Top 5 Best And Worst U.S. Industry ETFs In Q1 2023: AI and Bank Turmoil Shaped Stock Returns

Author: Piero Cingari | March 31, 2023 11:34am

The first quarter of 2023 was positive for the U.S. stock market as a whole, with the S&P 500 index faithfully tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), rising by 6%.

Nevertheless, there are some differences in performance within sectors, with technology represented by the Technology Select Sector SPDR Fund (NYSE:XLK) up 19% and substantially outperforming the financial sector represented by the Financial Select Sector SPDR Fund (NYSE:XLF), which was down 7%.

Moreover, if considering all the industries that constitute the various equity sectors, even more significant performance disparities can be observed.

Which U.S. industry ETFs fared the best in the market last quarter? Which of them experienced the greatest losses? Benzinga looked at the quarterly performance U.S. industries ETFs and found some intriguing insights.

Read Also: 5 Best And Worst Performing Country ETFs For Q1 2023: A Defaulting Country's Stock Market Beats S&P 500

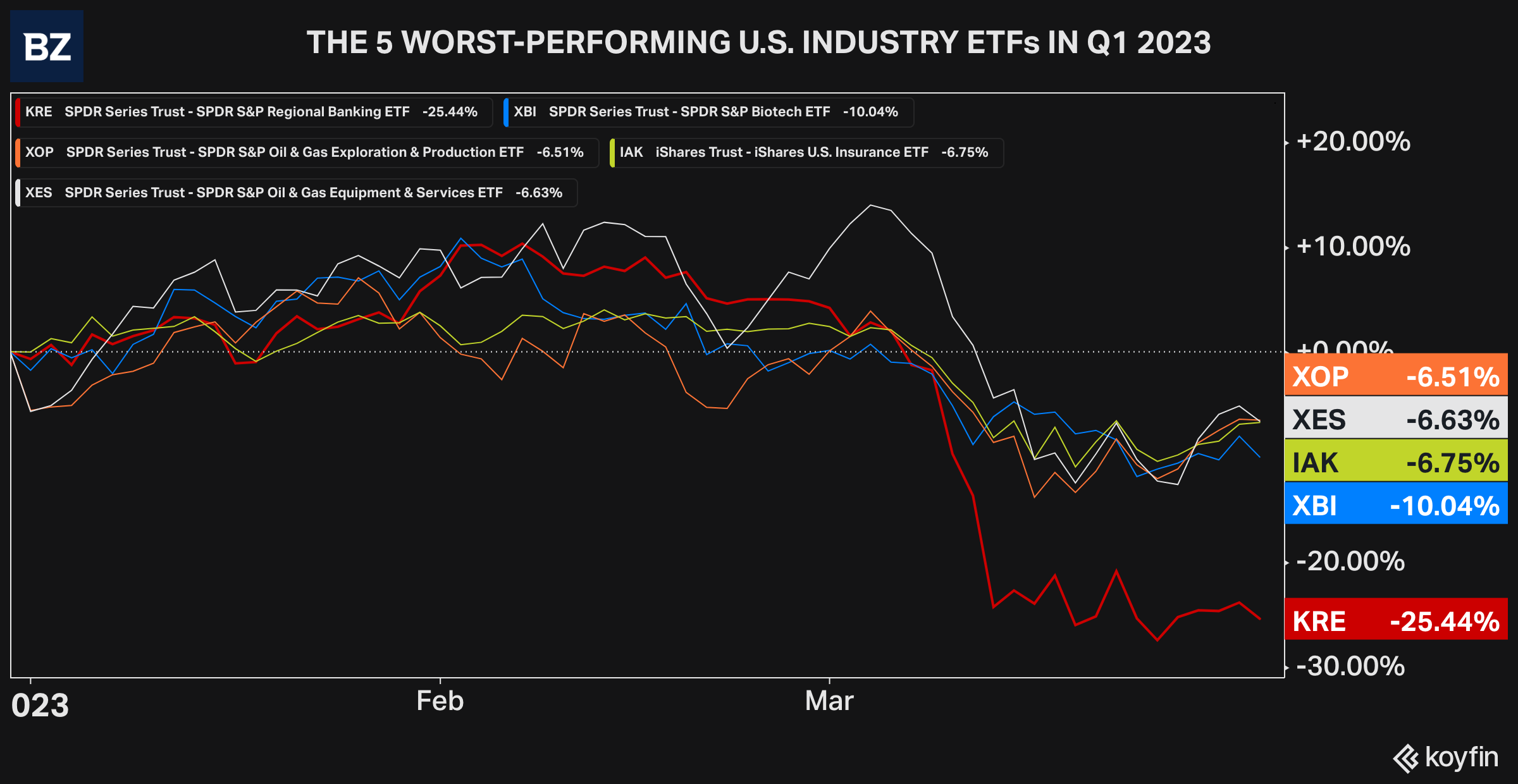

5 Worst-Performing U.S. Industry ETFs in Q1 2023

5) SPDR S&P Oil & Gas Exploration & Production ETF (NYSE:XOP)

- The SPDR S&P Oil & Gas Exploration & Production ETF invests in stocks of companies operating across energy, oil, gas and consumable fuels, oil and gas exploration and production sectors.

