The Analyst Landscape: 7 Takes On Integra Lifesciences

Author: Benzinga Insights | December 22, 2023 11:00am

In the preceding three months, 7 analysts have released ratings for Integra Lifesciences (NASDAQ:IART), presenting a wide array of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

2 |

3 |

1 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

2 |

1 |

0 |

0 |

| 2M Ago |

1 |

0 |

1 |

1 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

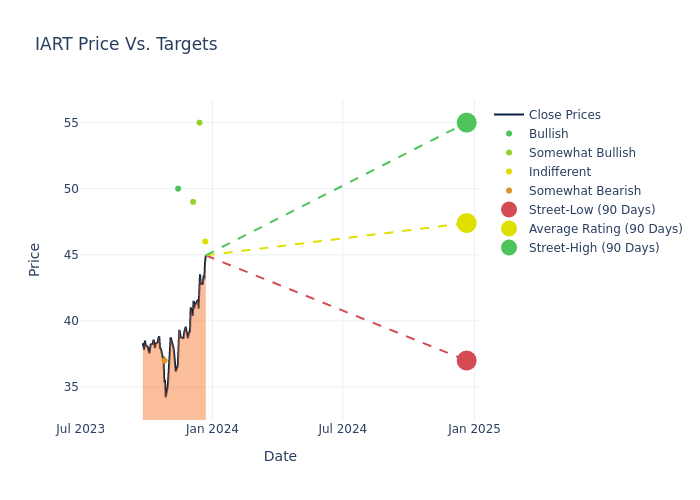

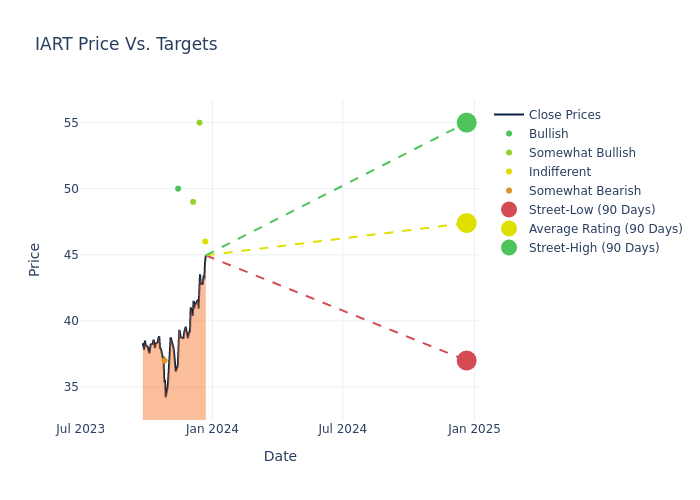

The 12-month price targets, analyzed by analysts, offer insights with an average target of $45.71, a high estimate of $55.00, and a low estimate of $37.00. Surpassing the previous average price target of $41.60, the current average has increased by 9.88%.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Integra Lifesciences among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Richard Newitter |

Truist Securities |

Raises |

Hold |

$46.00 |

$44.00 |

| Richard Newitter |

Truist Securities |

Raises |

Hold |

$44.00 |

$39.00 |

| David Turkaly |

JMP Securities |

Maintains |

Market Outperform |

$55.00 |

- |

| Larry Biegelsen |

Wells Fargo |

Raises |

Overweight |

$49.00 |

$40.00 |

| Kristen Stewart |

CL King |

Announces |

Buy |

$50.00 |

- |

| Richard Newitter |

Truist Securities |

Lowers |

Hold |

$39.00 |

$41.00 |

| Drew Ranieri |

Morgan Stanley |

Lowers |

Underweight |

$37.00 |

$44.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Integra Lifesciences. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Integra Lifesciences compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Integra Lifesciences's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Integra Lifesciences analyst ratings.

Get to Know Integra Lifesciences Better

Integra Lifesciences Holdings Corp is a New Jersey-based medical equipment company focused on developing products for regenerative therapy, extremity orthopedics, and neurosurgical applications. The firm is organized into two primary segments: Codman specialty surgical and tissue technologies. Codman specialty surgical generates maximum revenue from its segmental operations. Integra serves Europe, Asia Pacific, and the rest of the world whilst it derives key revenue from domestic sales.

A Deep Dive into Integra Lifesciences's Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Integra Lifesciences faced challenges, resulting in a decline of approximately -0.72% in revenue growth as of 30 September, 2023. This signifies a reduction in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Integra Lifesciences's net margin is impressive, surpassing industry averages. With a net margin of 5.1%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Integra Lifesciences's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.2% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.52%, the company showcases effective utilization of assets.

Debt Management: Integra Lifesciences's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.07, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: IART