Insights Into Southwestern Energy's Performance Versus Peers In Oil, Gas & Consumable Fuels Sector

Author: Benzinga Insights | January 24, 2024 12:01pm

In today's fast-paced and competitive business landscape, it is essential for investors and industry enthusiasts to thoroughly analyze companies before making investment decisions. In this article, we will conduct a comprehensive industry comparison, evaluating Southwestern Energy (NYSE:SWN) against its key competitors in the Oil, Gas & Consumable Fuels industry. By examining key financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company's performance within the industry.

Southwestern Energy Background

Southwestern Energy Co is a us-based independent energy company. It is engaged in exploration, development and production activities, including related natural gas gathering and marketing. The company principally carries its business activities in the United States. The operating segments of the company are the Exploration and Production and Marketing segment. Its Exploration and Production segment is the key revenue driver for the company which includes the revenue derived from the production and sale of natural gas and liquids. The Marketing segment generates revenue through the marketing of both the company and third-party produced natural gas and liquids volumes and through gathering fees associated with the transportation of natural gas to market.

| Company |

P/E |

P/B |

P/S |

ROE |

EBITDA (in billions) |

Gross Profit (in billions) |

Revenue Growth |

| Southwestern Energy Co |

1.37 |

1.06 |

0.85 |

0.69% |

$0.44 |

$0.56 |

-68.22% |

| ConocoPhillips |

11.76 |

2.69 |

2.20 |

5.87% |

$6.61 |

$4.62 |

-32.18% |

| EOG Resources Inc |

8.19 |

2.32 |

2.73 |

7.52% |

$3.51 |

$4.68 |

-19.54% |

| Pioneer Natural Resources Co |

10.45 |

2.25 |

2.74 |

5.81% |

$2.44 |

$1.98 |

-15.12% |

| Hess Corp |

28.86 |

4.89 |

4.05 |

5.96% |

$1.53 |

$1.77 |

-10.31% |

| Diamondback Energy Inc |

8.59 |

1.67 |

3.35 |

5.75% |

$1.75 |

$1.41 |

-3.85% |

| Devon Energy Corp |

7.04 |

2.27 |

1.73 |

8.03% |

$1.82 |

$1.27 |

-29.38% |

| Coterra Energy Inc |

8.52 |

1.45 |

2.86 |

2.53% |

$0.85 |

$0.57 |

-46.19% |

| EQT Corp |

4.83 |

1.02 |

2.39 |

0.62% |

$0.47 |

$-0.06 |

-72.73% |

| Marathon Oil Corp |

8.13 |

1.17 |

2.16 |

4.03% |

$1.21 |

$0.83 |

-11.8% |

| Ovintiv Inc |

4.19 |

1.19 |

0.99 |

4.3% |

$0.98 |

$1.23 |

-25.36% |

| Chesapeake Energy Corp |

2.03 |

0.95 |

1.07 |

0.68% |

$0.48 |

$0.86 |

-52.21% |

| APA Corp |

6.16 |

8.67 |

1.11 |

51.37% |

$1.33 |

$1.2 |

-20.06% |

| Permian Resources Corp |

14.90 |

1.96 |

1.66 |

1.34% |

$0.39 |

$0.42 |

37.97% |

| Range Resources Corp |

5.34 |

2.06 |

2.30 |

1.43% |

$0.18 |

$0.14 |

-63.57% |

| Antero Resources Corp |

7.97 |

0.96 |

1.38 |

0.26% |

$0.26 |

$0.15 |

-56.22% |

| Civitas Resources Inc |

7.26 |

1.09 |

1.75 |

2.52% |

$0.56 |

$0.45 |

2.77% |

| Matador Resources Co |

7.61 |

1.74 |

2.40 |

7.47% |

$0.52 |

$0.37 |

-8.16% |

| Chord Energy Corp |

6.36 |

1.27 |

1.68 |

