Where Fortrea Holdings Stands With Analysts

Author: Benzinga Insights | January 04, 2024 10:00am

Fortrea Holdings (NASDAQ:FTRE) has been analyzed by 5 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

2 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

2 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

0 |

0 |

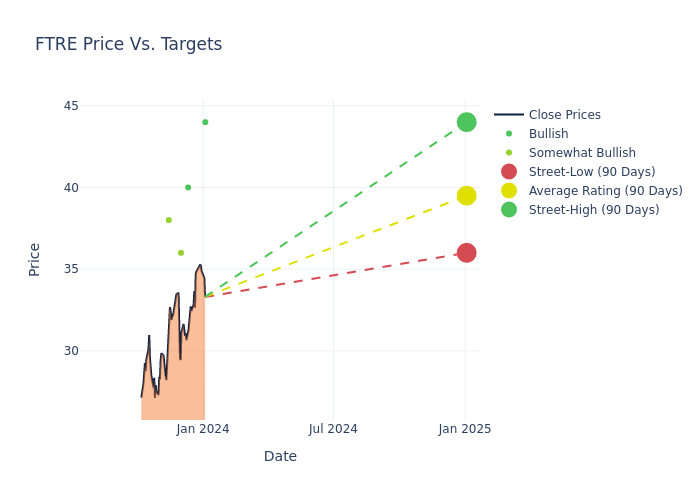

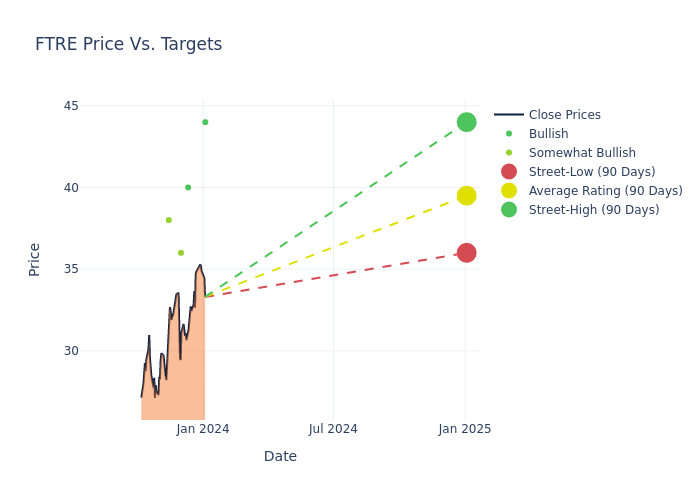

Analysts have set 12-month price targets for Fortrea Holdings, revealing an average target of $38.0, a high estimate of $44.00, and a low estimate of $32.00. Witnessing a positive shift, the current average has risen by 19.99% from the previous average price target of $31.67.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Fortrea Holdings among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| David Windley |

Jefferies |

Announces |

Buy |

$44.00 |

- |

| Patrick Donnelly |

Citigroup |

Raises |

Buy |

$40.00 |

$34.00 |

| Elizabeth Anderson |

Evercore ISI Group |

Raises |

Outperform |

$36.00 |

$32.00 |

| Luke Sergott |

Barclays |

Raises |

Overweight |

$38.00 |

$29.00 |

| Patrick Donnelly |

Citigroup |

Announces |

Neutral |

$32.00 |

- |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Fortrea Holdings. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Fortrea Holdings compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Fortrea Holdings's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Fortrea Holdings's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Fortrea Holdings analyst ratings.

All You Need to Know About Fortrea Holdings

Fortrea Holdings is a late-stage contract research organization, or CRO, that provides comprehensive Phase I through IV clinical trial management, clinical pharmacology, and patient access solutions. The company works with emerging and large biopharma, medical device, and diagnostic companies to run their clinical trials as a functional-service provider, full-service provider, and offers hybrid trials. In 2023, Fortrea was formed as an independent, publicly traded company after LabCorp spun off its clinical development business, which it acquired via its purchase of Covance in 2015 for $6.1 billion. Fortrea has 19,000 staff members across 90 countries.

Fortrea Holdings: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Fortrea Holdings's remarkable performance in 3 months is evident. As of 30 September, 2023, the company achieved an impressive revenue growth rate of 1.85%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Fortrea Holdings's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -1.69%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Fortrea Holdings's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -0.76%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.3%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Fortrea Holdings's debt-to-equity ratio stands notably higher than the industry average, reaching 1.0. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: FTRE