OPEC+ Shocks The Market, Cuts Production By+1 Million Bpd

Author: GRIT Capital | April 03, 2023 11:10am

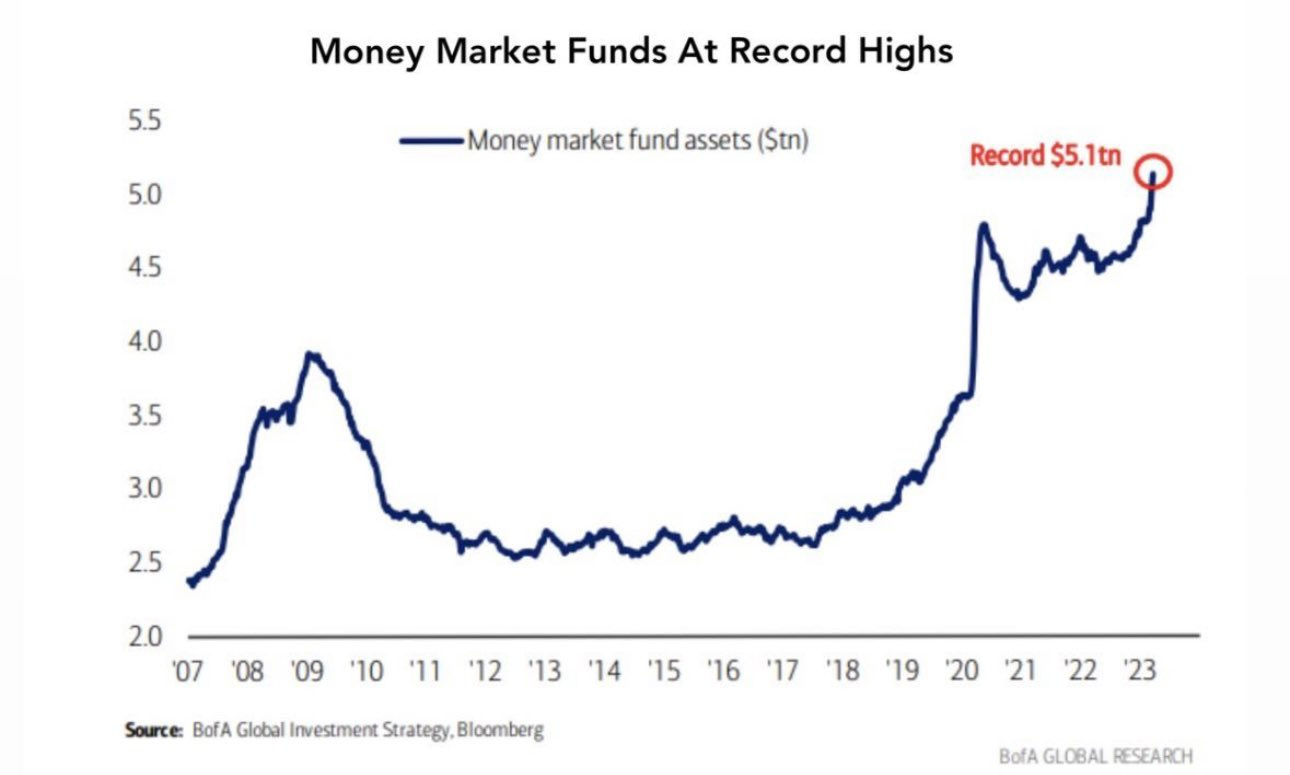

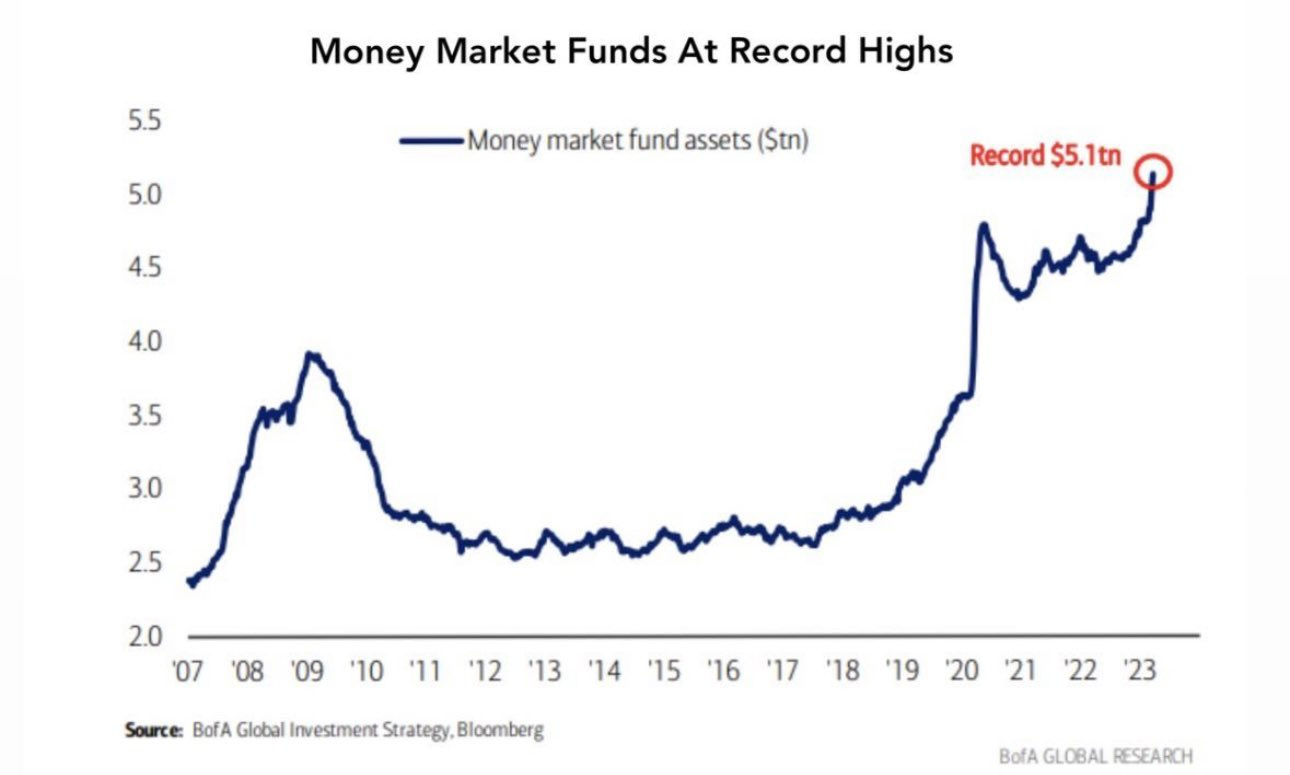

Since the recent high, total deposits at U.S. banks are down a record $1 trillion. Where did the money go? A lot went to money market funds which just hit a record high. Who wants to make 0.3% with a bank account when you can make 5% in a money market fund!?

