Demystifying Construction Partners: Insights From 4 Analyst Reviews

Author: Benzinga Insights | December 19, 2023 02:00pm

Gain insights into the latest analyst ratings for Construction Partners (NASDAQ:ROAD) within the past quarter:

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

0 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

2 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

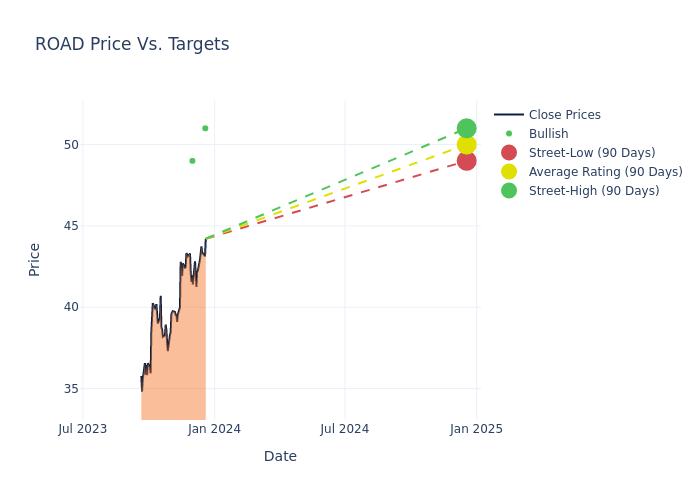

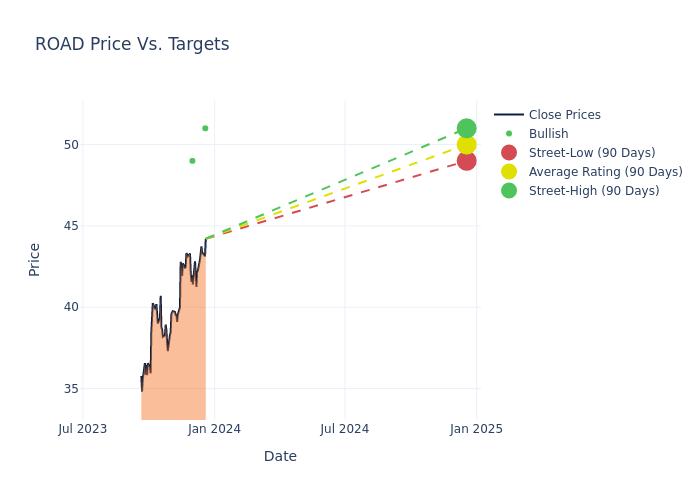

Find out what 4 analysts are predicting for Construction Partners in the next 12 months. The average price target is $47.5, with a high estimate of $51.00 and a low estimate of $45.00.

See a summary of 4 analysts' perspectives on Construction Partners over the past 3 months. The number of bullish ratings reflects a positive sentiment, while bearish ratings indicate a negative viewpoint.

This upward trend is apparent, with the current average reflecting a 10.47% increase from the previous average price target of $43.00.

Deciphering Analyst Ratings: An In-Depth Analysis

Embark on a journey into the analyses of financial experts and analysts, featuring a detailed breakdown of their recent assessments for Construction Partners. Our Ratings Table below provides a comprehensive overview of the moves made by key analysts, their present ratings, and price targets. Understanding the perceptions of these experts towards the company can unveil valuable insights into possible market trends and investor sentiment.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Stanley Elliott |

Stifel |

Raises |

Buy |

$51.00 |

$45.00 |

| Patrick Tyler Brown |

Raymond James |

Raises |

Strong Buy |

$49.00 |

$45.00 |

| Stanley Elliott |

Stifel |

Raises |

Buy |

$45.00 |

$44.00 |

| Patrick Tyler Brown |

Raymond James |

Raises |

Strong Buy |

$45.00 |

$38.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Construction Partners. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Construction Partners compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Construction Partners's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Construction Partners's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Construction Partners analyst ratings.

Get to Know Construction Partners Better

Construction Partners Inc operates as an infrastructure and road construction company. It provides construction products and services to the public and private sectors. Its services cover the construction of highways, roads, bridges, airports, and commercial and residential sites. The company provides site development, paving, utility and drainage systems, as well as supplies hot mix asphalt.

Construction Partners's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, Construction Partners showcased positive performance, achieving a revenue growth rate of 20.86% as of 30 September, 2023. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Construction Partners's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 6.51%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Construction Partners's ROE stands out, surpassing industry averages. With an impressive ROE of 6.2%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Construction Partners's ROA stands out, surpassing industry averages. With an impressive ROA of 2.57%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Construction Partners's debt-to-equity ratio is below the industry average. With a ratio of 0.76, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ROAD