Upstart Hldgs Unusual Options Activity

Author: Benzinga Insights | February 26, 2024 03:30pm

Financial giants have made a conspicuous bullish move on Upstart Hldgs. Our analysis of options history for Upstart Hldgs (NASDAQ:UPST) revealed 12 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $292,336, and 7 were calls, valued at $290,372.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $16.0 to $50.0 for Upstart Hldgs over the last 3 months.

Analyzing Volume & Open Interest

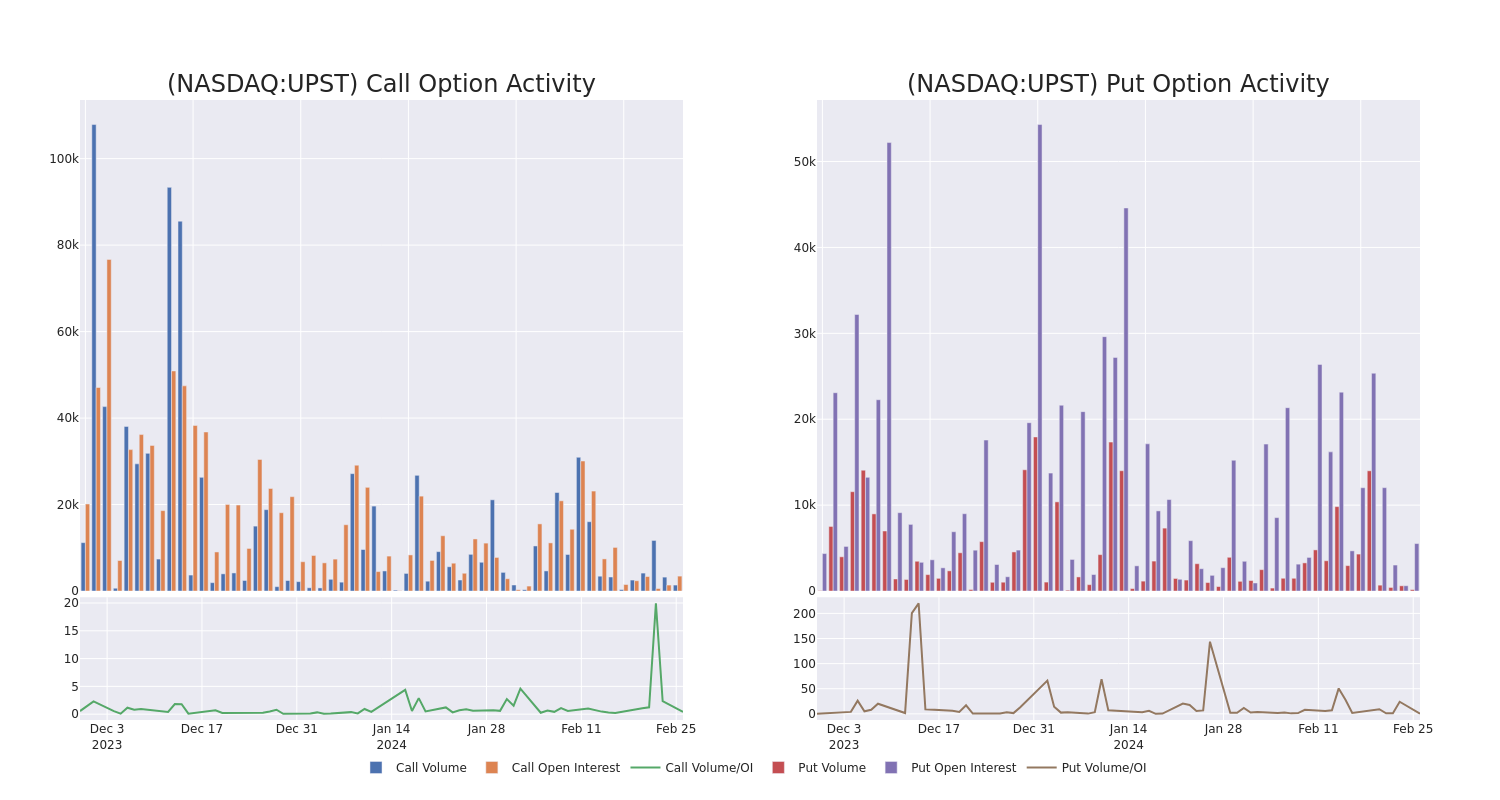

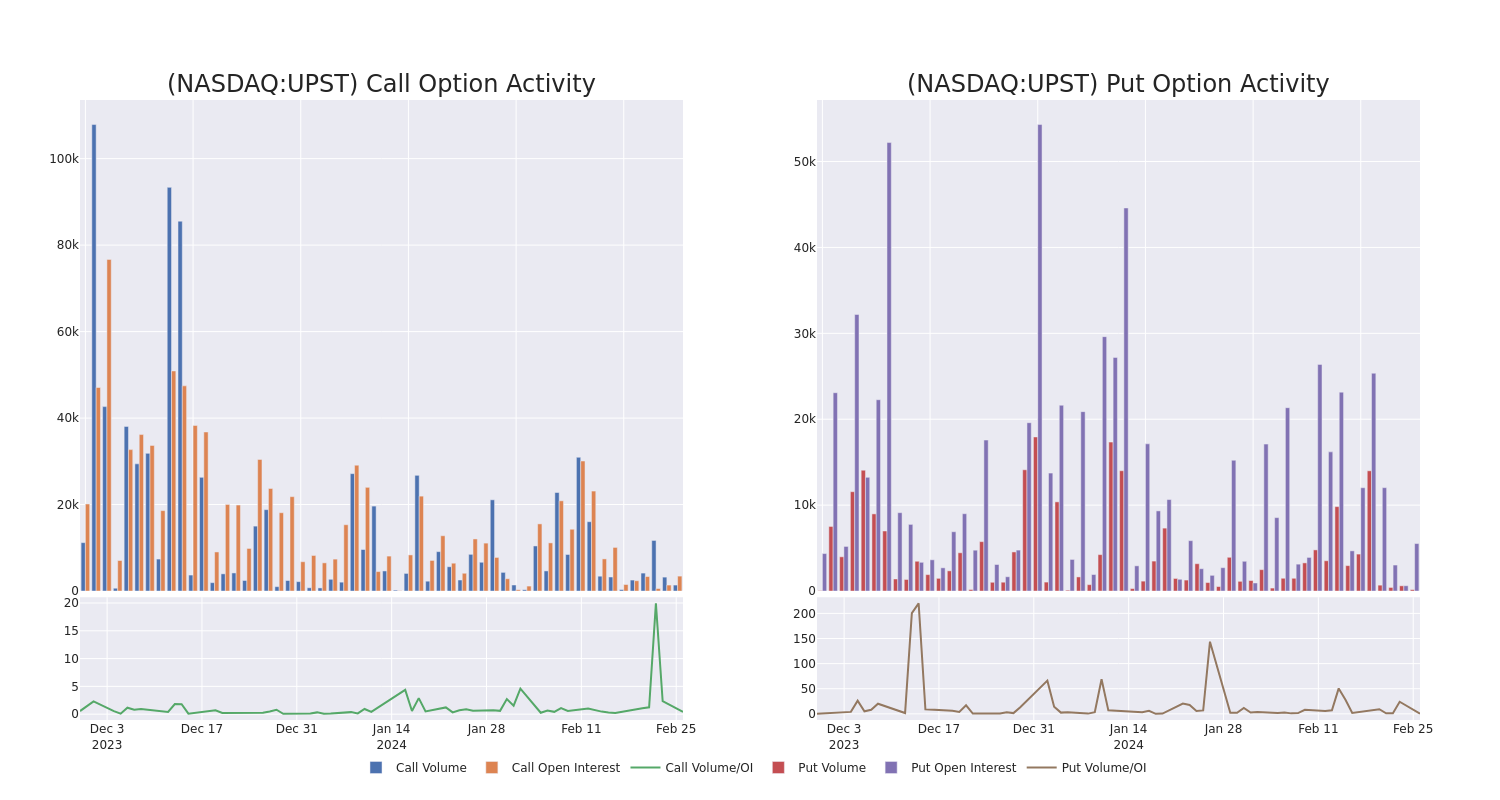

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Upstart Hldgs's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Upstart Hldgs's whale activity within a strike price range from $16.0 to $50.0 in the last 30 days.

Upstart Hldgs Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| UPST |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$40.00 |

$140.1K |

207 |

11 |

| UPST |

CALL |

SWEEP |

BULLISH |

04/05/24 |

$16.00 |

$75.6K |

0 |

200 |

| UPST |

PUT |

TRADE |

BULLISH |

01/17/25 |

$37.50 |

$56.4K |

501 |

35 |

| UPST |

CALL |

SWEEP |

BULLISH |

06/20/25 |

$35.00 |

$45.9K |

35 |

65 |

| UPST |

CALL |

TRADE |

BEARISH |

01/17/25 |

$20.00 |

$41.6K |

2.0K |

54 |

About Upstart Hldgs

Upstart Holdings Inc provides credit services. The company provides a proprietary, cloud-based, artificial intelligence lending platform. The platform aggregates consumer demand for loans and connects it to the network of Upstart AI-enabled bank partners. Upstart's platform includes personal loans, automotive retail and refinance loans, home equity lines of credit and small dollar loans.

Following our analysis of the options activities associated with Upstart Hldgs, we pivot to a closer look at the company's own performance.

Current Position of Upstart Hldgs

- Trading volume stands at 3,919,009, with UPST's price down by -0.33%, positioned at $24.16.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 71 days.

Professional Analyst Ratings for Upstart Hldgs

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $26.0.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Underweight rating on Upstart Hldgs with a target price of $24.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Neutral rating for Upstart Hldgs, targeting a price of $28.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Upstart Hldgs, Benzinga Pro gives you real-time options trades alerts.

Posted In: UPST