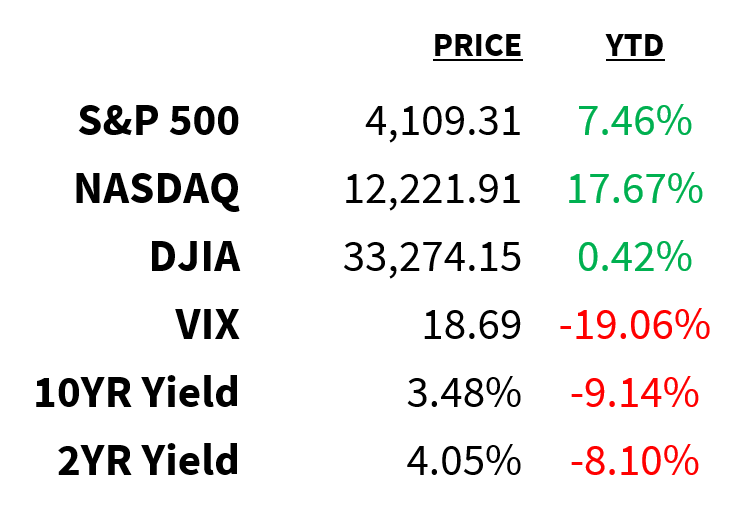

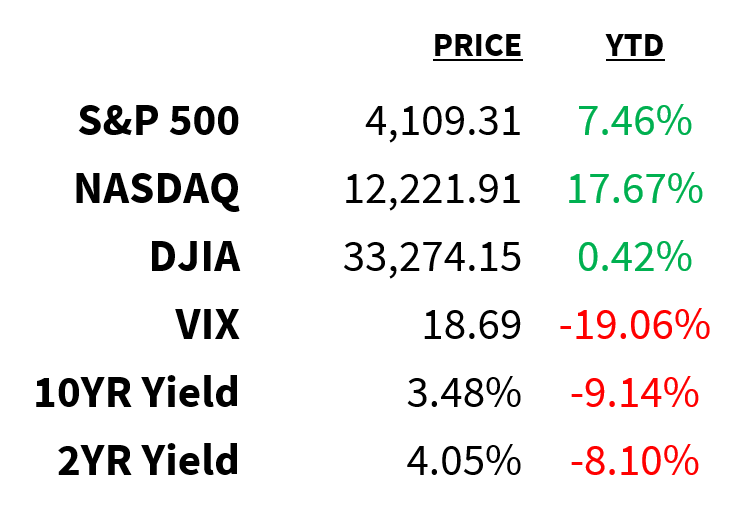

Market

Prices as of 4 pm EST, 3/31/23

Macro

-

Oil prices are surging this morning after OPEC+ surprised markets by announcing a production cut that will exceed 1 million barrels per day. The move, led by a 500k bpd cut by Saudi Arabia, runs contrary to signals sent by the group in recent weeks which suggested output would remain steady.

-

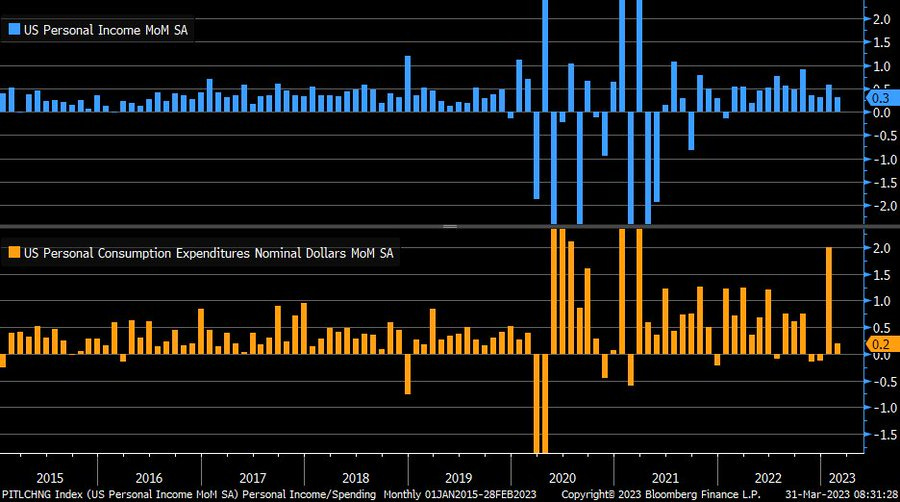

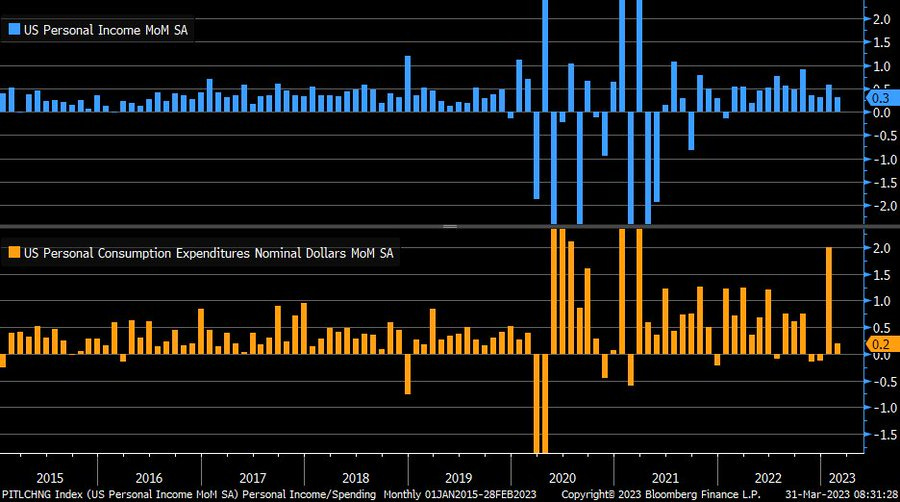

The Fed’s preferred measure of inflation, the personal consumption expenditures (PCE) price index excluding food and energy, rose less than expected in February with prices gaining 0.3% for the month. The deceleration pushed the index up 4.6% from a year earlier, marking the slowest annual increase since October 2021.

