Market Whales and Their Recent Bets on FICO Options

Author: Benzinga Insights | February 05, 2024 03:30pm

High-rolling investors have positioned themselves bearish on Fair Isaac (NYSE:FICO), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FICO often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 16 options trades for Fair Isaac. This is not a typical pattern.

The sentiment among these major traders is split, with 6% bullish and 93% bearish. Among all the options we identified, there was one put, amounting to $60,800, and 15 calls, totaling $1,018,922.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $650.0 and $1300.0 for Fair Isaac, spanning the last three months.

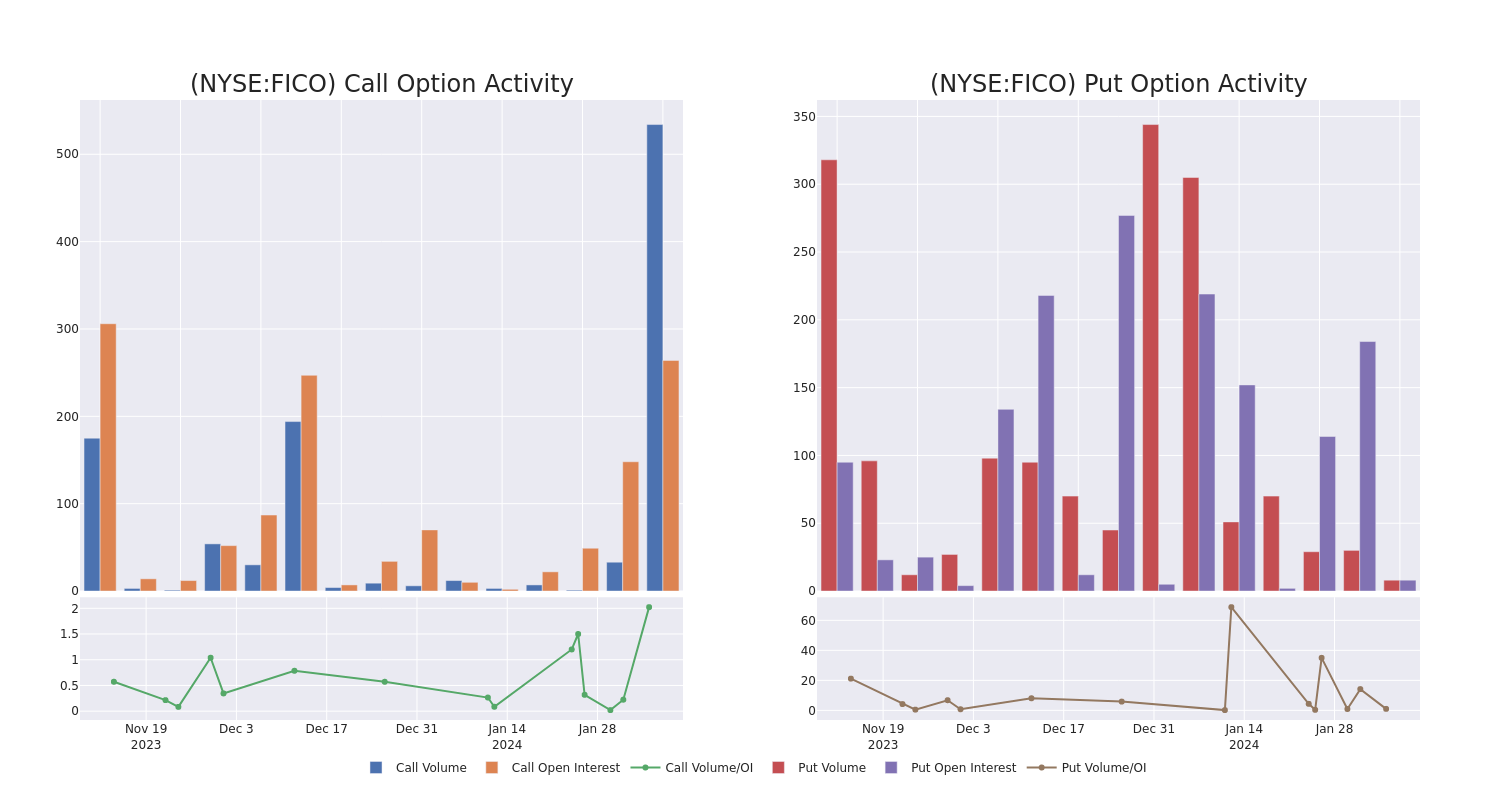

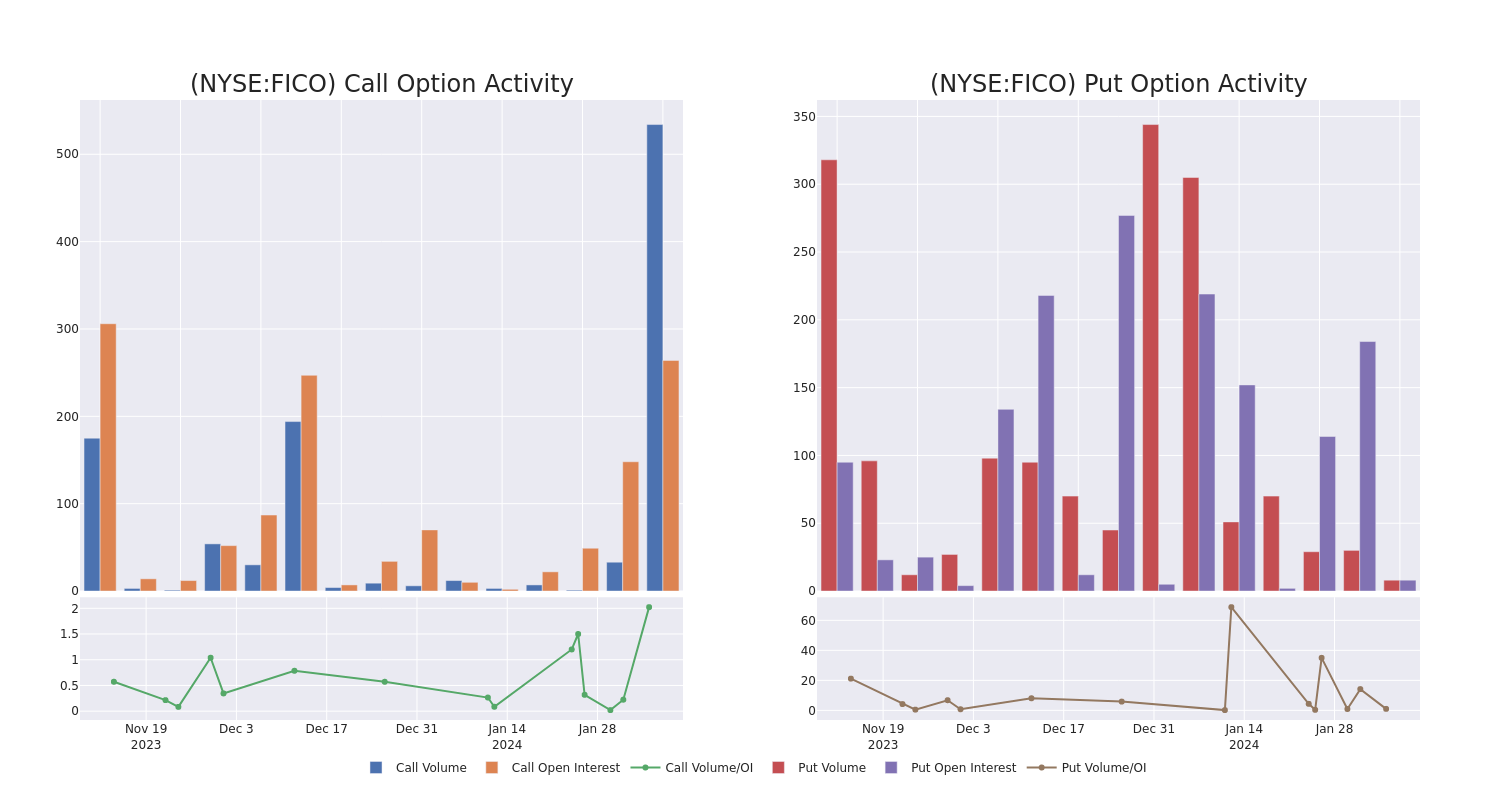

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Fair Isaac options trades today is 38.86 with a total volume of 542.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Fair Isaac's big money trades within a strike price range of $650.0 to $1300.0 over the last 30 days.

Fair Isaac Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| FICO |

CALL |

SWEEP |

BEARISH |

02/16/24 |

$1230.00 |

$141.7K |

127 |

76 |

| FICO |

CALL |

SWEEP |

BEARISH |

02/16/24 |

$1230.00 |

$129.6K |

127 |

34 |

| FICO |

CALL |

TRADE |

BEARISH |

06/21/24 |

$650.00 |

$121.7K |

5 |

4 |

| FICO |

CALL |

SWEEP |

BEARISH |

03/15/24 |

$1300.00 |

$97.2K |

122 |

36 |

| FICO |

CALL |

SWEEP |

BEARISH |

03/15/24 |

$1300.00 |

$83.8K |

122 |

45 |

About Fair Isaac

