Where VICI Props Stands With Analysts

Author: Benzinga Insights | January 10, 2024 01:00pm

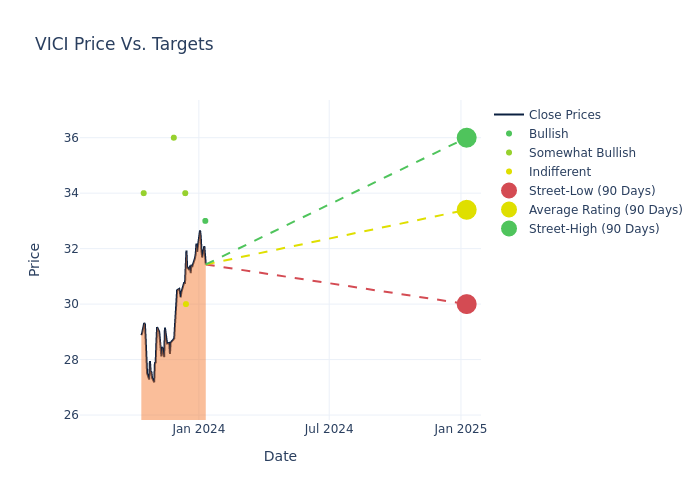

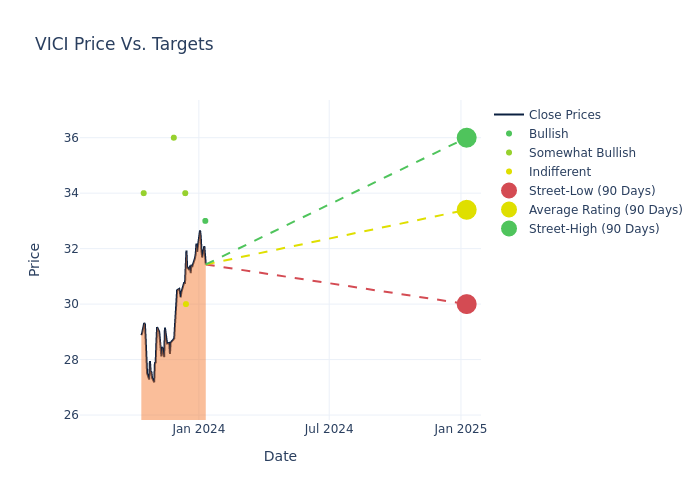

Analysts' ratings for VICI Props (NYSE:VICI) over the last quarter vary from bullish to bearish, as provided by 6 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

3 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

1 |

1 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $33.17, with a high estimate of $36.00 and a low estimate of $30.00. A 5.23% drop is evident in the current average compared to the previous average price target of $35.00.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive VICI Props. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Vikram Malhorta |

Mizuho |

Raises |

Buy |

$33.00 |

$32.00 |

| Richard Anderson |

Wedbush |

Maintains |

Neutral |

$30.00 |

- |

| Todd Thomas |

Keybanc |

Lowers |

Overweight |

$34.00 |

$36.00 |

| Haendel St. Juste |

Mizuho |

Lowers |

Buy |

$32.00 |

$34.00 |

| Steve Sakwa |

Evercore ISI Group |

Raises |

Outperform |

$36.00 |

$35.00 |

| Mitch Germain |

JMP Securities |

Lowers |

Market Outperform |

$34.00 |

$38.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to VICI Props. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of VICI Props compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of VICI Props's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of VICI Props's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on VICI Props analyst ratings.

Unveiling the Story Behind VICI Props

VICI Properties Inc is a real estate investment trust based in the US. It acts as an owner, acquirer, and developer of real estate assets across gaming, hospitality, entertainment and leisure destinations. The company's operating segments are real property business and golf course business. The Real property business segment consists of the leased real property whereas the Golf course business segment consists of several golf courses. Its golf courses include the Cascata golf course, the Rio Secco golf course, the Grand Bear golf course and the Chariot Run golf course.

Financial Milestones: VICI Props's Journey

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3 months period, VICI Props showcased positive performance, achieving a revenue growth rate of 20.33% as of 30 September, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 61.52%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): VICI Props's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.32% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): VICI Props's ROA excels beyond industry benchmarks, reaching 1.31%. This signifies efficient management of assets and strong financial health.

Debt Management: VICI Props's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.73.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: VICI