What Analysts Are Saying About NICE Stock

Author: Benzinga Insights | February 21, 2024 01:00pm

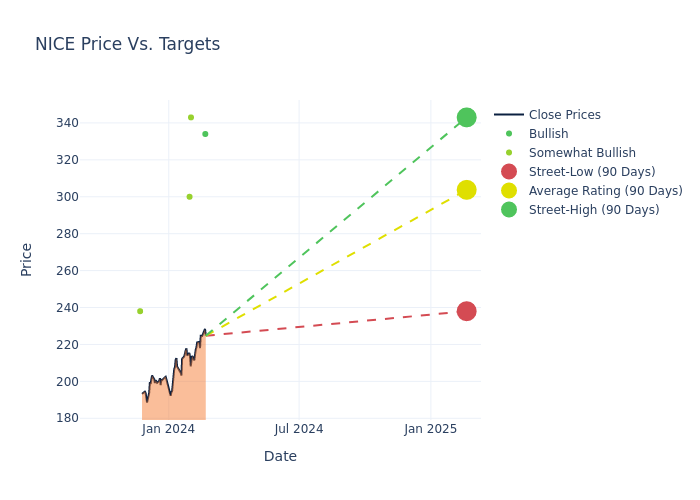

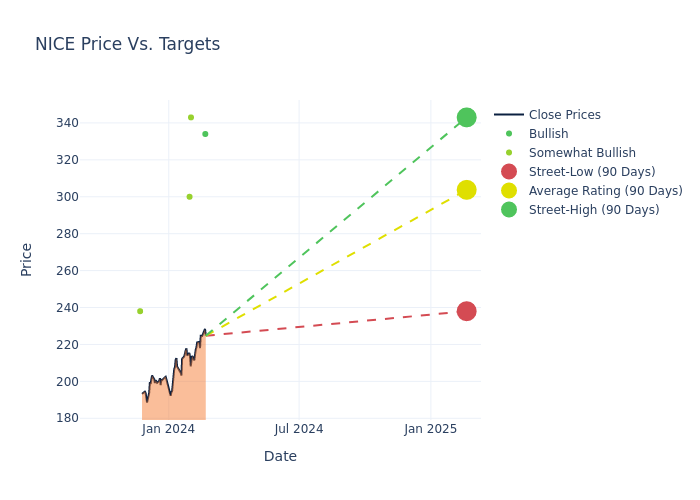

Analysts' ratings for NICE (NASDAQ:NICE) over the last quarter vary from bullish to bearish, as provided by 5 analysts.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

4 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

3 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $332.6, along with a high estimate of $343.00 and a low estimate of $300.00. Observing a 17.53% increase, the current average has risen from the previous average price target of $283.00.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of NICE by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Tyler Radke |

Citigroup |

Raises |

Buy |

$334.00 |

$283.00 |

| Patrick Walravens |

JMP Securities |

Maintains |

Market Outperform |

$343.00 |

- |

| Michael Latimore |

Northland Capital Markets |

Announces |

Outperform |

$300.00 |

- |

| Patrick Walravens |

JMP Securities |

Maintains |

Market Outperform |

$343.00 |

- |

| Patrick Walravens |

JMP Securities |

Maintains |

Market Outperform |

$343.00 |

- |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to NICE. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of NICE compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of NICE's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of NICE's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on NICE analyst ratings.

Delving into NICE's Background

Nice is an enterprise software company that serves the customer engagement and financial crime and compliance markets. The company provides data analytics-based solutions through both a cloud platform and on-premises infrastructure. Within customer engagement, Nice's CXone platform delivers solutions focused on contact center software and workforce engagement management, or WEM. Contact center offerings include solutions for digital self-service, customer journey and experience optimization, and compliance. WEM products optimize call center efficiency, leveraging data and AI analytics for call volume forecasting and agent scheduling. Within financial crime and compliance, Nice offers risk and investigation management, fraud prevention, anti-money laundering, and compliance solutions.

Financial Insights: NICE

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: NICE's remarkable performance in 3 months is evident. As of 30 September, 2023, the company achieved an impressive revenue growth rate of 8.4%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: NICE's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 15.36% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): NICE's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.89%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): NICE's ROA excels beyond industry benchmarks, reaching 1.88%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.23, NICE adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: NICE