Looking At Cleanspark's Recent Unusual Options Activity

Author: Benzinga Insights | March 07, 2024 02:01pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Cleanspark.

Looking at options history for Cleanspark (NASDAQ:CLSK) we detected 29 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 55% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $349,044 and 22, calls, for a total amount of $1,082,306.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2.5 to $30.0 for Cleanspark over the recent three months.

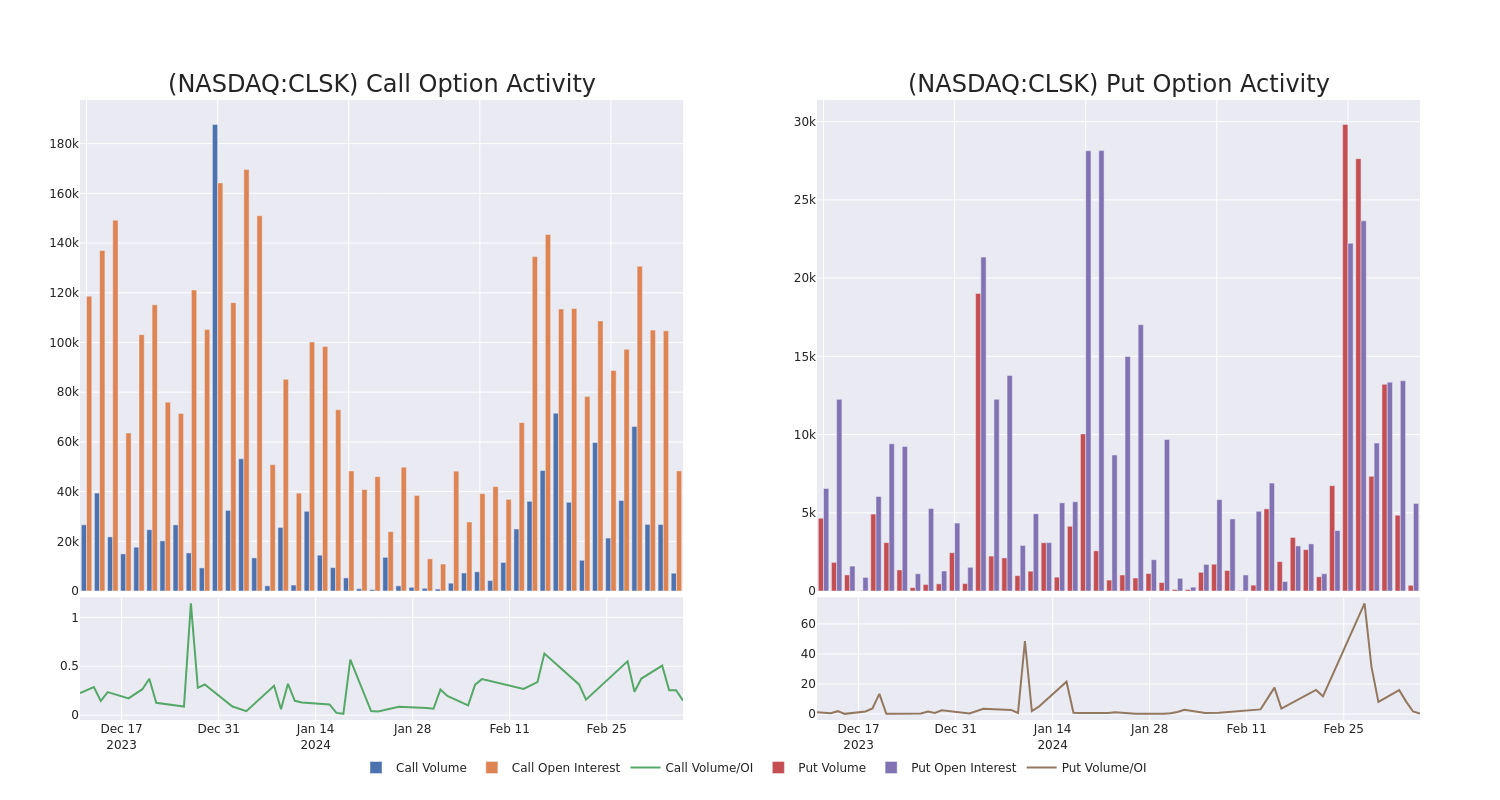

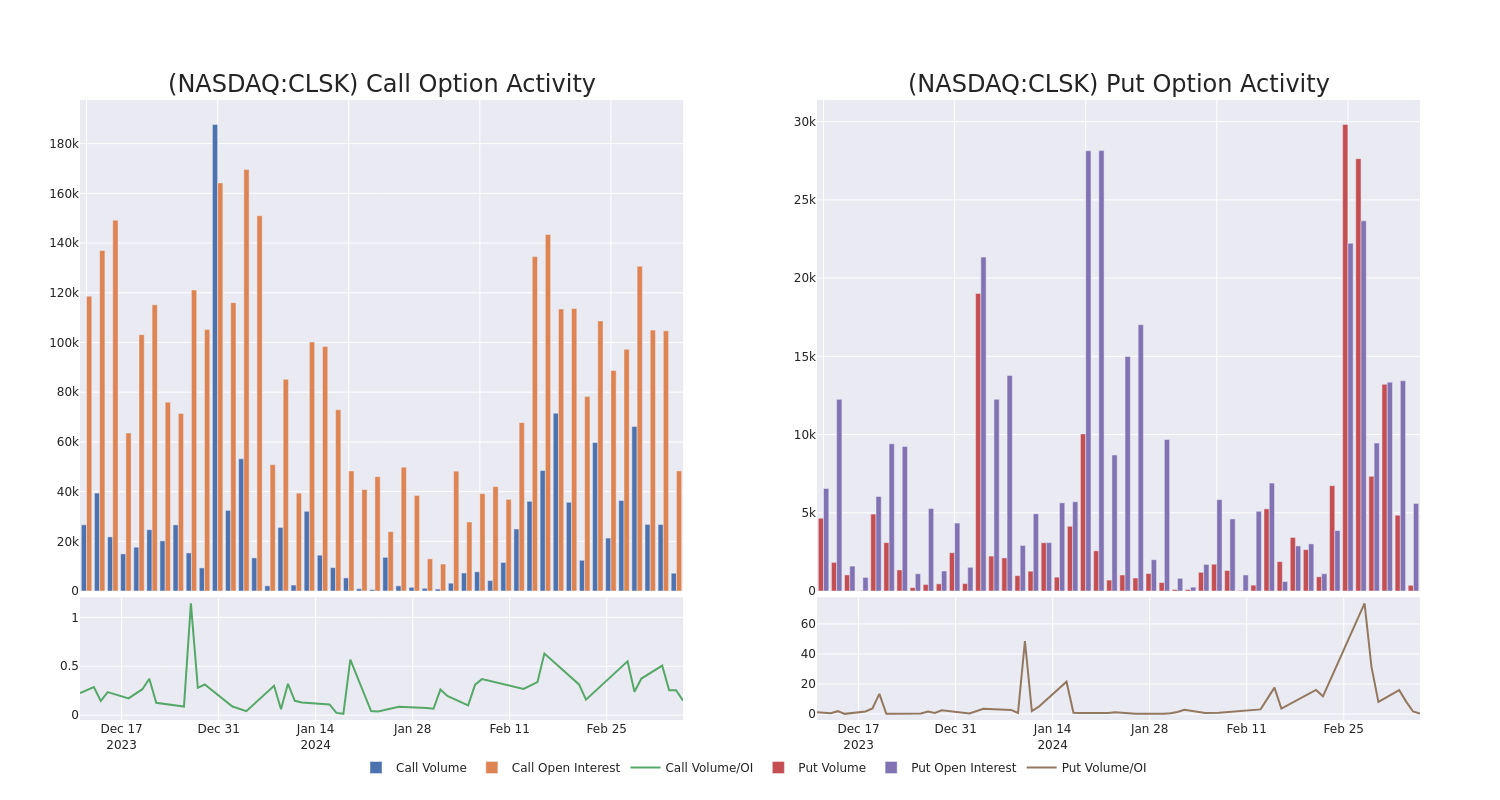

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Cleanspark's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Cleanspark's significant trades, within a strike price range of $2.5 to $30.0, over the past month.

Cleanspark 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CLSK |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$12.50 |

$124.2K |

2.1K |

175 |

| CLSK |

PUT |

SWEEP |

NEUTRAL |

01/17/25 |

$30.00 |

$115.9K |

8 |

0 |

| CLSK |

CALL |

TRADE |

NEUTRAL |

01/17/25 |

$2.50 |

$114.4K |

8.7K |

81 |

| CLSK |

CALL |

TRADE |

BULLISH |

03/15/24 |

$17.00 |

$74.8K |

1.8K |

1.0K |

| CLSK |

CALL |

TRADE |

BEARISH |

03/15/24 |

$18.00 |

$68.0K |

2.9K |

1.5K |

About Cleanspark

Cleanspark Inc is a bitcoin mining company. Through CleanSpark, Inc., and the Company's wholly owned subsidiaries, the company mines bitcoin. The company entered the bitcoin mining industry through its acquisition of ATL. Bitcoin mining is the sole reportable segment of the company.

In light of the recent options history for Cleanspark, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Cleanspark Standing Right Now?

- With a volume of 18,727,521, the price of CLSK is down -0.45% at $16.5.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 62 days.

Expert Opinions on Cleanspark

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $26.333333333333332.

- Consistent in their evaluation, an analyst from Chardan Capital keeps a Buy rating on Cleanspark with a target price of $26.

- An analyst from Chardan Capital persists with their Buy rating on Cleanspark, maintaining a target price of $26.

- An analyst from HC Wainwright & Co. has decided to maintain their Buy rating on Cleanspark, which currently sits at a price target of $27.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cleanspark options trades with real-time alerts from Benzinga Pro.

Posted In: CLSK