Assessing Norwegian Cruise Line: Insights From 6 Financial Analysts

Author: Benzinga Insights | February 28, 2024 02:00pm

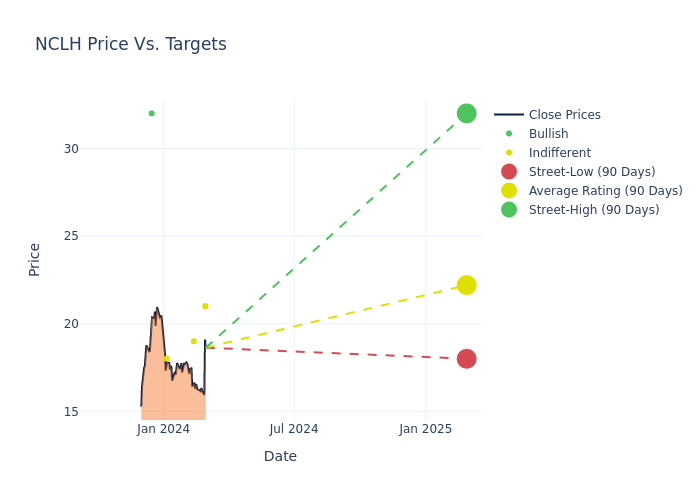

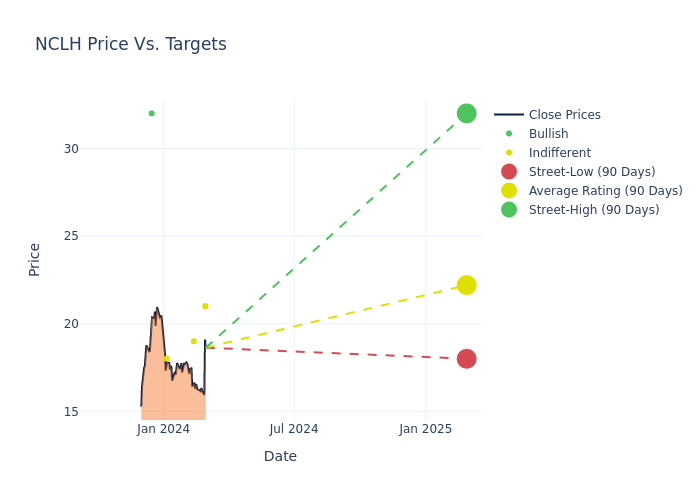

During the last three months, 6 analysts shared their evaluations of Norwegian Cruise Line (NYSE:NCLH), revealing diverse outlooks from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

0 |

5 |

0 |

0 |

| Last 30D |

0 |

0 |

2 |

0 |

0 |

| 1M Ago |

0 |

0 |

2 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

Analysts have recently evaluated Norwegian Cruise Line and provided 12-month price targets. The average target is $21.83, accompanied by a high estimate of $32.00 and a low estimate of $18.00. This upward trend is apparent, with the current average reflecting a 3.12% increase from the previous average price target of $21.17.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Norwegian Cruise Line's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Brandt Montour |

Barclays |

Raises |

Equal-Weight |

$21.00 |

$20.00 |

| Christopher Stathoulopoulos |

Susquehanna |

Raises |

Neutral |

$21.00 |

$20.00 |

| James Hardiman |

Citigroup |

Lowers |

Neutral |

$19.00 |

$23.00 |

| Christopher Stathoulopoulos |

Susquehanna |

Raises |

Neutral |

$20.00 |

$14.00 |

| Daniel Politzer |

Wells Fargo |

Maintains |

Equal-Weight |

$18.00 |

$18.00 |

| Ivan Feinseth |

Tigress Financial |

Maintains |

Strong Buy |

$32.00 |

$32.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Norwegian Cruise Line. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Norwegian Cruise Line compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Norwegian Cruise Line's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Norwegian Cruise Line's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Norwegian Cruise Line analyst ratings.

Delving into Norwegian Cruise Line's Background

Norwegian Cruise Line is the world's third-largest cruise company by berths (at more than 66,000), operating 31 ships across three brands (Norwegian, Oceania, and Regent Seven Seas), offering both freestyle and luxury cruising. The company had redeployed its entire fleet as of May 2022. With six passenger vessels on order among its brands through 2028 (representing 16,500 incremental berths), Norwegian is increasing capacity faster than its peers, expanding its brand globally. Norwegian sails to around 700 global destinations.

Norwegian Cruise Line: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Norwegian Cruise Line's remarkable performance in 3 months is evident. As of 30 September, 2023, the company achieved an impressive revenue growth rate of 56.98%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 13.64%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Norwegian Cruise Line's ROE excels beyond industry benchmarks, reaching 152.4%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Norwegian Cruise Line's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.83%, the company showcases efficient use of assets and strong financial health.

Debt Management: Norwegian Cruise Line's debt-to-equity ratio is notably higher than the industry average. With a ratio of 31.63, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: NCLH