Unpacking the Latest Options Trading Trends in Cytokinetics

Author: Benzinga Insights | February 28, 2024 02:45pm

Financial giants have made a conspicuous bearish move on Cytokinetics. Our analysis of options history for Cytokinetics (NASDAQ:CYTK) revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $148,711, and 5 were calls, valued at $170,948.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $100.0 for Cytokinetics during the past quarter.

Analyzing Volume & Open Interest

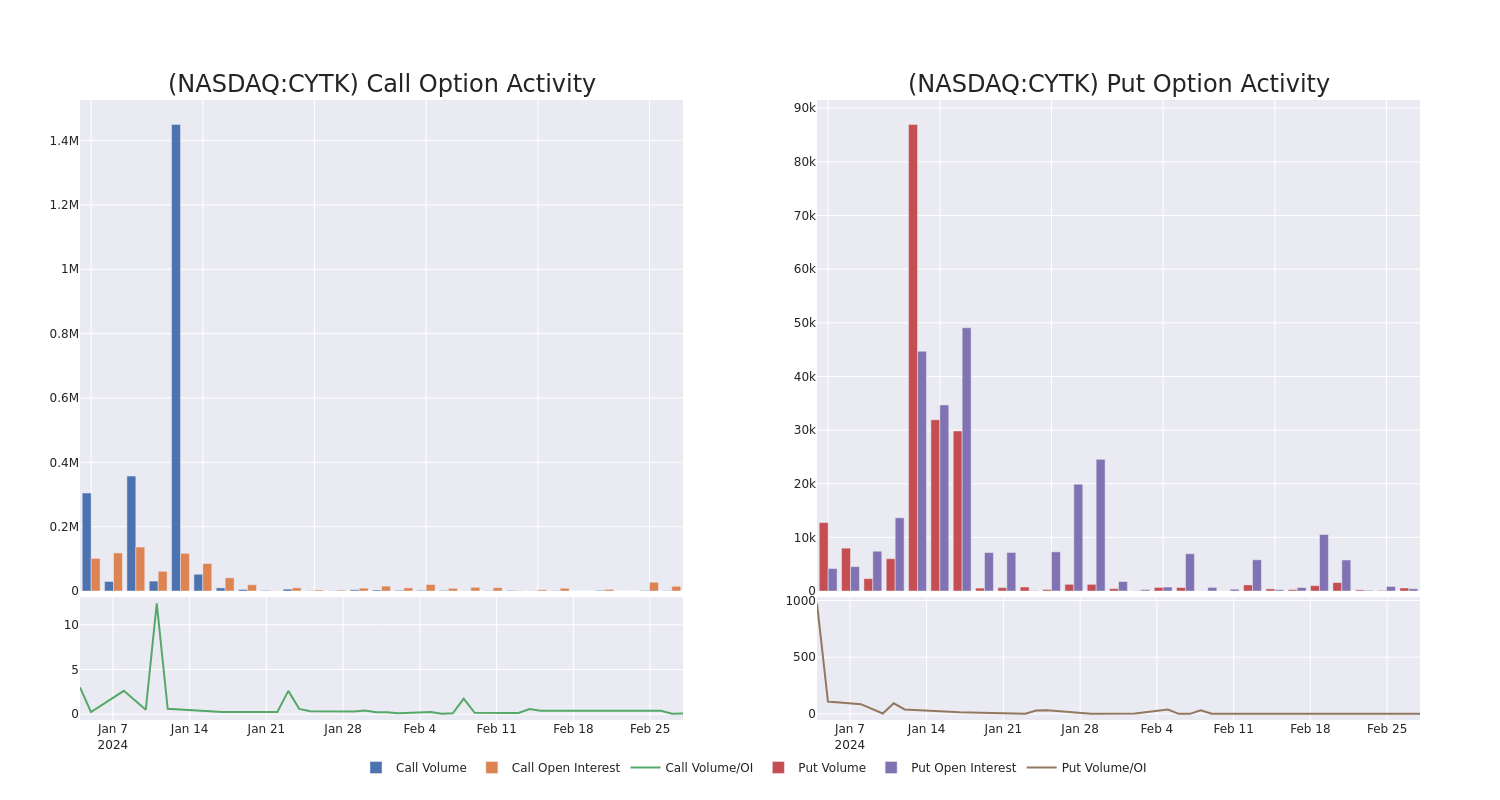

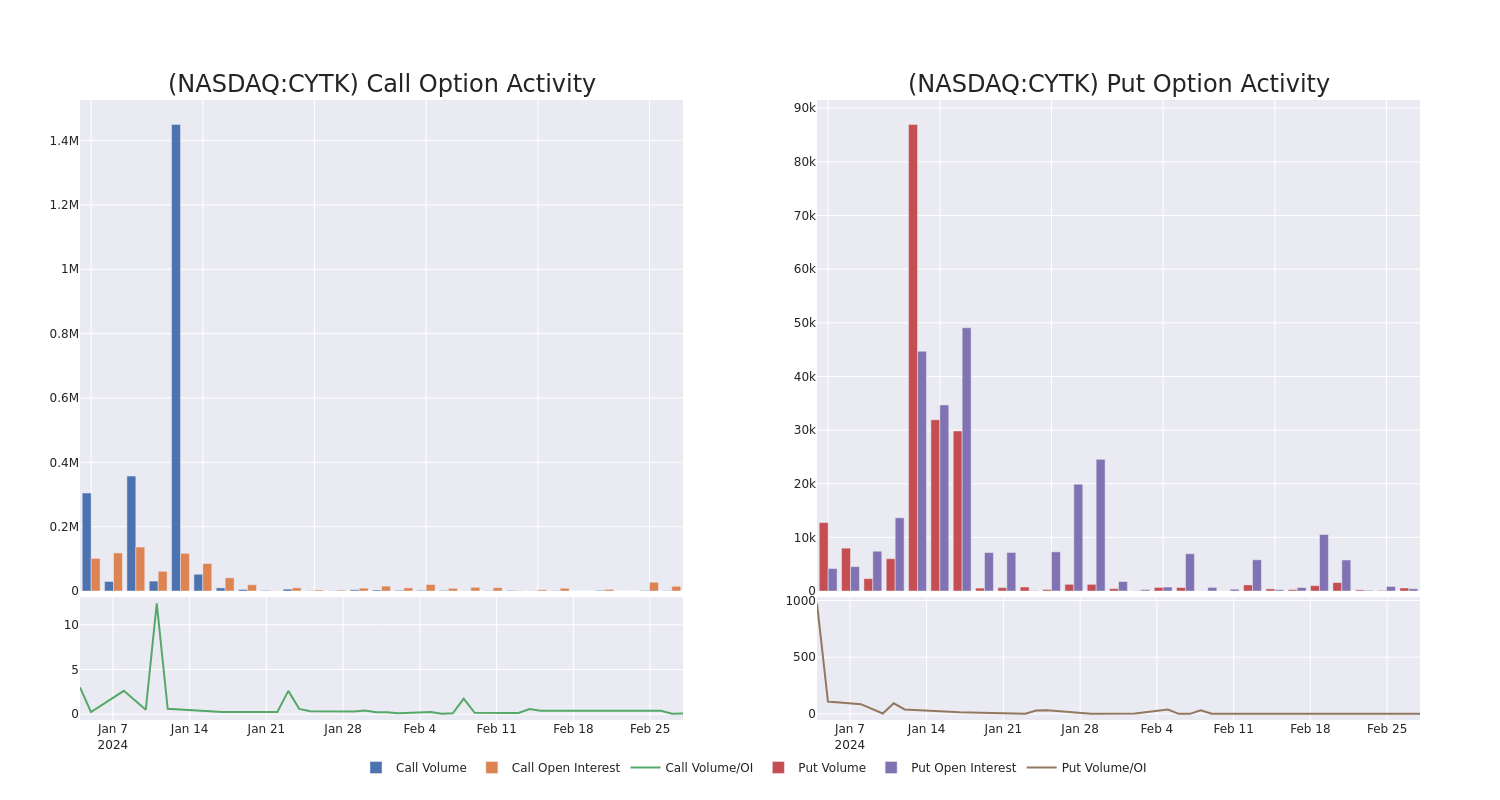

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Cytokinetics's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cytokinetics's whale activity within a strike price range from $50.0 to $100.0 in the last 30 days.

Cytokinetics Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CYTK |

PUT |

SWEEP |

BULLISH |

06/21/24 |

$60.00 |

$76.1K |

386 |

62 |

| CYTK |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$100.00 |

$50.8K |

665 |

14 |

| CYTK |

PUT |

SWEEP |

BULLISH |

06/21/24 |

$60.00 |

$45.8K |

386 |

484 |

| CYTK |

CALL |

TRADE |

BEARISH |

03/15/24 |

$100.00 |

$35.0K |

9.2K |

1.1K |

| CYTK |

CALL |

TRADE |

BEARISH |

01/17/25 |

$50.00 |

$29.5K |

1.5K |

10 |

About Cytokinetics

Cytokinetics Inc is a biotechnology company that develops muscle biology-driven treatments for diseases characterized by reduced muscle function, muscle weakness, and fatigue. The company develops treatments for diseases such as amyotrophic lateral sclerosis, heart failure, spinal muscular atrophy, and chronic obstructive pulmonary disease. The treatment is based on small molecules specifically engineered to increase muscle function and contractility. The company is developing muscle-directed investigational medicines that may potentially improve the health span of people with devastating cardiovascular and neuromuscular diseases of impaired muscle function.

Current Position of Cytokinetics

- Currently trading with a volume of 2,126,180, the CYTK's price is down by -3.9%, now at $77.83.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 64 days.

Professional Analyst Ratings for Cytokinetics

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $101.0.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $108.

- An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $94.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cytokinetics with Benzinga Pro for real-time alerts.

Posted In: CYTK