Evaluating WestRock: Insights From 4 Financial Analysts

Author: Benzinga Insights | January 29, 2024 10:00am

WestRock (NYSE:WRK) underwent analysis by 4 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

4 |

0 |

0 |

| Last 30D |

0 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

2 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

2 |

0 |

0 |

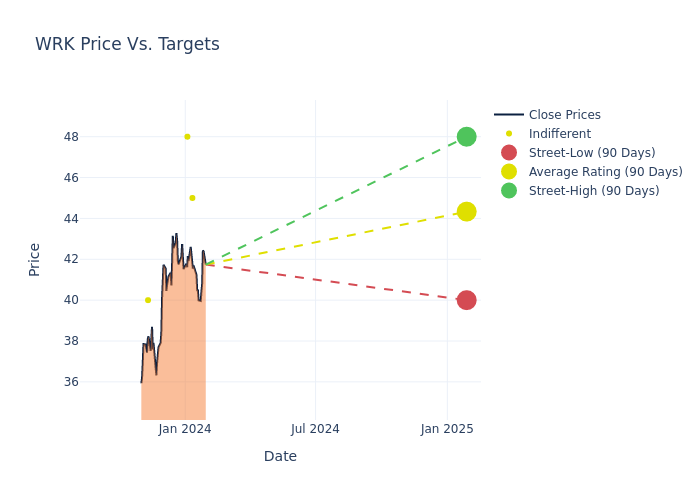

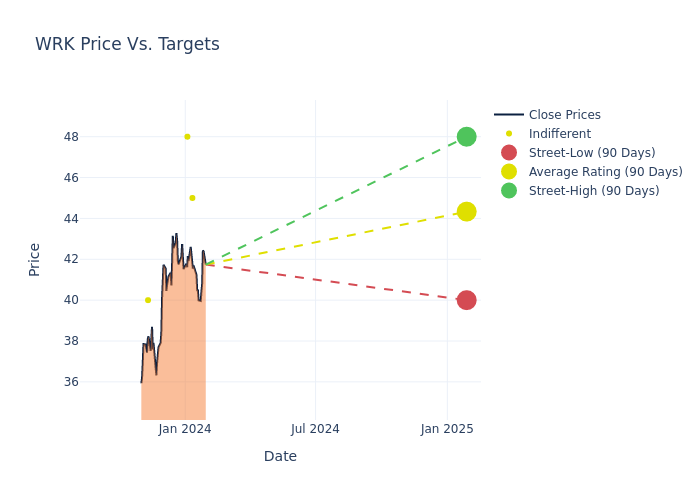

Insights from analysts' 12-month price targets are revealed, presenting an average target of $43.25, a high estimate of $48.00, and a low estimate of $40.00. Marking an increase of 5.49%, the current average surpasses the previous average price target of $41.00.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of WestRock among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Gabrial Hajde |

Wells Fargo |

Raises |

Equal-Weight |

$45.00 |

$42.00 |

| Michael Roxland |

Truist Securities |

Raises |

Hold |

$48.00 |

$40.00 |

| Michael Roxland |

Truist Securities |

Lowers |

Hold |

$40.00 |

$44.00 |

| Paul Quinn |

RBC Capital |

Raises |

Sector Perform |

$40.00 |

$38.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to WestRock. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of WestRock compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of WestRock's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of WestRock's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on WestRock analyst ratings.

Discovering WestRock: A Closer Look

WestRock manufactures corrugated packaging and consumer packaging, such as folding cartons and paperboard. After the merger of RockTenn and MeadWestvaco in fall 2015, WestRock became the largest North American producer of solid bleached sulfate and the second-largest producer of containerboard, which is used in the production of shipping containers.

WestRock: Financial Performance Dissected

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Decline in Revenue: Over the 3 months period, WestRock faced challenges, resulting in a decline of approximately -7.67% in revenue growth as of 30 September, 2023. This signifies a reduction in the company's top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: WestRock's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.2% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.09%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): WestRock's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.4% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: WestRock's debt-to-equity ratio is below the industry average. With a ratio of 0.85, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: WRK