Beyond The Numbers: 6 Analysts Discuss Kimberly-Clark Stock

Author: Benzinga Insights | March 01, 2024 08:00am

6 analysts have shared their evaluations of Kimberly-Clark (NYSE:KMB) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

0 |

3 |

2 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

3 |

1 |

0 |

| 3M Ago |

0 |

0 |

0 |

1 |

0 |

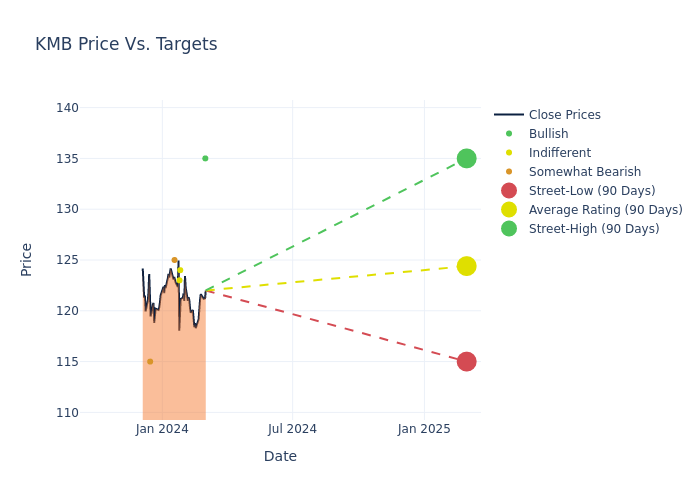

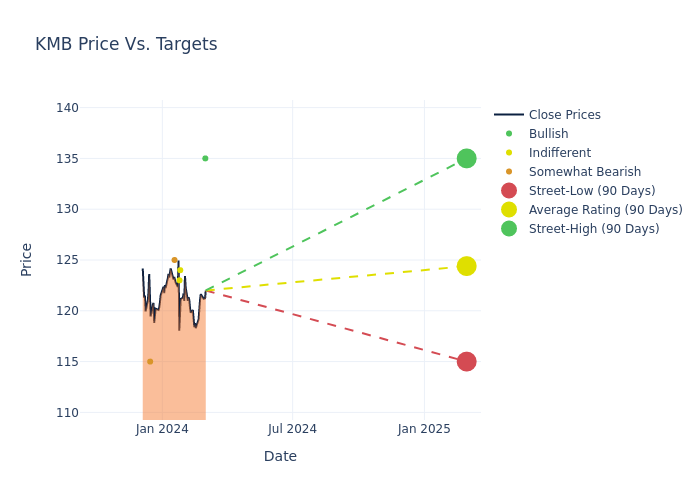

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $125.0, with a high estimate of $135.00 and a low estimate of $115.00. This current average represents a 1.96% decrease from the previous average price target of $127.50.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive Kimberly-Clark. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jason English |

Goldman Sachs |

Maintains |

Buy |

$135.00 |

$135.00 |

| Lauren Lieberman |

Barclays |

Lowers |

Equal-Weight |

$124.00 |

$128.00 |

| Nik Modi |

RBC Capital |

Lowers |

Sector Perform |

$123.00 |

$125.00 |

| Andrea Teixeira |

JP Morgan |

Raises |

Underweight |

$125.00 |

$119.00 |

| Lauren Lieberman |

Barclays |

Raises |

Equal-Weight |

$128.00 |

$123.00 |

| Anna Lizzul |

B of A Securities |

Lowers |

Underperform |

$115.00 |

$135.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Kimberly-Clark. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Kimberly-Clark compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Kimberly-Clark's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Kimberly-Clark's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Kimberly-Clark analyst ratings.

Unveiling the Story Behind Kimberly-Clark

With more than half of sales from personal care and another third from consumer tissue products, Kimberly-Clark sits as a leading manufacturer in the tissue and hygiene realm. Its brand mix includes Huggies, Pull-Ups, Kotex, Depend, Kleenex, and Cottonelle. The firm also operates K-C Professional, which partners with businesses to provide safety and sanitary offerings for the workplace. Kimberly-Clark generates just over of half its sales in North America and more than 10% in Europe, with the rest primarily concentrated in Asia and Latin America.

Understanding the Numbers: Kimberly-Clark's Finances

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Positive Revenue Trend: Examining Kimberly-Clark's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.12% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Net Margin: Kimberly-Clark's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 10.24%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Kimberly-Clark's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 63.82%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Kimberly-Clark's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.95% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Kimberly-Clark's debt-to-equity ratio is below the industry average at 8.87, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: KMB