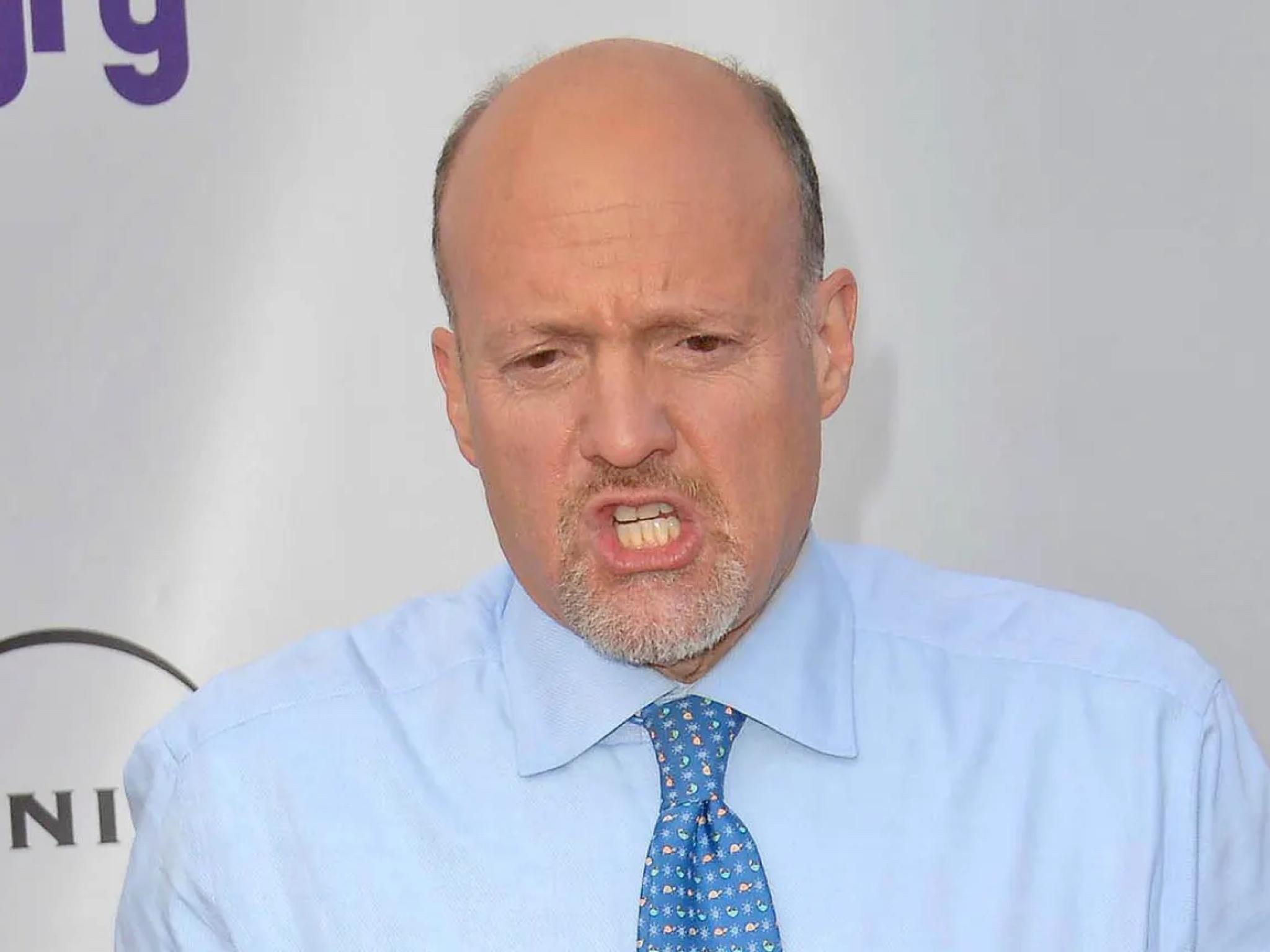

Cramer Hypes Up This 'Classic Stock,' Disagrees With Billionaire CEO's 'Dire' View

Author: Avi Kapoor | February 01, 2024 09:51am

On CNBC’s "Mad Money Lightning Round," Jim Cramer said he has always liked Woodward, Inc. (NASDAQ: WWD).

Woodward reported better-than-expected first-quarter financial results on Monday. The company posted adjusted earnings of $1.45 per share, beating market estimates of $1.10 per share. The company’s quarterly sales came in at $787.00 million versus expectations of $748.29 million, according to data from Benzinga Pro.

When asked about Starwood Property Trust, Inc. (NYSE:STWD), he said, "There are problems with commercial real estate, no doubt about it, but they’re not nearly as dire as Mr. Sternlicht says."

Cramer was referring to billionaire Starwood CEO Barry Sternlicht, who recently predicted that office real estate losses will reach $1 trillion.

Starwood Property Trust is expected to release its fourth quarter and full year 2023 financial results on Feb. 22, 2024 before the opening bell.

Simpson Manufacturing Co., Inc. (NYSE:SSD) is just "kind of a good, classic stock to own," Cramer said.

Simpson Manufacturing is scheduled to report its financial results for the fourth quarter on Feb. 5, 2024.

Don’t forget to check out our premarket coverage here

When asked about Super Group (SGHC) Limited (NYSE:SGHC), he said, "I don’t know what’s going on, because I do know that it is a very good company." Cramer said he likes DraftKings Inc. (NASDAQ:DKNG) though.

Super Group, during November, said third-quarter revenue rose 16% to €356.9 million.

"It’s too low," Cramer said about Devon Energy Corporation (NYSE:DVN). "$40, buy Devon."

On Jan. 24, Raymond James analyst John Freeman maintained Devon Energy with an Outperform and lowered the price target from $53 to $52, while Piper Sandler analyst Mark Lear maintained the stock with an Overweight and lowered the price target from $61 to $59.

Price Action:

- Shares of Devon Energy fell 3% to close at $42.02 on Wednesday.

- Super Group shares declined 2.5% to $3.13 on Wednesday.

- Simpson Manufacturing shares fell 3.9% to settle at $180.99 during Wednesday’s session.

- Shares of Starwood Property Trust fell 3.2% to close at $20.33 on Wednesday.

- Woodward shares fell 2.6% to settle at $137.77.

Image: Shutterstock

Now Read This: Top 5 Energy Stocks That May Crash This Quarter

Posted In: DKNG DVN SGHC SSD STWD WWD