Founded in 1956, Fair Isaac Corporation is a leading applied analytics company. Fair Isaac is primarily known for its FICO credit scores, which is a widely used industry benchmark to determine the creditworthiness of an individual consumer. The firm's credit scores business accounts for most of the firm's profits and consists of business-to-business and business-to-consumer offerings. In addition to scores, Fair Isaac also sells software primarily to financial institutions for areas such as analytics, decision-making, customer workflows, and fraud.

Following our analysis of the options activities associated with Fair Isaac, we pivot to a closer look at the company's own performance.

Present Market Standing of Fair Isaac

- Currently trading with a volume of 50,438, the FICO's price is down by 0.0%, now at $1255.29.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 80 days.

Expert Opinions on Fair Isaac

In the last month, 5 experts released ratings on this stock with an average target price of $1402.8.

- An analyst from Needham has decided to maintain their Buy rating on Fair Isaac, which currently sits at a price target of $1500.

- An analyst from Raymond James persists with their Outperform rating on Fair Isaac, maintaining a target price of $1214.

- An analyst from Barclays has decided to maintain their Overweight rating on Fair Isaac, which currently sits at a price target of $1500.

- An analyst from Jefferies has decided to maintain their Buy rating on Fair Isaac, which currently sits at a price target of $1450.

- An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $1350.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Fair Isaac options trades with real-time alerts from Benzinga Pro.

Posted In: FICO