S&P 500 Rebounds; Tech, Gold, Bitcoin Rally As Investors Bet On Fed Pause In May

Author: Shanthi Rexaline | March 23, 2023 01:26pm

Risk appetite sharply recovered on Thursday amid increased expectations of a Fed rate pause in May. This helped to alleviate fears raised by Treasury Secretary Janet Yellen's rejection of complete protection on bank deposits.

Cues From Wednesday’s Trading:

Negative pressure on the U.S. Dollar and U.S. Treasury yields continued on Thursday, after the Bank of England hiked interest rates by 25bps to 4.25% and the ECB signaled ongoing increases in interest rates.

Expectations on future U.S. interest rates eased further, with money markets now assigning a greater probability to a hold in May (60%), while three 25-basis-point cuts are now fully priced until December 2023.

Dovish rate expectations by the market were sufficient to send all U.S. major stock indices higher during the session.

See Also: Best High-Volume Penny Stocks

The S&P 500 index briefly reclaimed 4,000 points, before marginally retracing to 3,990, advancing 1.45% on the day.

The Nasdaq Composite rose above 11,900, gaining 2%, while the Dow Jones Industrial added 335 points rising 1%.

U.S. Indices' Performance On Thursday

| Index |

Performance (+/-) |

|

Value |

| Nasdaq Composite |

+2.1% |

|

11,915.79 |

| S&P 500 Index |

+1.45% |

|

3,993.65 |

| Dow Industrials |

+1.00% |

|

32,399.34 |

Analyst Color:

Tighter credit standards can take the place of policy rate hikes, according to BofA US Economist Michael Gapen.

BofA revised its forecast for the terminal policy rate to 5.0-5.25% in May, down from 5.25%-5.5% in June.

ETF Movers Today

In midday trading on Thursday, the SPDR S&P 500 ETF Trust (NYSE:SPY) rose 1.31% to $397.11 and the Invesco QQQ Trust (NASDAQ:QQQ) soared 2% to $312.52, according to Benzinga Pro data.

