China's Lithium Prices Plunge To 26-Month Low: How Have Mining Stocks Fared?

Author: Michael Cohen | November 24, 2023 02:59pm

China's lithium market has undergone a major downturn, with prices reaching a 26-month low. This decline is largely attributed to an unexpected increase in supply, as evidenced by a trial delivery to the Guangzhou Futures Exchange, a key player in the global battery metal industry.

What Happened: The most actively traded lithium futures for January on the exchange saw a modest 1% increase on Friday, closing the week at 124,050 yuan (approximately $17,202.65) per metric ton. This figure represents a 10% decrease over the week, following a 7% drop the previous week, Reuters Reports.

Thursday marked a significant 7% fall in prices, bringing them to less than half of their value since the inception of trading in July. This sharp decline was triggered by a test delivery for the new contract, which revealed a higher-than-anticipated availability of lithium, surprising market analysts and traders.

Now Read: Best Lithium Stocks

Zhang Weixin, a lithium analyst at China Futures, told Reuters, "The trial disappointed those who had bet on a shortage of deliverable goods when the contract matured, accelerating the price fall."

This downturn in futures has also impacted spot lithium prices. Fastmarkets MB-LI-0036 reported an 11% decrease in spot lithium carbonate this week, hitting a 26-month low at 129,000 yuan per ton. This is the steepest weekly decline in the past seven months, following a 4% fall last week.

According to Zhang, prices could potentially drop to 100,000 yuan per ton by the end of the year, with no signs of a demand increase. This is a stark contrast from last November, when prices nearly reached 600,000 yuan, prior to China ending its national electric vehicle subsidies.

The market is also feeling the pressure of increased domestic production of lithium carbonate and reduced costs for raw materials. The price for spodumene, a key lithium chemical raw material, has plummeted to $1,590 per ton this week, marking an 80% decrease this year and the lowest since August 2021.

How Major Lithium Miners Have Performed Since Nov. 24, 2021:

Albemarle Corporation (NYSE:ALB): Over the past two years, the stock has fallen over 52%.

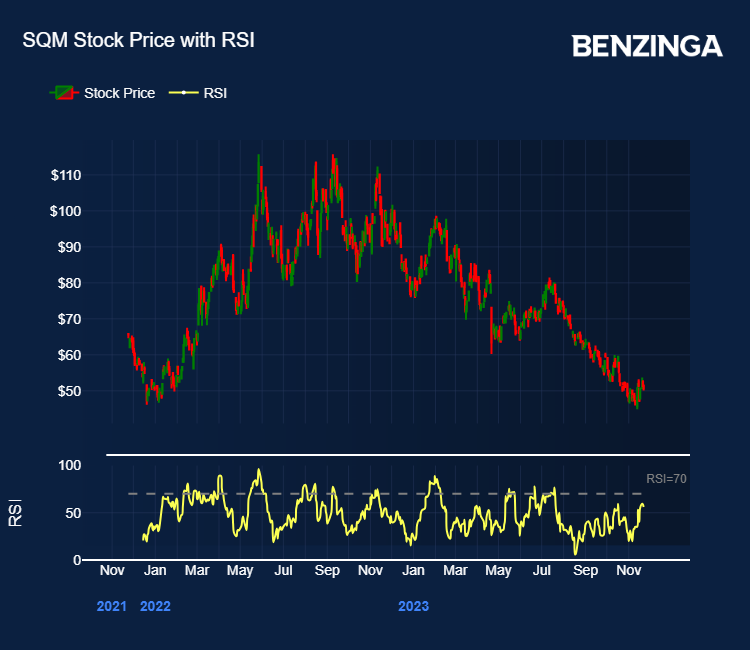

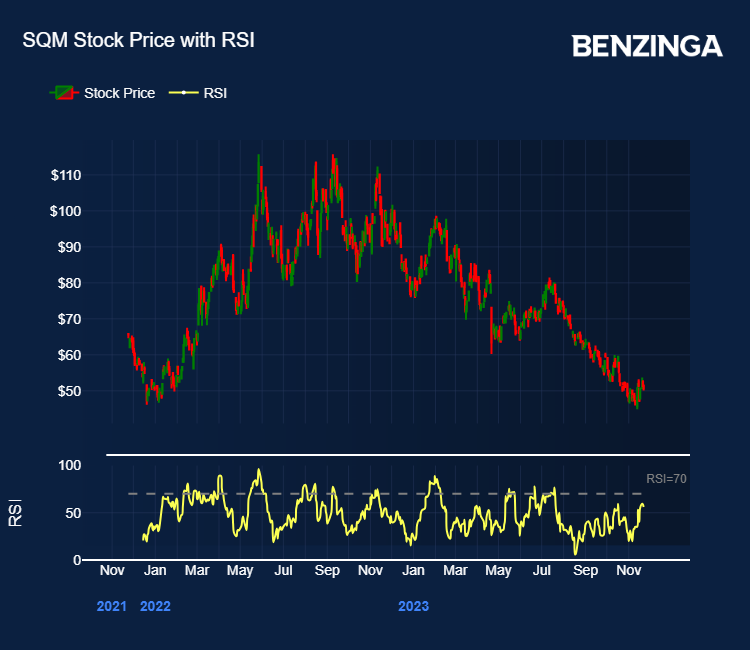

Sociedad Química y Minera de Chile (NYSE:SQM): Shares are down over 21% since Nov. 24, 2021.

Livent Corporation (NYSE:LTHM): The stock is down over 55% over the past two years.

Lithium Americas Corp. (NYSE:LAC): The stock is down over 68% since Nov. 24, 2021.

Image: Tradingview

Ganfeng Lithium (OTC:GNENF): Shares are down over 81% over the past two years.

Now Read: Best Lithium ETFs

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Shutterstock

Posted In: ALB GNENF LAC LTHM SQM