Upstart Hldgs Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | February 28, 2024 11:46am

Investors with significant funds have taken a bullish position in Upstart Hldgs (NASDAQ:UPST), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in UPST usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 10 options transactions for Upstart Hldgs. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 50% being bullish and 50% bearish. Of all the options we discovered, 9 are puts, valued at $462,406, and there was a single call, worth $75,000.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $35.0 for Upstart Hldgs during the past quarter.

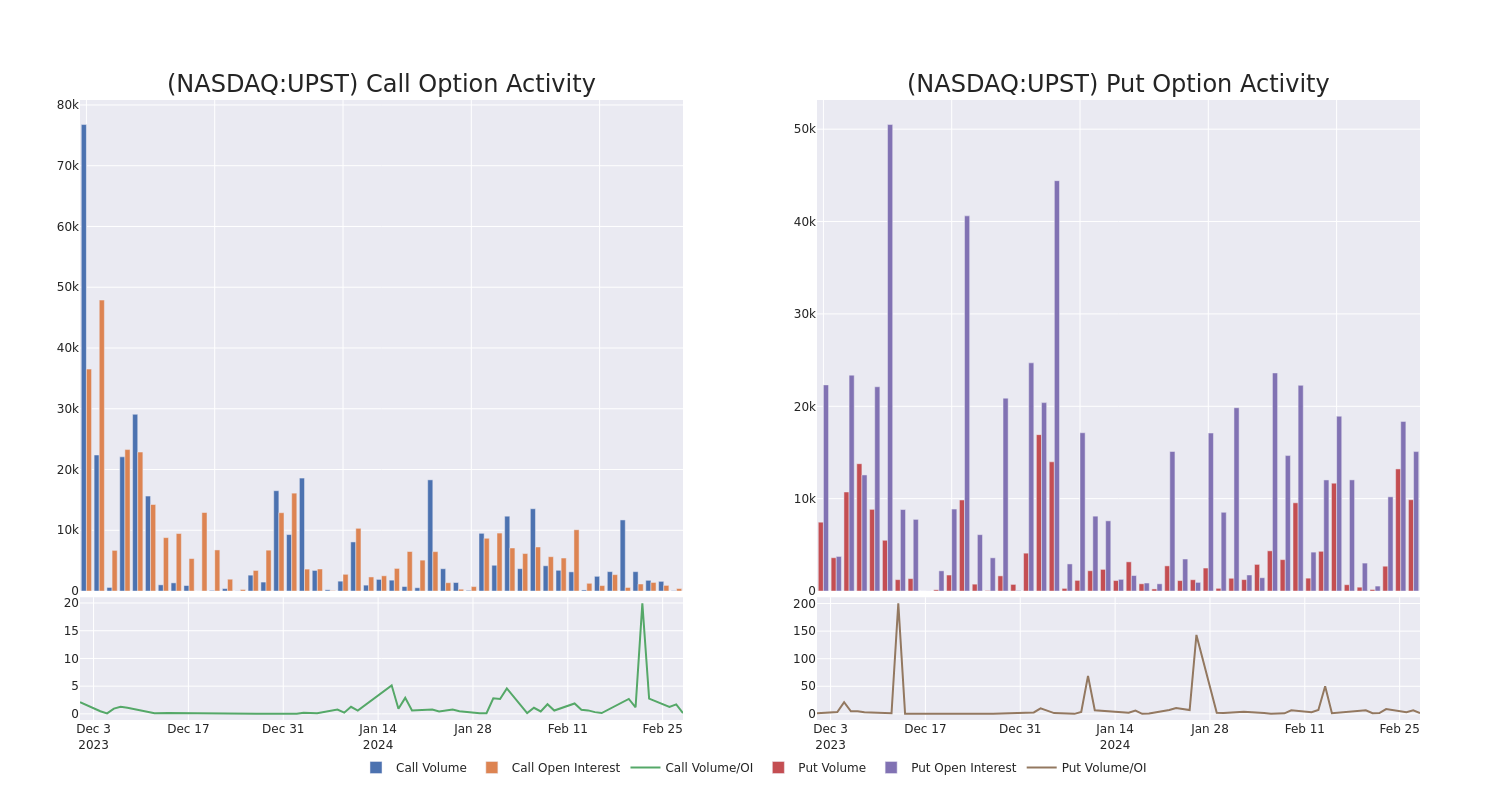

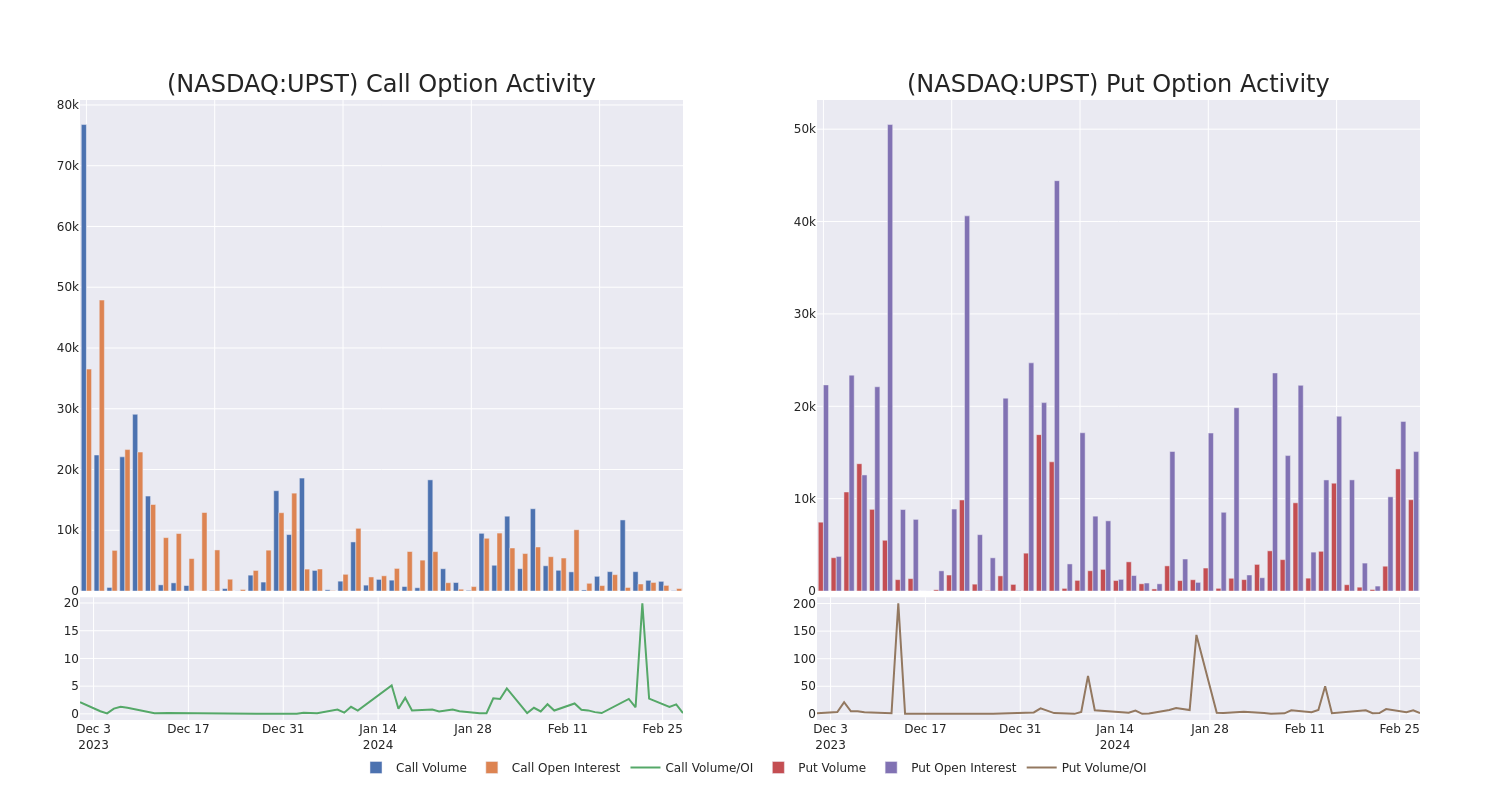

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Upstart Hldgs's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Upstart Hldgs's whale activity within a strike price range from $25.0 to $35.0 in the last 30 days.

Upstart Hldgs 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| UPST |

PUT |

SWEEP |

BULLISH |

03/15/24 |

$27.50 |

$107.9K |

7.7K |

1.5K |

| UPST |

PUT |

SWEEP |

BEARISH |

03/15/24 |

$27.50 |

$86.7K |

7.7K |

1.0K |

| UPST |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$25.00 |

$75.0K |

410 |

61 |

| UPST |

PUT |

SWEEP |

BULLISH |

03/15/24 |

$27.50 |

$63.0K |

7.7K |

751 |

| UPST |

PUT |

SWEEP |

BULLISH |

03/15/24 |

$27.50 |

$51.8K |

7.7K |

3.9K |

About Upstart Hldgs

Upstart Holdings Inc provides credit services. The company provides a proprietary, cloud-based, artificial intelligence lending platform. The platform aggregates consumer demand for loans and connects it to the network of Upstart AI-enabled bank partners. Upstart's platform includes personal loans, automotive retail and refinance loans, home equity lines of credit and small dollar loans.

Current Position of Upstart Hldgs

- Currently trading with a volume of 1,920,929, the UPST's price is down by -1.79%, now at $25.75.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 69 days.

Professional Analyst Ratings for Upstart Hldgs

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $26.0.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Underweight rating for Upstart Hldgs, targeting a price of $24.

- An analyst from Piper Sandler persists with their Neutral rating on Upstart Hldgs, maintaining a target price of $28.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Upstart Hldgs with Benzinga Pro for real-time alerts.

Posted In: UPST