- Q1 2023 % change: down by 6.5%.

- Q1 2023 net flows: outflows for $930 million.

- Best-performing stock in the industry: Vertex Energy, Inc. (NASDAQ:VTNR), up 59.4%

- Worst-performing stock in the industry: Ovintiv Inc. (NYSE:OVV), down by 29%.

4) SPDR S&P Oil & Gas Equipment & Services ETF (NYSE:XES)

- The SPDR S&P Oil & Gas Equipment & Services ETF invests in stocks of companies operating across energy, energy equipment and services, oil and gas equipment and services sectors.

- Q1 2023 % change: down by 6.6%.

- Q1 2023 net flows: inflows for $198 million.

- Best-performing stock in the industry: Noble Corporation PLC (NYSE:NE), up by 57.6%.

- Worst-performing stock in the industry: Profrac Holding Corp. (NASDAQ:ACDC), down by 51.4%.

3) iShares U.S. Insurance ETF (NYSE:IAK)

- The iShares U.S. Insurance ETF invests in stocks of companies operating across financials and insurance sectors.

- Q1 2023 % change: down by 6.75%.

- Q1 2023 net flows: outflows for $75.6 million.

- Best-performing stock in the industry: BridgeBio Pharma Inc (NASDAQ:BBIO), up by 125%.

- Worst-performing stock in the industry: Biohaven Ltd. (NYSE:BHVN), down by 90.4%.

2) SPDR S&P Biotech ETF (NYSE:XBI)

- The SPDR S&P Biotech ETF invests in stocks of companies operating across health care, pharmaceuticals, biotechnology and life sciences sectors.

- Q1 2023 % change: down by 10%.

- Q1 2023 net flows: outflows for $1 billion.

- Best-performing stock in the industry: BridgeBio Pharma Inc (NASDAQ:BBIO), up by 125%.

- Worst-performing stock in the industry: Biohaven Ltd. (NYSE:BHVN), down by 90.4%.

1) SPDR S&P Regional Banks ETF (NYSE:KRE)

- The SPDR S&P Banks ETF invests in stocks in stocks of companies operating across financials and bank sectors.

- Due to regional bank failures, involving Silicon Valley Bank, Signature Bank and Silvergate Capital, the regional banking industry had the worst performance among U.S. stock market industries in the first quarter of 2023.

- Q1 2023 % change: down by 25.44%.

- Q1 2023 net flows: inflows for $975 million.

- Best-performing stock in the industry: Columbia Banking System, Inc. (NYSE:COLB), up by 19%.

- Worst-performing stock in the industry: First Republic Bank (NYSE:FRC), down by 88%.