4.27% |

$0.44 |

$0.38 |

-5.51% |

| Murphy Oil Corp |

8.01 |

1.10 |

1.66 |

4.83% |

$0.62 |

$0.46 |

-18.23% |

| SM Energy Co |

5.26 |

1.23 |

1.79 |

6.63% |

$0.39 |

$0.31 |

-22.7% |

| Magnolia Oil & Gas Corp |

7.32 |

2.21 |

3 |

6.12% |

$0.23 |

$0.2 |

-34.64% |

| California Resources Corp |

7.96 |

1.68 |

1.22 |

-1.06% |

$0.04 |

$0.34 |

-24.72% |

| Average |

8.49 |

2.08 |

2.1 |

6.19% |

$1.21 |

$1.07 |

-24.17% |

When conducting a detailed analysis of Southwestern Energy, the following trends become clear:

-

A Price to Earnings ratio of 1.37 significantly below the industry average by 0.16x suggests undervaluation. This can make the stock appealing for those seeking growth.

-

The current Price to Book ratio of 1.06, which is 0.51x the industry average, is substantially lower than the industry average, indicating potential undervaluation.

-

With a relatively low Price to Sales ratio of 0.85, which is 0.4x the industry average, the stock might be considered undervalued based on sales performance.

-

The Return on Equity (ROE) of 0.69% is 5.5% below the industry average, suggesting potential inefficiency in utilizing equity to generate profits.

-

Compared to its industry, the company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $440 Million, which is 0.36x below the industry average, potentially indicating lower profitability or financial challenges.

-

The company has lower gross profit of $560 Million, which indicates 0.52x below the industry average. This potentially indicates lower revenue after accounting for production costs.

-

The company's revenue growth of -68.22% is significantly lower compared to the industry average of -24.17%. This indicates a potential fall in the company's sales performance.

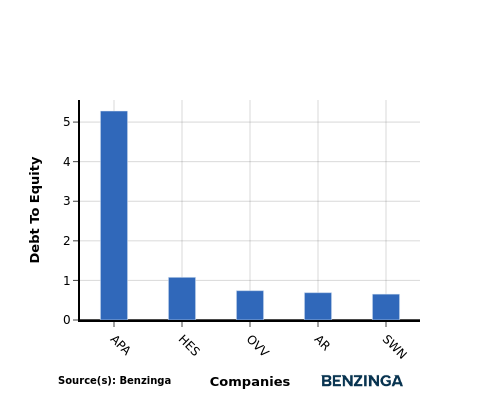

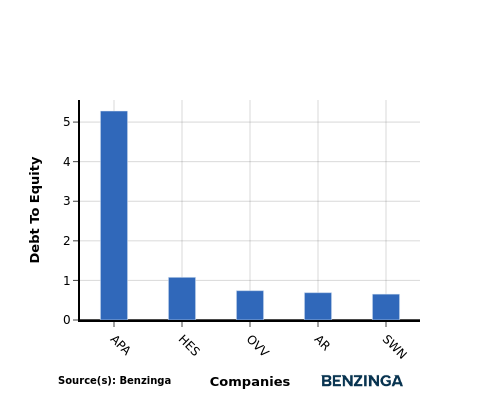

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a measure that indicates the level of debt a company has taken on relative to the value of its assets net of liabilities.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

In light of the Debt-to-Equity ratio, a comparison between Southwestern Energy and its top 4 peers reveals the following information:

-

Southwestern Energy is in a relatively stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.65.

-

This implies that the company relies less on debt financing and has a more favorable balance between debt and equity.

Key Takeaways

The valuation analysis for Southwestern Energy in the Oil, Gas & Consumable Fuels industry indicates that its PE, PB, and PS ratios are low compared to its peers. This suggests that the company may be undervalued in terms of its earnings, book value, and sales. However, its low ROE, EBITDA, gross profit, and revenue growth indicate potential challenges in generating profitability and growth compared to its industry peers. Further analysis is recommended to understand the underlying factors affecting these ratios and their implications for Southwestern Energy's performance in the industry.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SWN