The Analyst Verdict: Nordstrom In The Eyes Of 9 Experts

Author: Benzinga Insights | March 07, 2024 03:00pm

Ratings for Nordstrom (NYSE:JWN) were provided by 9 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

6 |

3 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

5 |

3 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

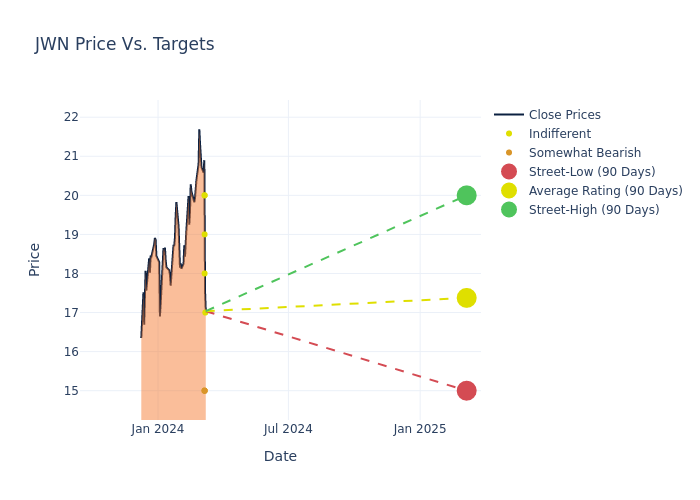

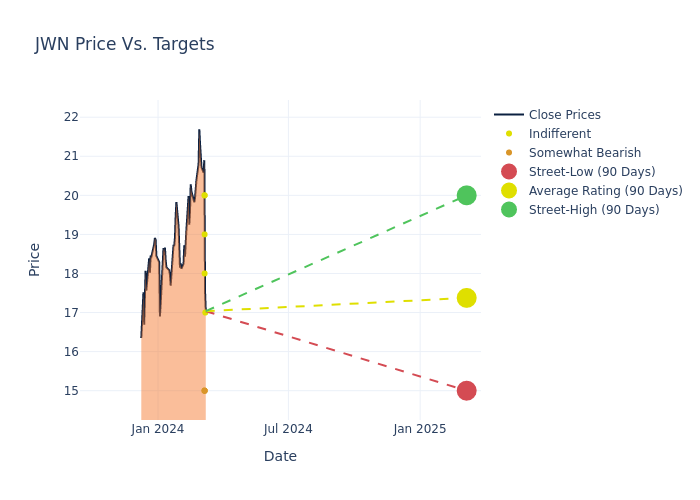

In the assessment of 12-month price targets, analysts unveil insights for Nordstrom, presenting an average target of $17.78, a high estimate of $21.00, and a low estimate of $15.00. This current average reflects an increase of 10.37% from the previous average price target of $16.11.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Nordstrom among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Ashley Helgans |

Jefferies |

Lowers |

Hold |

$17.00 |

$18.00 |

| Brooke Roach |

Goldman Sachs |

Raises |

Neutral |

$18.00 |

$16.00 |

| Edward Yruma |

Piper Sandler |

Raises |

Neutral |

$20.00 |

$17.00 |

| Paul Kearney |

Barclays |

Raises |

Underweight |

$15.00 |

$14.00 |

| Lorraine Hutchinson |

B of A Securities |

Raises |

Underperform |

$15.00 |

$13.00 |

| Paul Lejuez |

Citigroup |

Lowers |

Neutral |

$20.00 |

$21.00 |

| Matthew Boss |

JP Morgan |

Raises |

Underweight |

$15.00 |

$14.00 |

| Dana Telsey |

Telsey Advisory Group |

Raises |

Market Perform |

$19.00 |

$17.00 |

| Paul Lejuez |

Citigroup |

Raises |

Neutral |

$21.00 |

$15.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Nordstrom. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Nordstrom compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Nordstrom's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Nordstrom's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Nordstrom analyst ratings.

About Nordstrom

Nordstrom is a fashion retailer that operates about 93 department stores and approximately 260 off-price Nordstrom Rack stores. The company also operates both full- and off-price e-commerce sites, two clearance stores, and seven Local locations. Nordstrom's largest merchandise categories are women's apparel (28% of 2022 sales), shoes (26% of 2022 sales), men's apparel (15% of 2022 sales), and women's accessories (13% of 2022 sales). Nordstrom, which traces its history to a shoe store opened in Seattle in 1901, continues to be partially owned and managed by members of the eponymous family.

A Deep Dive into Nordstrom's Financials

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3 months period, Nordstrom faced challenges, resulting in a decline of approximately -6.37% in revenue growth as of 31 October, 2023. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Nordstrom's net margin excels beyond industry benchmarks, reaching 2.02%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Nordstrom's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.55% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.75%, the company showcases effective utilization of assets.

Debt Management: Nordstrom's debt-to-equity ratio surpasses industry norms, standing at 6.17. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: JWN