P/E Ratio Insights for Sumitomo Mitsui Finl Gr

Author: Benzinga Insights | August 24, 2023 11:31am

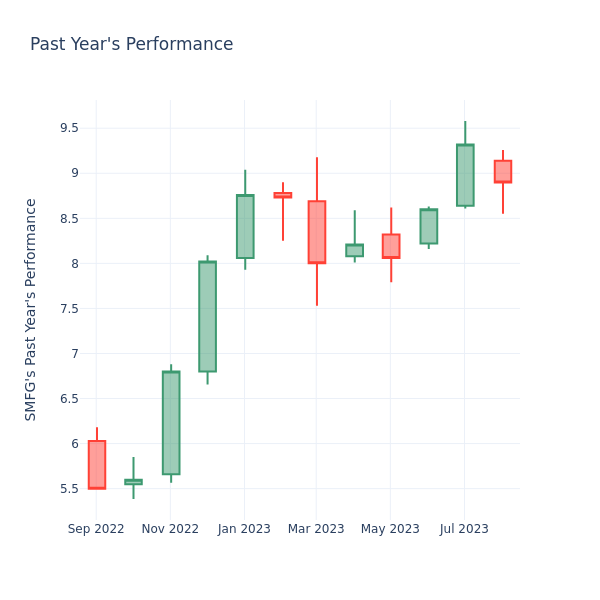

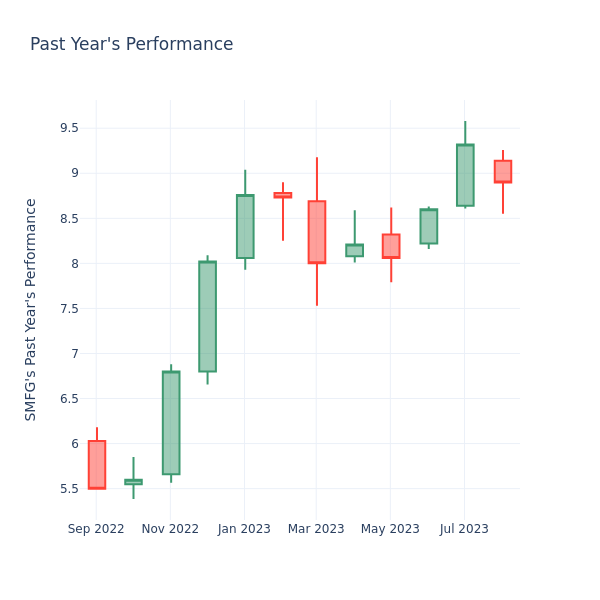

Looking into the current session, Sumitomo Mitsui Finl Gr Inc. (NYSE:SMFG) shares are trading at $8.90, after a 0.02% decrease. Over the past month, the stock decreased by 2.85%, but over the past year, it actually went up by 46.60%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company's price-to-earnings ratio.

How Does Sumitomo Mitsui Finl Gr P/E Compare to Other Companies?

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 29.6 in the Banks industry, Sumitomo Mitsui Finl Gr Inc. has a lower P/E ratio of 11.0. Shareholders might be inclined to think that the stock might perform worse than it's industry peers. It's also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Posted In: SMFG