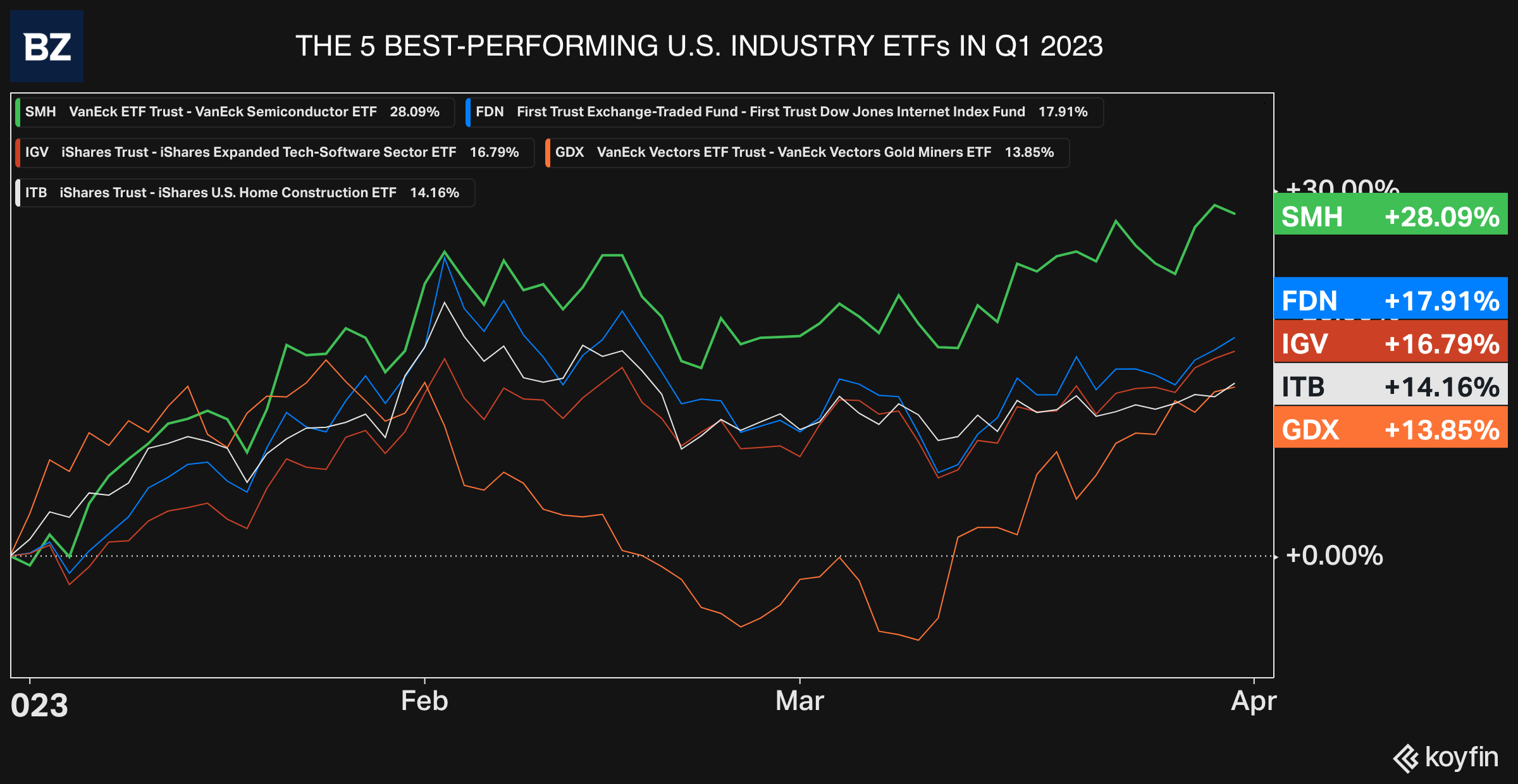

Five Best-Performing U.S. Industry ETFs in Q1 2023

5) VanEck Vectors Gold Miners ETF (NYSE:GDX)

- The VanEck Vectors Gold Miners ETF invests in stocks of companies operating across materials, metals and mining, gold, silver sectors.

- Q1 2023 % change: up by 13.85%.

- Q1 2023 net flows: inflows for $351 million.

- Best-performing stock in the industry: Equinox Gold Corp (NYSE:EQX), up by 63.5%.

- Worst-performing stock in the industry: West African Resources Ltd (OTCPK: WAF), down by 17.5%.

4) iShares U.S. Home Construction ETF (NYSE:ITB)

The iShares U.S. Home Construction ETF invests in stocks of companies operating across home construction sector.

- Q1 2023 % change: up by 14.1%.

- Q1 2023 net flows: inflows for $20.2 million.

- Best-performing stock in the industry: Skyline Champion Corp (NYSE:SKY), up by 44%.

- Worst-performing stock in the industry: LL Flooring Holdings Inc (NYSE:LL), down by 36%.

3) iShares Expanded Tech-Software Sector ETF (BATS:IGV)

- The iShares Expanded Tech-Software Sector ETF invests in stocks of companies operating across media and entertainment, information technology, software and services.

- Q1 2023 % change: up by 16.8%.

- Q1 2023 net flows: inflows for $104.5 million.

- Best-performing stock in the industry: C3.ai, Inc. (NYSE:AI), up by 146%.

- Worst-performing stock in the industry: LivePerson Inc (NYSE:LPSN), down by 59%.

2) First Trust Dow Jones Internet Index Fund (NYSE:FDN)

- The First Trust Dow Jones Internet Index Fund invests in stocks of companies operating across information technology, software and services, IT services, internet services and infrastructure sectors.

- Q1 2023 % change: up by 17.9%.

- Q1 2023 net flows: outflows for $215.4 million.

- Best-performing stock in the industry: Fastly Inc (NYSE:FSLY), up by 107%.

- Worst-performing stock in the industry: ZoomInfo Technologies Inc (NASDAQ:ZI), down by 19%.

1) VanEck Semiconductor ETF (NASDAQ:SMH)

- The VanEck Semiconductor ETF invests in stocks of companies operating across information technology, semiconductors and semiconductor equipment sectors.

- The semiconductor industry has been the best performing so far in 2023, mainly owing to a broad AI-driven rally in various industry equities.

- Q1 2023 % change: up by 28%.

- Q1 2023 net flows: outflows for $109 million.

- Best-performing stock in the industry: NVIDIA Corporation (NASDAQ:NVDA), up by 86%.

- Worst-performing stock in the industry: KLA Corp (NASDAQ:KLAC), up by 4%.

Read More: Fed's Preferred Inflation Measure Comes In Cooler Than Expected As Banking Crisis Complicates Powell's Plan

Posted In: ACDC AI BBIO BHVN COLB FRC FSLY IGV KLAC LL LPSN NE NVDA OSCR OVV SKY SMH SPY VTNR ZI