What's Going On With Wix.com Stock Wednesday?

Author: Anusuya Lahiri | February 21, 2024 10:13am

Wix.com Ltd (NASDAQ:WIX) reported its fourth-quarter results Wednesday. Revenue grew 14% Y/Y to $403.8 million, beating the consensus of $402.8 million.

The adjusted EPS of $1.22 beat the consensus of $0.95. The stock gained after the results.

Revenue growth was led by Partners’ revenue growth (+38% Y/Y).

Segments: Creative Subscription revenue increased 12% Y/Y to $296.2 million. The Creative Subscriptions bookings climbed 1% Y/Y to $283.5 million. Creative Subscriptions ARR was $1.19 billion, up 10% Y/Y.

Business Solutions’ revenue rose 20% Y/Y to $107.6 million, and the bookings jumped 24% Y/Y to $111.5 million. The adjusted gross margin expanded to 70% from 65% a year ago.

Wix.com generated $90.4 million in operating cash flow and held $965.02 million in cash and cash equivalents as of December 31, 2023.

Avishai Abrahami, Wix Co-founder and CEO said, “In just six months, more than 500,000 agencies and freelancers have created Studio accounts, driving the number of Studio premium subscriptions to be ahead of plan. Most excitingly, nearly half of these Studio accounts were created by new Partners – a powerful indication that Studio is successfully winning a new market of large agencies who had not built on Wix before. AI was another major focus of innovation in 2023, building on nearly a decade of leading AI research and development at Wix.”

Outlook: Wix.com expects first-quarter revenue of $415 million to $419 million (consensus $416.55 million), up 11%-12% Y/Y.

The company expects fiscal 2024 revenue of $1.73 billion-$1.76 billion vs. the consensus of $1.75 billion. Wix.com projects 2024 bookings of $1.78 – $1.81 billion, up 12% – 14% Y/Y.

The company expects to generate free cash flow, excluding headquarters costs, of $370 million – $400 million, or 21 – 23% of revenue in 2024.

Price Action: WIX shares are up 4.93% at $131.50 premarket on the last check Wednesday.

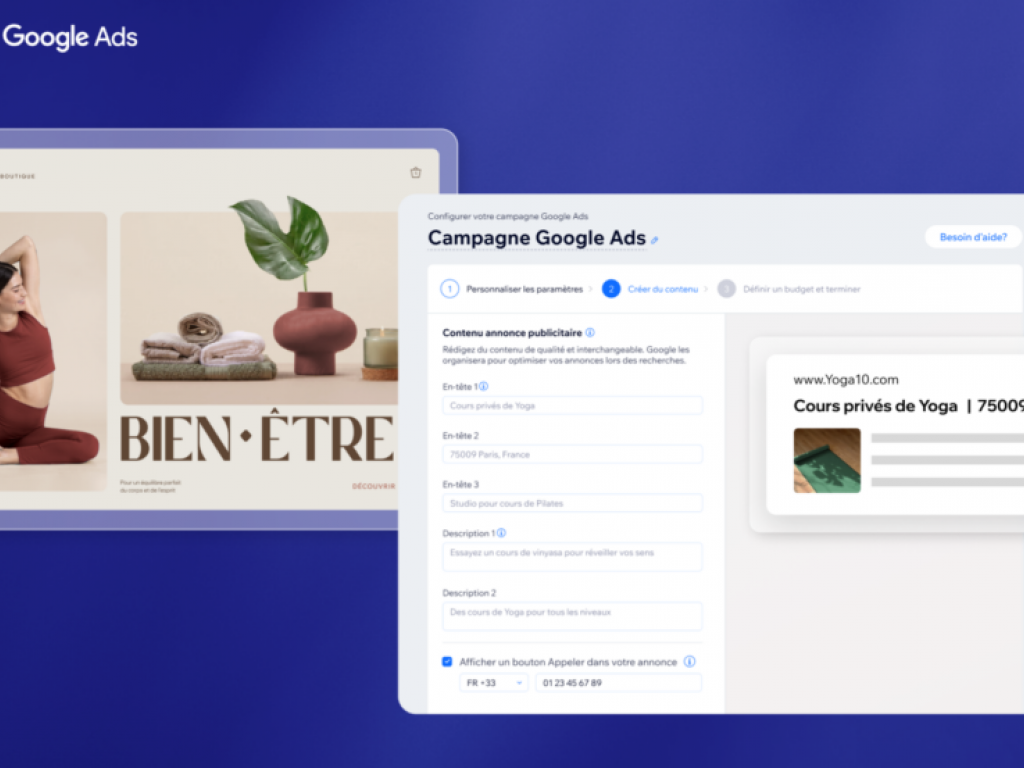

Photo via Company

Posted In: WIX