Analyst Scoreboard: 4 Ratings For Patrick Industries

Author: Benzinga Insights | January 12, 2024 09:00am

In the latest quarter, 4 analysts provided ratings for Patrick Industries (NASDAQ:PATK), showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

2 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

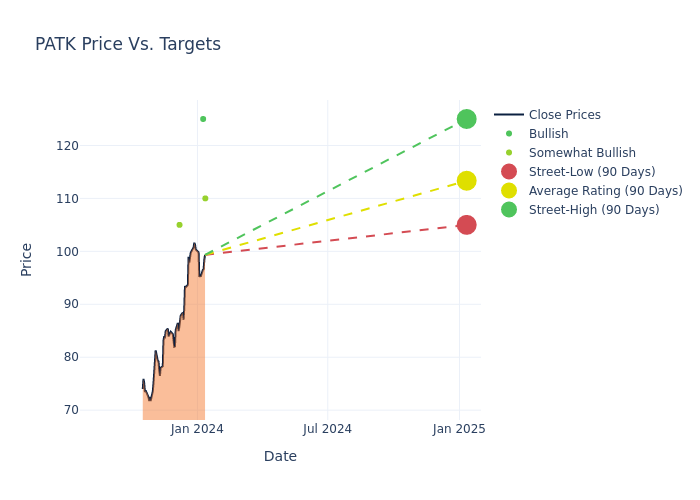

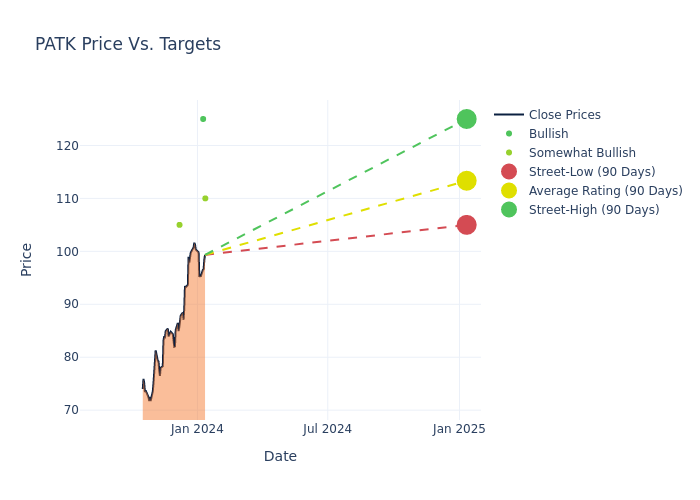

Analysts have recently evaluated Patrick Industries and provided 12-month price targets. The average target is $108.75, accompanied by a high estimate of $125.00 and a low estimate of $95.00. This upward trend is evident, with the current average reflecting a 12.5% increase from the previous average price target of $96.67.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Patrick Industries by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Brett Andress |

Keybanc |

Raises |

Overweight |

$110.00 |

$95.00 |

| Michael Swartz |

Truist Securities |

Raises |

Buy |

$125.00 |

$95.00 |

| Tristan Thomas-Martin |

BMO Capital |

Announces |

Outperform |

$105.00 |

- |

| Michael Swartz |

Truist Securities |

Lowers |

Buy |

$95.00 |

$100.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Patrick Industries. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Patrick Industries compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Patrick Industries's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Patrick Industries's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Patrick Industries analyst ratings.

All You Need to Know About Patrick Industries

Patrick Industries Inc makes and sells building products and materials for recreational vehicles and manufactured housing. The company is organized into two segments based on product type: manufacturing and distribution. The manufacturing segment, which generates the majority of revenue, sells laminated and vinyl products that include furniture, shelving, cabinets, bath fixtures, and countertops. The distribution segment sells prefinished wall and ceiling panels, as well as electrical and plumbing products for the RV and manufactured-housing industries. One of the firm's RV customers makes up a significant portion of revenue. Nearly all of Patrick Industries' revenue comes from North America.

Patrick Industries: Financial Performance Dissected

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Challenges: Patrick Industries's revenue growth over 3 months faced difficulties. As of 30 September, 2023, the company experienced a decline of approximately -22.12%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Patrick Industries's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 4.57%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Patrick Industries's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 3.9%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Patrick Industries's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.47%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Patrick Industries's debt-to-equity ratio is below the industry average. With a ratio of 1.25, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PATK