Evaluating Myriad Genetics: Insights From 4 Financial Analysts

Author: Benzinga Insights | December 21, 2023 08:00am

During the last three months, 4 analysts shared their evaluations of Myriad Genetics (NASDAQ:MYGN), revealing diverse outlooks from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

0 |

2 |

1 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

1 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

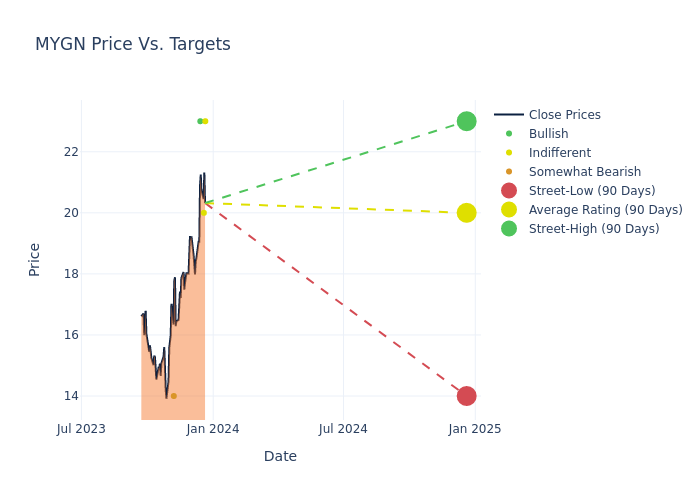

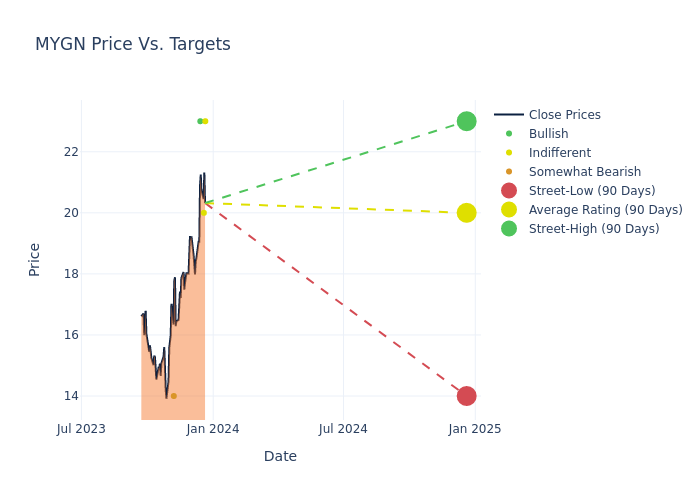

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $20.0, a high estimate of $23.00, and a low estimate of $14.00. Witnessing a positive shift, the current average has risen by 17.65% from the previous average price target of $17.00.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Myriad Genetics by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| John Peterson |

Piper Sandler |

Announces |

Neutral |

$23.00 |

- |

| Timothy Daley |

Wells Fargo |

Announces |

Equal-Weight |

$20.00 |

- |

| Subbu Nambi |

Guggenheim |

Announces |

Buy |

$23.00 |

- |

| Rachel Vatnsdal |

JP Morgan |

Lowers |

Underweight |

$14.00 |

$17.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Myriad Genetics. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Myriad Genetics compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Myriad Genetics's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Myriad Genetics's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Myriad Genetics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Myriad Genetics

Myriad Genetics is a molecular diagnostics company that provides testing services designed to assess an individual's risk of developing a disease. The firm produces MyRisk, a 48-gene panel with the capability to identify the elevated risk of developing 11 types of cancer. Other diagnostic products include BRACAnalysis CDx, the FDA-approved companion diagnostic for PARP inhibitors; GeneSight, which helps improve responses to psychotropic drugs for patients suffering from depression; and Prequel, a noninvasive prenatal test. Precise Oncology Solutions, launched in 2022, combines Precise Tumor with companion diagnostic and prognostic tests such as MyChoice CDx, Prolaris, and EndoPredict. The firm offers biomarker discovery and companion diagnostic services to pharma and biotech companies.

Unraveling the Financial Story of Myriad Genetics

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Myriad Genetics displayed positive results in 3 months. As of 30 September, 2023, the company achieved a solid revenue growth rate of approximately 22.7%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Myriad Genetics's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -31.94%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Myriad Genetics's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -8.64%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Myriad Genetics's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -5.25%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a high debt-to-equity ratio of 0.29, Myriad Genetics faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MYGN