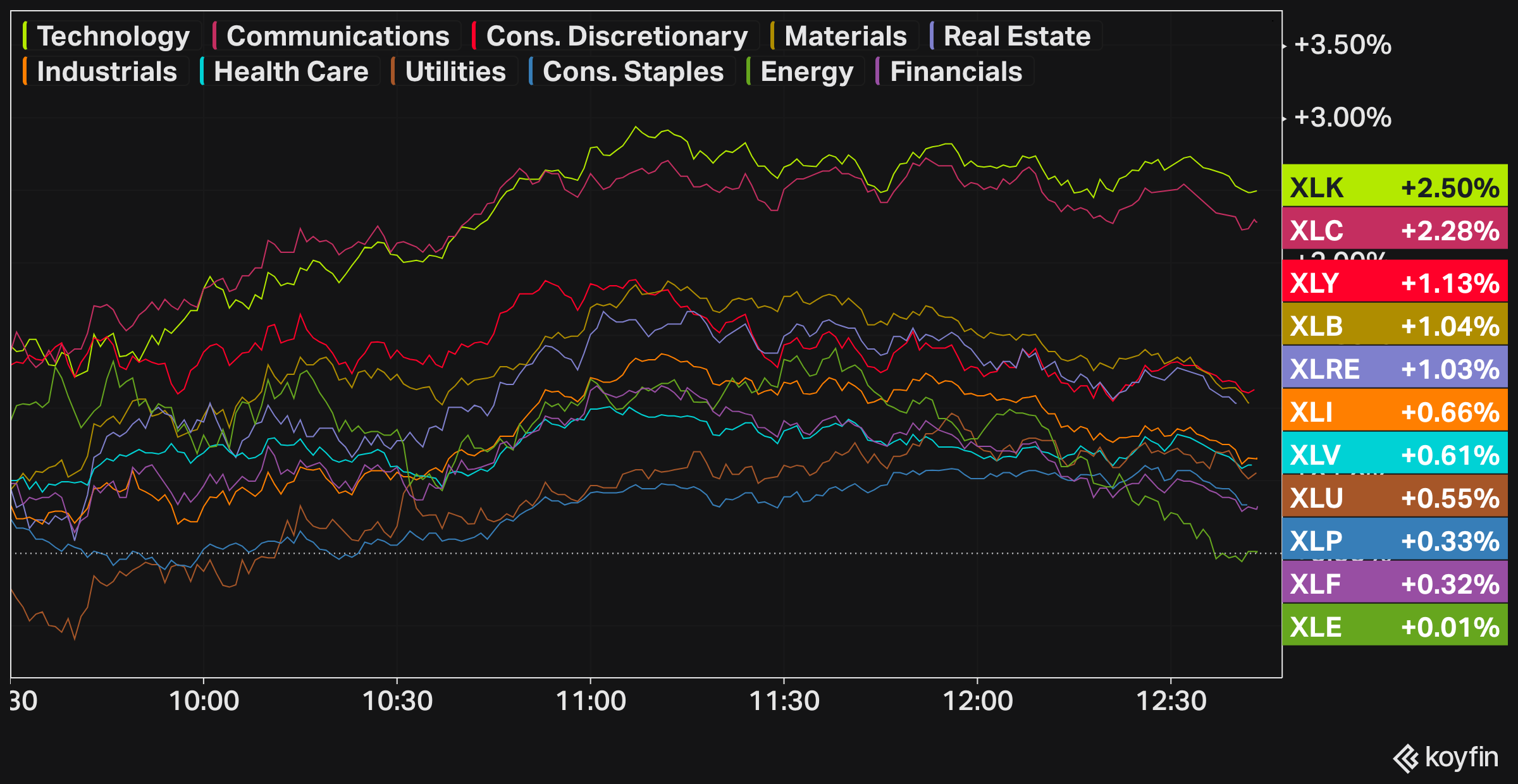

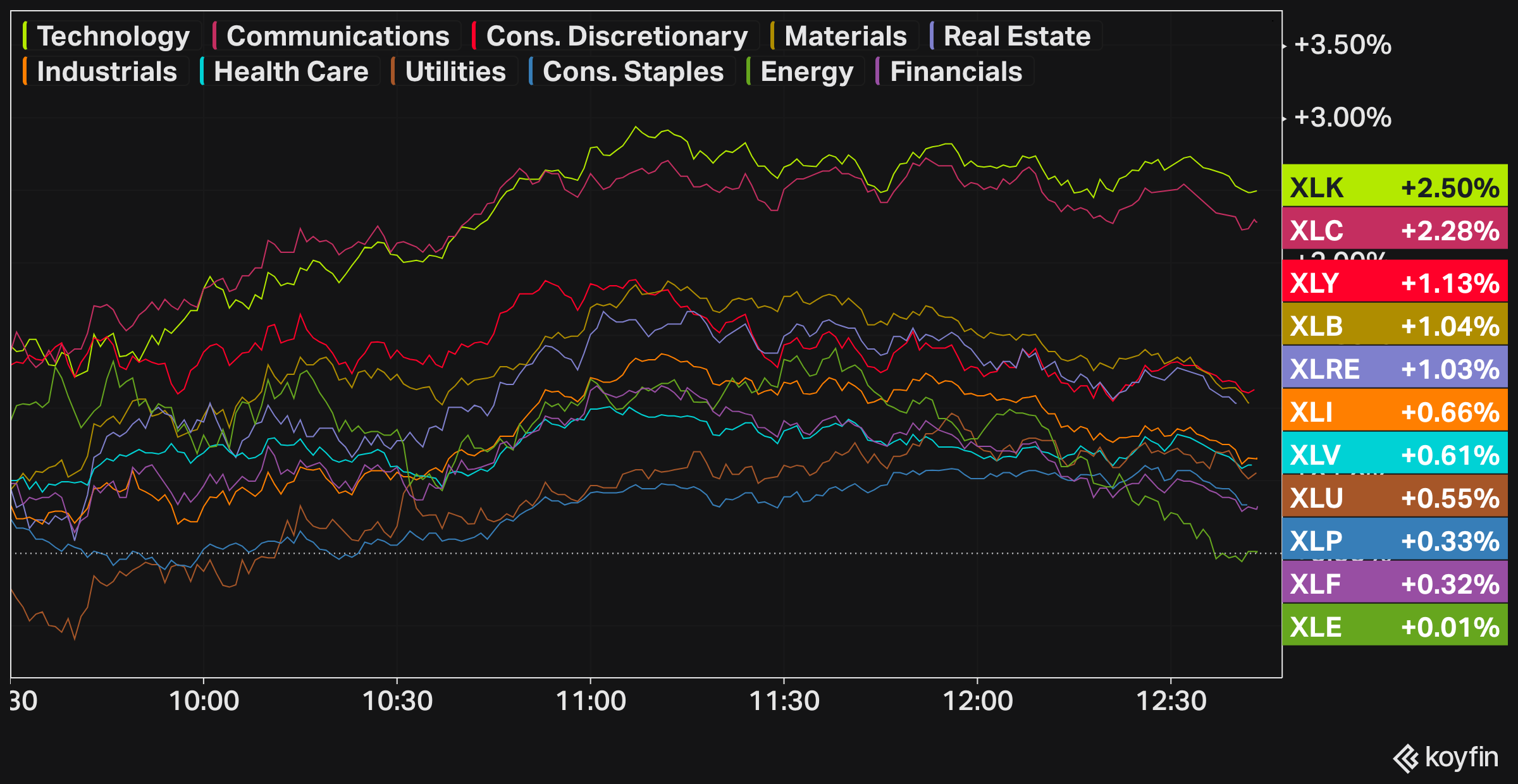

Every S&P 500 sector was in the green. The Technology Select Sector SPDR Fund (NYSE:XLK) and the Communication Services Select Sector SPDR Fund (NYSE:XLC) outperformed by gaining 2%. The Financial Select Sector SPDR Fund (NYSE:XLF) and the Energy Select Sector SPDR Fund (NYSE:XLE) were flat.

S&P 500 sectors, price action on March 23, 2023 – Chart: Koyfin

Latest Economic Data:

The number of jobless claims declined by 1,000 from the previous week to 191,000 in the week ending March 18th, compared to 197,000 expected, showing that the labor market remains tight and in good shape, according to the U.S. Department of Labor.

The Chicago Federal Reserve revealed that the Chicago Fed National Activity Index declined to -0.19 in February 2023 from +0.23 in January.

The US current account deficit narrowed to $206.8 billion in the fourth quarter of 2022, the lowest level since mid-2021, and somewhat less than market projections of a $213.2 billion deficit, according to data from the Bureau of Economic Analysis.

The U.S. Census Bureau reported that in February 2023, sales of new single-family homes grew 1.1% month-over-month to a seasonally adjusted annualized rate of 640,000 units, the highest level since August of last year but below projections of 650,000.

The Kansas City Fed’s Manufacturing Production index rose to 3 in March of 2023 from -9 in the previous month, posting the largest increase since July 2022.

Stocks In Focus:

- Tesla Inc. (NASDAQ:TSLA) rose 2% likely aided by expectations of lower interest rates. The positive performance came despite EV news outlet Electrek, citing people familiar with the matter, reported that Tesla Model 3 sedan will lose eligibility for the full $7,500 tax credit, because the car uses LFP batteries sourced from China.

