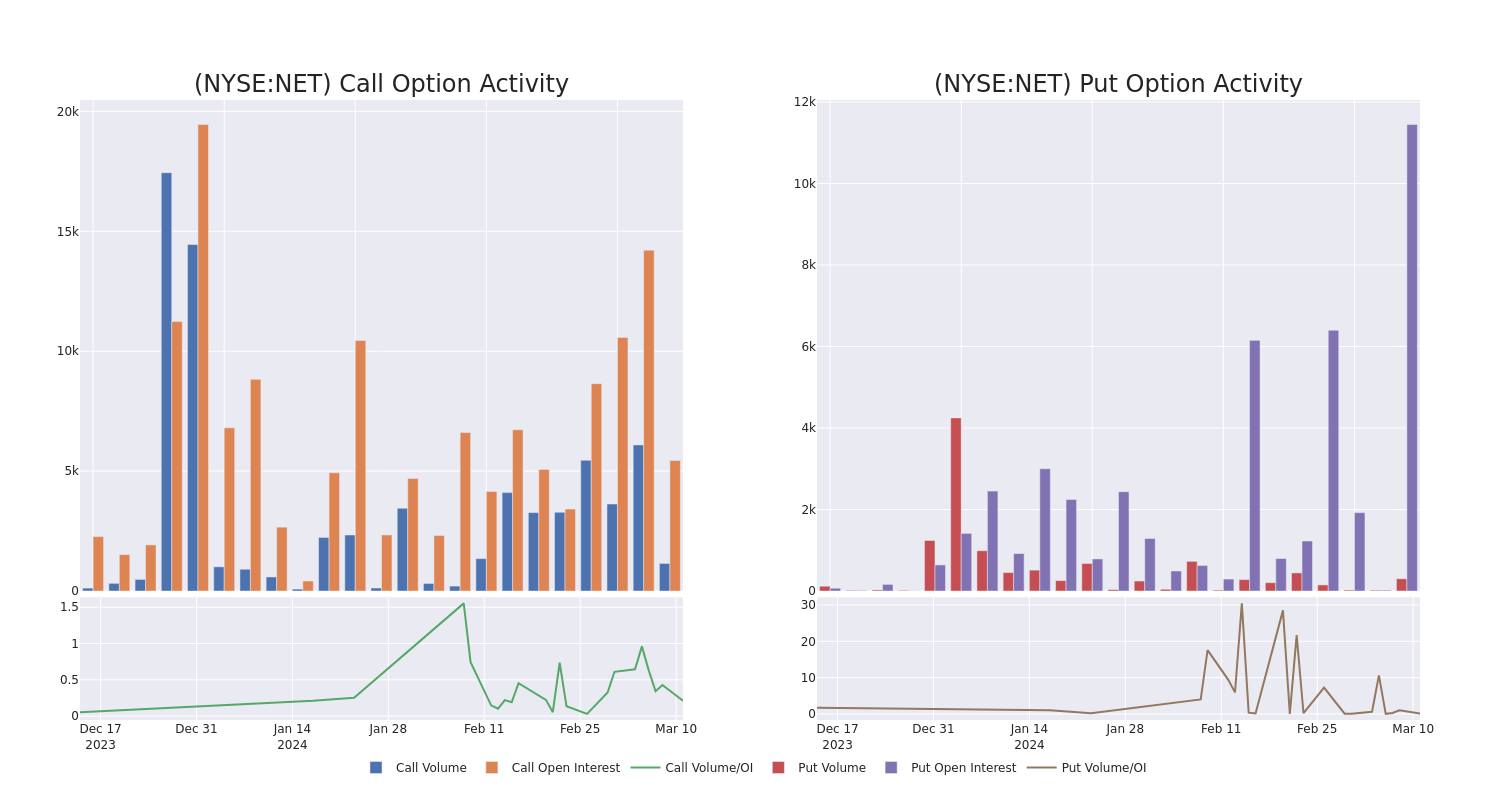

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Cloudflare stands at 2413.0, with a total volume reaching 1,453.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cloudflare, situated within the strike price corridor from $95.0 to $105.0, throughout the last 30 days.

Cloudflare 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NET |

PUT |

TRADE |

BULLISH |

08/16/24 |

$95.00 |

$180.7K |

1.9K |

170 |

| NET |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$95.00 |

$54.1K |

6.6K |

130 |

| NET |

PUT |

SWEEP |

BULLISH |

03/15/24 |

$95.00 |

$37.3K |

2.8K |

1 |

| NET |

CALL |

SWEEP |

NEUTRAL |

01/16/26 |

$100.00 |

$30.5K |

431 |

41 |

| NET |

CALL |

SWEEP |

BEARISH |

03/22/24 |

$100.00 |

$28.0K |

295 |

454 |

About Cloudflare

Cloudflare is a software company based in San Francisco, California, that offers security and web performance offerings by utilizing a distributed, serverless content delivery network, or CDN. The firm's edge computing platform, Workers, leverages this network by providing clients the ability to deploy, and execute code without maintaining servers.

In light of the recent options history for Cloudflare, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Cloudflare Standing Right Now?

- With a trading volume of 1,341,554, the price of NET is down by -0.99%, reaching $97.02.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 45 days from now.

Professional Analyst Ratings for Cloudflare

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $100.66666666666667.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Cloudflare, maintaining a target price of $92.

- Reflecting concerns, an analyst from DZ Bank lowers its rating to Hold with a new price target of $110.

- An analyst from Cantor Fitzgerald downgraded its action to Neutral with a price target of $100.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cloudflare options trades with real-time alerts from Benzinga Pro.

Posted In: NET