Nordson Demonstrates Strong Performance and Increased Profits, Maximizing Returns for Shareholders

Author: Benzinga Insights | January 02, 2024 11:05am

By the close of today, January 02, 2024, Nordson (NASDAQ:NDSN) will issue a dividend payout of $0.68 per share, resulting in an annualized dividend yield of 1.14%. This payout is exclusively for shareholders who held the stock before the ex-dividend date on December 18, 2023.

Nordson Recent Dividend Payouts

| Ex-Date |

Payments per year |

Dividend |

Yield |

Announced |

Record |

Payable |

| 2023-12-18 |

4 |

$0.68 |

1.14% |

2023-12-06 |

2023-12-19 |

2024-01-02 |

| 2023-08-21 |

4 |

$0.68 |

1.11% |

2023-08-09 |

2023-08-22 |

2023-09-05 |

| 2023-05-22 |

4 |

$0.65 |

1.2% |

2023-05-10 |

2023-05-23 |

2023-06-06 |

| 2023-02-17 |

4 |

$0.65 |

1.06% |

2023-02-08 |

2023-02-21 |

2023-03-07 |

| 2022-12-19 |

4 |

$0.65 |

1.11% |

2022-12-07 |

2022-12-20 |

2023-01-03 |

| 2022-08-22 |

4 |

$0.65 |

1.13% |

2022-08-10 |

2022-08-23 |

2022-09-06 |

| 2022-05-23 |

4 |

$0.51 |

0.98% |

2022-05-11 |

2022-05-24 |

2022-06-07 |

| 2022-02-18 |

4 |

$0.51 |

0.88% |

2022-02-09 |

2022-02-22 |

2022-03-08 |

| 2021-12-20 |

4 |

$0.51 |

0.77% |

2021-12-08 |

2021-12-21 |

2022-01-04 |

| 2021-08-23 |

4 |

$0.51 |

0.92% |

2021-08-11 |

2021-08-24 |

2021-09-07 |

| 2021-05-24 |

4 |

$0.39 |

0.75% |

2021-05-12 |

2021-05-25 |

2021-06-08 |

| 2021-02-22 |

4 |

$0.39 |

0.83% |

2021-02-10 |

2021-02-23 |

2021-03-09 |

When comparing Nordson's dividend yield against its industry peers, the company sits comfortably in the middle, with its peer Stanley Black & Decker (NYSE:SWK) having the highest annualized dividend yield at 3.30%.

Analyzing Nordson Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

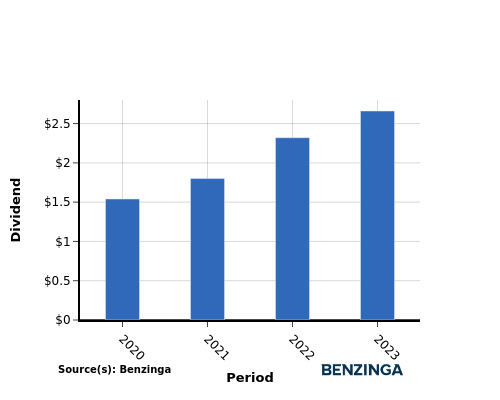

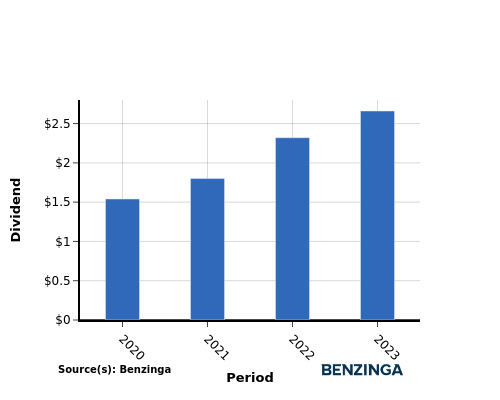

YoY Growth in Dividend Per Share

From 2020 to 2023, the company's dividend per share showed a positive trend, increasing steadily from $1.54 in 2020 to $2.66 in 2023. This demonstrates the company's commitment to rewarding shareholders by consistently raising dividends.

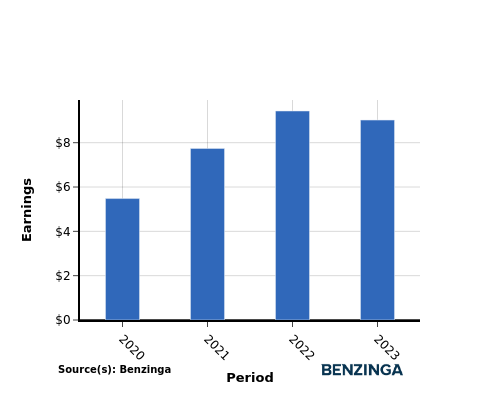

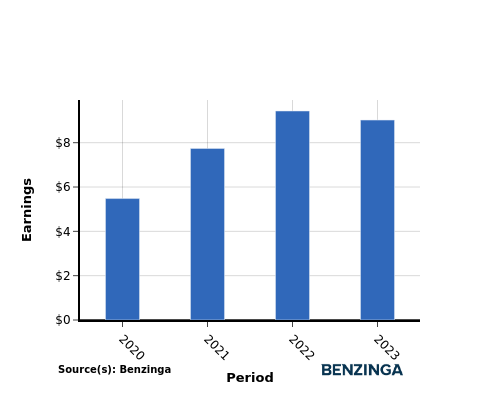

YoY Earnings Growth For Nordson

The earnings chart above shows that from 2020 to 2023, Nordson has experienced an increase in their earnings from $5.48 per share to $9.02 per share. This positive earnings trend is promising for income-seeking investors as it suggests that the company has more potential to increase its cash dividend payout if the trend continues.

Recap

In this article, we delve into Nordson's recent dividend payout and examine how it impacts shareholders. The company has announced a dividend distribution of $0.68 per share today, resulting in an annualized dividend yield of 1.14%.

When comparing Nordson's dividend yield against its industry peers, the company sits comfortably in the middle, with its peer Stanley Black & Decker having the highest annualized dividend yield at 3.30%.

The increase in both dividend per share and earnings per share from 2020 to 2023 for Nordson indicates a positive financial trend, suggesting their capacity to continue distributing profits to shareholders.

Keeping a close watch on the company's performance in the coming quarters will enable investors to stay abreast of any modifications in financials or dividend disbursements.

\To stay up-to-date with the companies that are announcing their dividends, click here to visit our Dividends Calendar.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: NDSN SWK