-

Meanwhile, personal incomes rose by 0.3% (vs. 0.2% expected) driven by increases in wages for workers in the services sector. On the flip side, after a sharp jump in January, consumer spending moderated in February, rising less than expected at 0.2%.

Stocks

-

A probe by Switzerland’s top prosecutor into potential crimes related to UBS’s takeover of Credit Suisse may lead to major job cuts. The deal is expected to result in a 30% reduction in the overall workforce, with as many as 11,000 layoffs in Switzerland and another 25,000 worldwide.

-

Speaking of—McDonald’s is temporarily closing its US offices and asking corporate employees to work from home as it gets ready to inform them of layoffs due to a company-wide restructuring. The virtual announcements will come after the company warned in January it would be making “difficult” decisions about its corporate staffing levels by April.

-

Despite falling short of analysts’ expectations, Tesla (NASDAQ:TSLA) delivered a record 422,875 vehicles in Q1, up 36% from a year earlier. The number comes after the EV maker slashed prices across its models earlier in the year, dropping the price tag of some by nearly 20%.

Energy

-

The White House is not happy with the surprise OPEC+ production cuts. The administration called the reductions in output “ill-advised” given current market conditions and says it will continue to work with producers and consumers to support economic growth and lower gas prices for Americans.

-

Goldman Sachs (NYSE:GS), meanwhile, has lifted its forecast for Brent oil prices to $95 a barrel for December (from $90) and $100 for December 2024 (from $95).

Earnings

News

-

Retail: Net purchases of stocks by retail investors decelerated sharply in recent weeks, with individuals buying ~$8.9 billion in equities over the 10 days ending Thursday, down from $17 billion in the comparable period a month earlier.

-

Cash buffers: After entering the year with less cash on hand than at any time since the 2008 Great Financial Crisis, regional banks in the US were particularly vulnerable to the deposit outflows that took the sector by storm last month.

-

Proactive meeting: Bipartisan lawmakers are set to meet with CEOs and top executives at Disney (NYSE:DIS), Alphabet (NASDAQ:GOOGL), Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT), among others, to discuss Russia-China relations, forced labor, and artificial intelligence.

-

Overhaul: Fund managers are joining in opposition to the SEC’s proposed stock market reforms which aim to increase transparency and improve pricing for smaller retail traders.

-

Global growth: The World Bank has warned of a potential “lost decade” for global growth due to structural slowdowns compounded by the war, the pandemic, and high inflation.

Week Ahead

-

Monday: S&P Global manufacturing PMI, ISM manufacturing PMI

-

Tuesday: JOLTs, factory orders

-

Wednesday: ADP employment change, balance of trade, S&P global composite/services PMIs, ISM services PMI

-

Thursday: Challenger job cuts, initial jobless claims

-

Friday: Non-farm payrolls, unemployment rate, average hourly earnings, consumer credit change

