City Office REIT: The Provider of Investor Satisfaction with Steady Earnings Performance

Author: Benzinga Insights | October 24, 2023 11:05am

Investors eagerly anticipate the dividend payout from City Office REIT (NYSE:CIO) on October 24, 2023. With a payout of $0.10 per share and an annualized dividend yield of 7.86%, this reward is exclusively for shareholders who held the stock before the ex-dividend date on October 06, 2023

City Office REIT Recent Dividend Payouts

| Ex-Date |

Payments per year |

Dividend |

Yield |

Announced |

Record |

Payable |

| 2023-10-06 |

4 |

$0.1 |

7.86% |

2023-09-15 |

2023-10-10 |

2023-10-24 |

| 2023-07-06 |

4 |

$0.1 |

7.17% |

2023-05-05 |

2023-07-07 |

2023-07-21 |

| 2023-04-10 |

4 |

$0.2 |

10.83% |

2023-03-14 |

2023-04-11 |

2023-04-25 |

| 2023-01-09 |

4 |

$0.2 |

8.65% |

2022-12-15 |

2023-01-10 |

2023-01-24 |

| 2022-10-06 |

4 |

$0.2 |

7.09% |

2022-09-15 |

2022-10-07 |

2022-10-21 |

| 2022-07-07 |

4 |

$0.2 |

6.84% |

2022-06-16 |

2022-07-08 |

2022-07-22 |

| 2022-04-07 |

4 |

$0.2 |

4.72% |

2022-03-15 |

2022-04-08 |

2022-04-22 |

| 2022-01-10 |

4 |

$0.2 |

4.49% |

2021-12-17 |

2022-01-11 |

2022-01-25 |

| 2021-10-07 |

4 |

$0.15 |

3.58% |

2021-09-16 |

2021-10-08 |

2021-10-22 |

| 2021-07-08 |

4 |

$0.15 |

4.71% |

2021-06-15 |

2021-07-09 |

2021-07-23 |

| 2021-04-08 |

4 |

$0.15 |

5.85% |

2021-03-24 |

2021-04-09 |

2021-04-23 |

| 2021-01-08 |

4 |

$0.15 |

6.22% |

2020-12-15 |

2021-01-11 |

2021-01-25 |

Analyzing City Office REIT Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

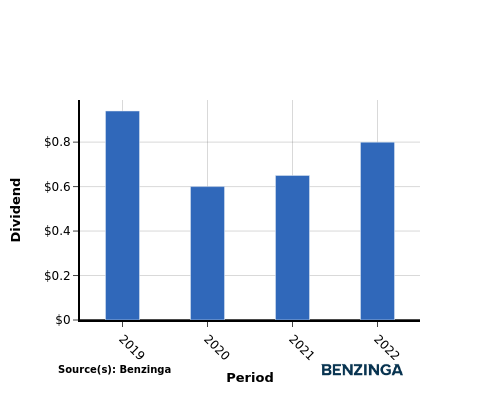

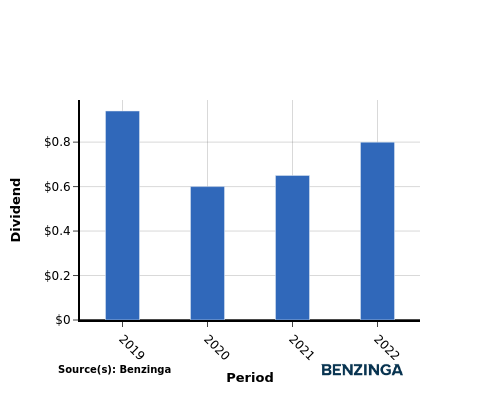

YoY Growth in Dividend Per Share

As you can see, from 2019 to 2022, investors saw an average decrease in the company's dividend per share, decreasing from $0.94 in 2019 to $0.80 in 2022. This is not favorable for investors as it indicates a decline in the company's dividend payout over the years. Further analysis is recommended to understand the factors contributing to this decrease.

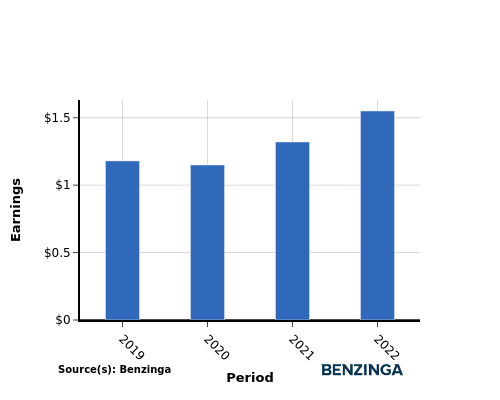

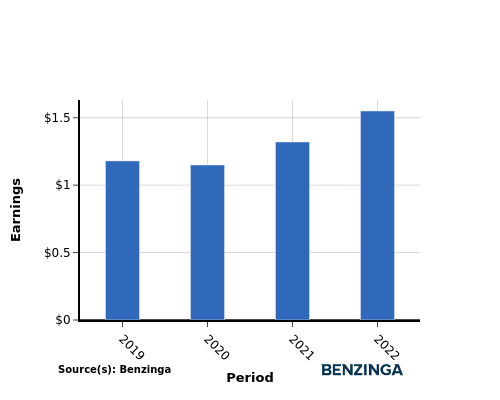

YoY Earnings Growth For City Office REIT

Investors can observe a growth in earnings for City Office REIT from 2019 to 2022, as earnings per share increased from $1.18 to $1.55. This upward trajectory in earnings indicates potential for future cash dividend payout increases, which can be advantageous for income-seeking investors.

Recap

In this article, we delve into City Office REIT's recent dividend payout and examine how it impacts shareholders. The company has announced a dividend distribution of $0.10 per share today, resulting in an annualized dividend yield of 7.86%.

With dividend per share decreasing and earnings per share increasing from 2019 to 2022, City Office REIT appears to be emphasizing business growth by reinvesting profits rather than focusing on dividend distributions.

It is advisable for investors to monitor the company's performance in the coming quarters to stay in the loop about any adjustments in financials or dividend disbursements.

[Track real-time stock fluctuations for City Office REIT on Benzinga.](https://www.benzinga.com/quote/City Office REIT (NYSE: CIO))

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CIO