A Closer Look at 5 Analyst Recommendations For GEN Restaurant Gr

Author: Benzinga Insights | March 07, 2024 01:00pm

5 analysts have shared their evaluations of GEN Restaurant Gr (NASDAQ:GENK) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

0 |

0 |

0 |

0 |

| Last 30D |

3 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

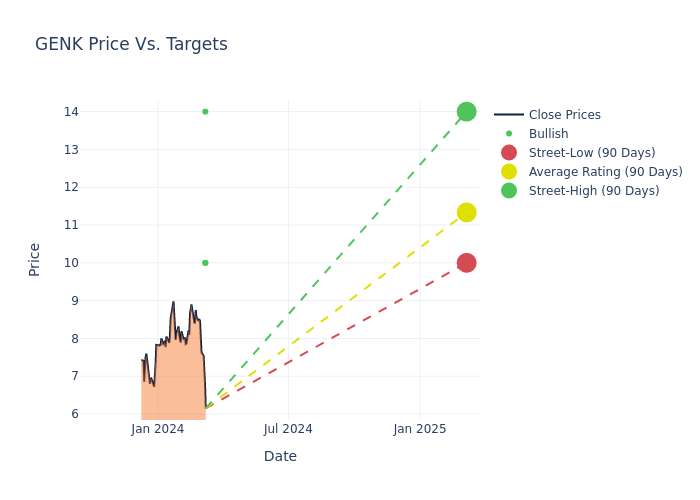

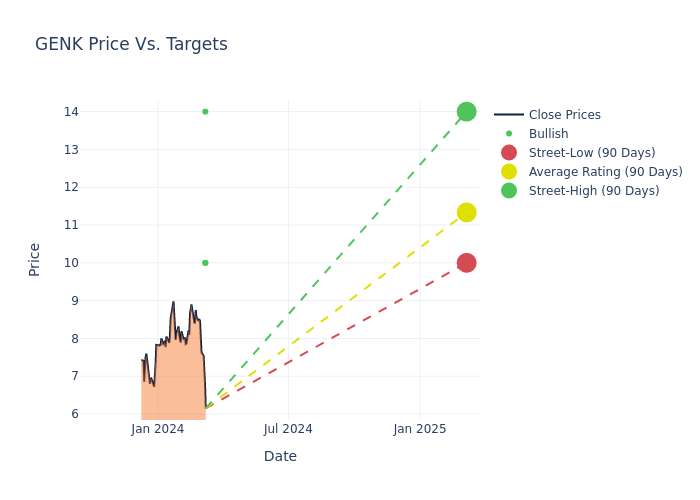

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $12.2, a high estimate of $16.00, and a low estimate of $10.00. Experiencing a 17.57% decline, the current average is now lower than the previous average price target of $14.80.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive GEN Restaurant Gr is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jeremy Hamblin |

Craig-Hallum |

Lowers |

Buy |

$10.00 |

$13.00 |

| Todd Brooks |

Benchmark |

Lowers |

Buy |

$14.00 |

$16.00 |

| George Kelly |

Roth MKM |

Lowers |

Buy |

$10.00 |

$11.00 |

| George Kelly |

Roth MKM |

Lowers |

Buy |

$11.00 |

$14.00 |

| Todd Brooks |

Benchmark |

Lowers |

Buy |

$16.00 |

$20.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to GEN Restaurant Gr. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of GEN Restaurant Gr compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of GEN Restaurant Gr's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of GEN Restaurant Gr's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on GEN Restaurant Gr analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind GEN Restaurant Gr

GEN Restaurant Group Inc is engaged in GEN Korean BBQ which is one of the largest Asian casual dining restaurants. It offers an extensive menu of traditional Korean and Korean-American food, including high-quality meats, poultry, seafood and mixed vegetables, all at a superior value. Its restaurants have modern decor, lively Korean pop music playing in the background and embedded grills in the center of each table. Its food is served family style and requires guests to share and coordinate their cooking responsibilities, which fosters more meaningful interaction than traditional casual dining. The company believes in its unique culinary experience appeals to a vast segment of the population, particularly Millennials and Gen Z.

Breaking Down GEN Restaurant Gr's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: GEN Restaurant Gr's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2023, the company achieved a revenue growth rate of approximately 7.41%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 0.74%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): GEN Restaurant Gr's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.78% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): GEN Restaurant Gr's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.19% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: GEN Restaurant Gr's debt-to-equity ratio stands notably higher than the industry average, reaching 19.04. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: GENK