Unleashing Growth Potential: Life Storage Surpasses Expectations with Strong Performance and Increasing Profits

Author: Benzinga Insights | July 19, 2023 11:05am

Investors eagerly anticipate the dividend payout from Life Storage (NYSE:LSI) on July 19, 2023. With a payout of $0.90 per share and an annualized dividend yield of 2.71%, this reward is exclusively for shareholders who held the stock before the ex-dividend date on July 12, 2023

Life Storage Recent Dividend Payouts

| Ex-Date |

Payments per year |

Dividend |

Yield |

Announced |

Record |

Payable |

| 2023-07-12 |

4 |

$0.9 |

2.71% |

2023-07-03 |

2023-07-13 |

2023-07-19 |

| 2023-04-13 |

4 |

$1.2 |

3.66% |

2023-04-03 |

2023-04-14 |

2023-04-26 |

| 2023-01-12 |

4 |

$1.2 |

4.87% |

2023-01-03 |

2023-01-13 |

2023-01-26 |

| 2022-10-13 |

4 |

$1.08 |

3.9% |

2022-10-03 |

2022-10-14 |

2022-10-26 |

| 2022-07-14 |

4 |

$1.08 |

3.74% |

2022-07-05 |

2022-07-15 |

2022-07-26 |

| 2022-04-13 |

4 |

$1.0 |

2.85% |

2022-04-01 |

2022-04-14 |

2022-04-26 |

| 2022-01-13 |

4 |

$1.0 |

2.61% |

2022-01-03 |

2022-01-14 |

2022-01-26 |

| 2021-10-12 |

4 |

$0.86 |

3.0% |

2021-10-01 |

2021-10-13 |

2021-10-26 |

| 2021-07-13 |

4 |

$0.74 |

2.76% |

2021-07-01 |

2021-07-14 |

2021-07-26 |

| 2021-04-13 |

4 |

$0.74 |

3.44% |

2021-04-01 |

2021-04-14 |

2021-04-26 |

| 2021-01-14 |

4 |

$1.11 |

3.72% |

2021-01-04 |

2021-01-15 |

2021-01-27 |

| 2020-10-09 |

4 |

$0.71 |

2.71% |

2020-10-01 |

2020-10-13 |

2020-10-26 |

Analyzing Life Storage Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

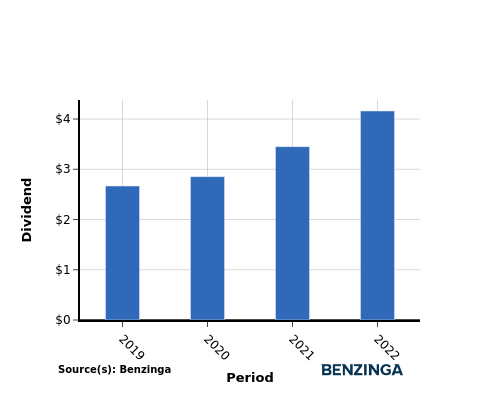

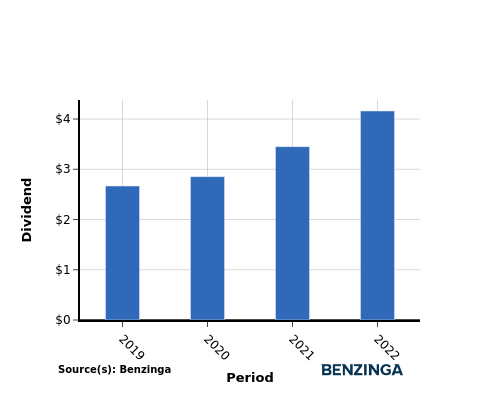

YoY Growth in Dividend Per Share

Investors witnessed an upward trajectory in the company's dividend per share between 2019 and 2022. The dividend per share rose from $2.67 to $4.16, indicating the company's dedication to enhancing shareholder value through increased dividends.

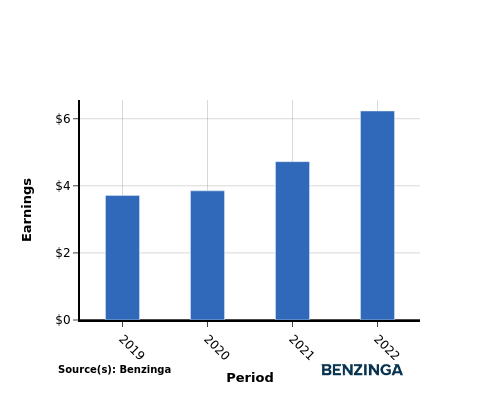

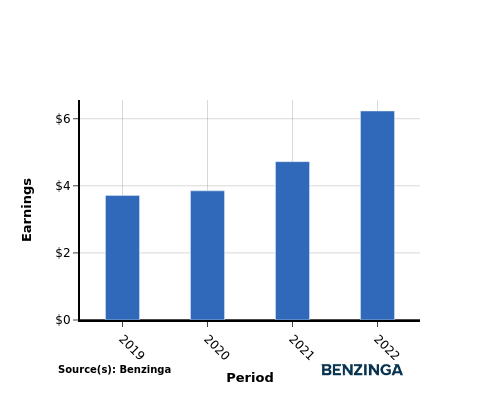

YoY Earnings Growth For Life Storage

The earnings chart illustrates an increase in Life Storage's earnings per share, from $3.71 in 2019 to $6.23 in 2022. This positive earnings growth provides income-seeking investors with optimism, as it suggests potential for higher cash dividend payouts in the future.

Recap

This article provides an in-depth analysis of Life Storage's recent dividend distribution and the impact it has on shareholders. The company is currently distributing a dividend of $0.90 per share, resulting in an annualized dividend yield of 2.71%.

The upward trend in dividend per share and earnings per share for Life Storage from 2019 to 2022 reflects a strong financial position, supporting the company's ability to consistently distribute profits to their investors.

It is advisable for investors to monitor the company's performance in the coming quarters to stay in the loop about any adjustments in financials or dividend disbursements.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: LSI