- First Republic Bank (NYSE:FRC) extended declines, losing 8% on the day to $12, after Treasury Secretary Yellen dismissed a full deposit guarantee.

- Ford Motor Company (NYSE:F) rose 1% despite the company expected its electric vehicle division's 2023 core loss to rise 43%, but affirmed consolidated outlook.

- Accenture plc (NYSE:ACN), General Mills Inc. (NYSE:GIS), Darden Restaurants Inc. (NYSE:DRI), Oxford Industries Inc. (NYSE:OXM) and Manchester United plc. (NYSE:MANU) are among the notable companies reporting their earnings on Thursday.

Top Analyst Calls

- Chewy Inc. (NYSE:CHWY): Barclays maintains Equal Weight rating and lowers price target from $35 to $33.

- Nike Inc. (NYSE:NKE): Citigroup raised price target from $115 to $125.

- AMC Entertainment Holdings Inc. (NYSE:AMC): Citigroup resumes coverage with Sell rating and $1.6 price target.

Commodities, Bonds, Other Global Equity Markets:

Oil prices continued to rise and are on track to post their fourth straight session of gains. A barrel of WTI-grade light-sweet crude topped $70, up 0.6%.

Short-term U.S. Treasury yields moved further down, with the two-year Note settling at 3.9%, down by basis points. Long-term U.S. Treasury yields, instead, moved up, with the thirty-year Bond adding 7bps to 3.72%. The 10-year benchmark held steady at 3.47%.

European equities were slightly positive on the day. The iShares MSCI Eurozone ETF (BATS:EZU) gained 1%, while the iShares MSCI United Kingdom ETF (BATS:EWU) was flat. The Bank of England hiked interest rates by 25bps to 4.25% as expected.

Gold rose 1% to $1,993/oz, with the SPDR Gold Trust ETF (NYSE:GLD) breaking monthly highs.

Bitcoin, tracked by the ProShares Bitcoin Strategy ETF (NYSE:BITO) soared 4% to 28,383.

Read Next: Coinbase CEO, Executives Dump $20M+ In Stock Ahead Of SEC Inquiry: Was It Planned Ahead Of Time?

Staff writer Piero Cingari updated this story midday Thursday.

Posted In: ACN AMC CHWY DRI EWU EZU F FRC GIS MANU NKE NVDA OXM PACW QQQ RF SPY TSLA WAL XLK