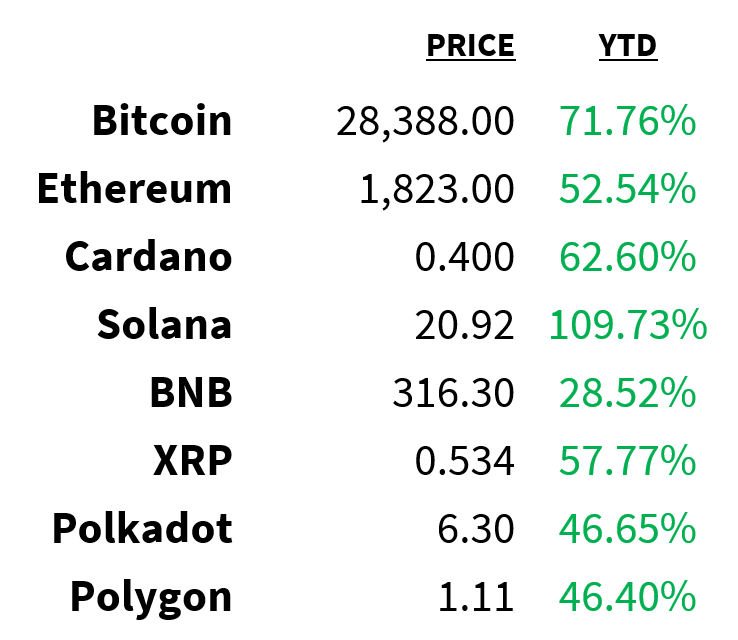

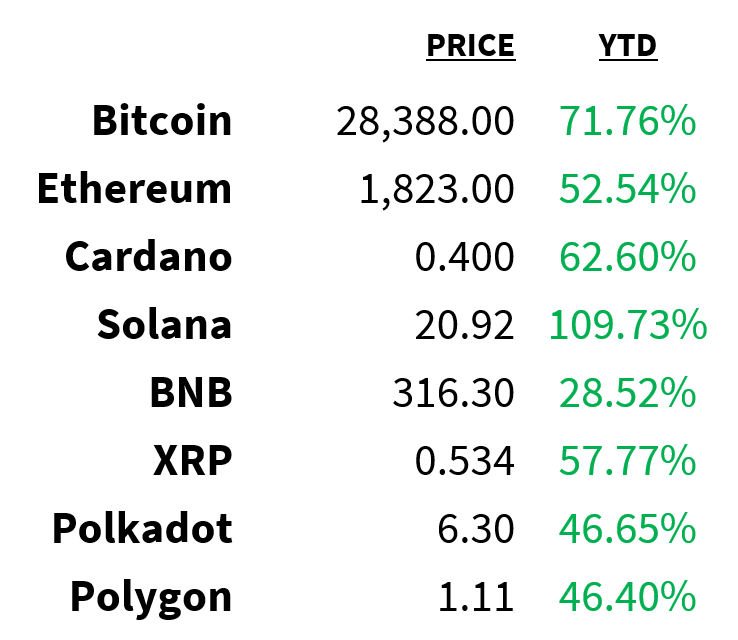

Crypto

Prices as of 4 pm EST, 3/31/23

-

Liquidity: Prices may be surging, but Bitcoin’s (CRYPTO: BTC) low liquidity is causing investors to pay more on trades due to slippage and could result in even more volatile price swings.

-

Halted: A US judge has put Binance.US’ $1 billion acquisition of Voyager Digital’s assets on hold saying the US government has a “substantial case on the merits” in its bid to stop the deal.

-

Governance: After its first proposal drew over 78% opposition, Arbitrum will hold separate votes on its controversial governance package.

-

Tokenization: Major energy companies are trading tokenized emissions credits known as certified environmental tokens (CETs) in a move that could incentivize other producers to reduce their environmental footprints via tokenization.

-

Komainu Connect: A crypto custody joint venture between Nomura, Ledger, and Coinshares—Komainu—is offering a regulated and segregated collateral management product that allows institutional clients to deploy digital assets in collateralization scenarios.

Deals

-

Ringside: Endeavor—which owns Ultimate Fighting Championship (UFC)—is in advanced talks to buy Vince McMahon’s World Wrestling Entertainment (NYSE:WWE) in a deal that would combine the two entities.

-

Cinemas: Cineworld Group (OTC:CNNWQ) is planning to raise $2.26 billion as part of a restructuring plan to reduce its heavy debt load and exit bankruptcy.

-

Security: The world’s largest private security group, Allied Universal, is putting its multibillion-dollar IPO on hold due to recruitment problems and market uncertainty.

-

Automakers: Despite a delay due to discussions surrounding intellectual property, Nissan and Renault expect agreements on their alliance restructuring will soon be signed.

-

Music: Initially hoping to fetch as much as $2 billion, Warner Bros Discovery (NASDAQ:WBD) has scaled back its plan to sell its film soundtracks after receiving lower-than-expected offers.

Posted In: $BTC AAPL CNNWQ DIS GOOGL GS MSFT SAIC SWK TSLA WBD WWE