Workday's Options Frenzy: What You Need to Know

Author: Benzinga Insights | March 05, 2024 02:03pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Workday.

Looking at options history for Workday (NASDAQ:WDAY) we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 58% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $293,505 and 9, calls, for a total amount of $517,569.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $255.0 and $320.0 for Workday, spanning the last three months.

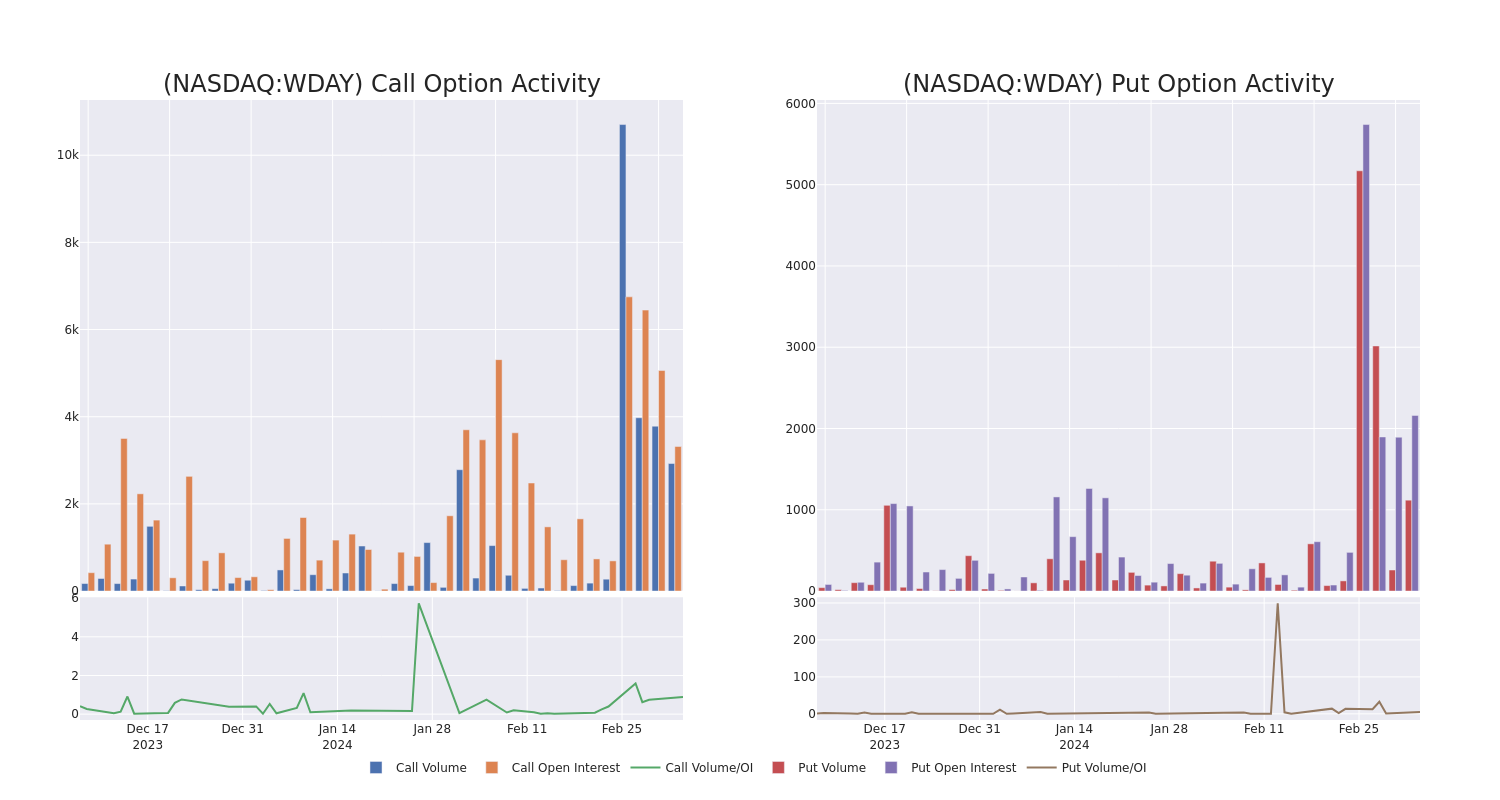

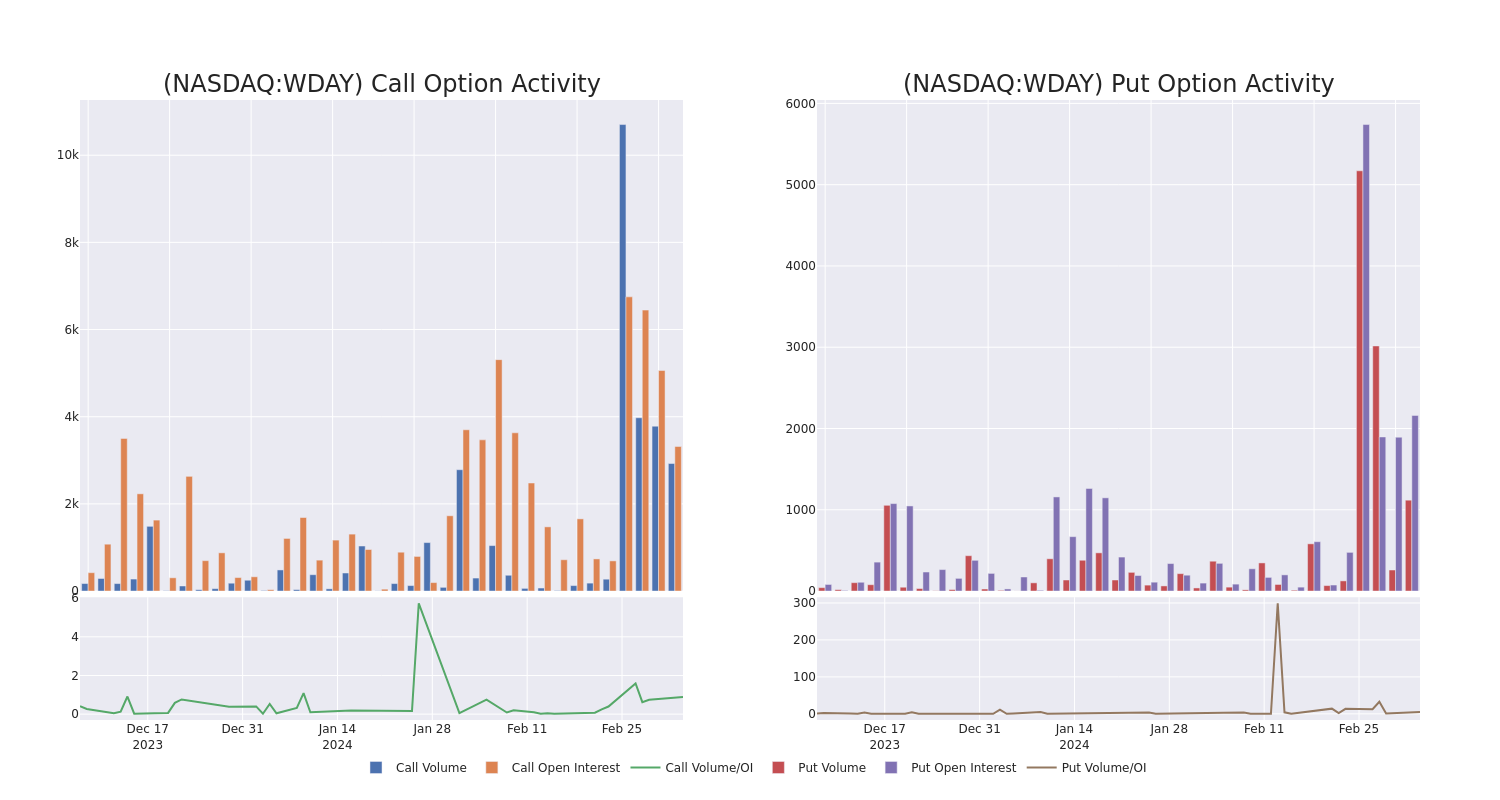

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Workday stands at 421.31, with a total volume reaching 4,044.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Workday, situated within the strike price corridor from $255.0 to $320.0, throughout the last 30 days.

Workday Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| WDAY |

CALL |

SWEEP |

BEARISH |

04/12/24 |

$275.00 |

$169.5K |

331 |

300 |

| WDAY |

CALL |

SWEEP |

NEUTRAL |

06/21/24 |

$300.00 |

$76.5K |

1.1K |

124 |

| WDAY |

CALL |

TRADE |

BEARISH |

01/16/26 |

$260.00 |

$62.0K |

17 |

10 |

| WDAY |

PUT |

TRADE |

NEUTRAL |

03/15/24 |

$290.00 |

$61.3K |

872 |

2 |

| WDAY |

CALL |

TRADE |

BEARISH |

01/17/25 |

$270.00 |

$54.8K |

286 |

15 |

About Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Having examined the options trading patterns of Workday, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Workday

- Trading volume stands at 2,885,539, with WDAY's price down by -0.85%, positioned at $270.7.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 79 days.

Expert Opinions on Workday

In the last month, 5 experts released ratings on this stock with an average target price of $329.8.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Workday, which currently sits at a price target of $350.

- Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $315.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Workday, targeting a price of $316.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Workday, targeting a price of $338.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Workday with a target price of $330.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Workday with Benzinga Pro for real-time alerts.

Posted In: WDAY