Wealthfront Launches 'Spotify For Stocks' Platform: What Investors Need To Know

Author: Renato Capelj | March 20, 2023 03:42pm

This month, Wealthfront launched fractional share trading of stocks with zero commissions.

Wealthfront Stock Investing Accounts, which can be opened with just $1, offer clients curated stock selections and round out the brand’s saving, investing, and lending suite.

To learn more, Benzinga spoke with vice president of product Dave Myszewski, who began his career at Apple Inc (NASDAQ:AAPL) as an engineer on the original iPhone.

Frustrated with the financial advisory space, Myszewski went to Wealthfront in 2016. Read on to hear his thoughts on why this launch is so important for young investors who are keen on wealth-building in today's market.

BZ: What exactly was the frustration with the financial advisory industry?

D.M.: A number of things led me to manage money myself. Understanding why and how to manage your money is the hardest part while actually doing it is a bit more simple. Anyways, I was wondering why there wasn’t a company out there that was offering a solution to my problems, and I stumbled upon Wealthfront which was engaging in some heavy technology investment.

What did your experience at Apple teach you?

My very first demo as an executive was a proud moment for me. This executive was complaining about a problem he had for a very long time. In the middle of that demo, he pointed out something that was still wrong, and that was formative for me in that he pointed out the bad, not the good. It held me to a super high standard. Holding yourself to high standards is important in creating good product experiences.

What makes Wealthfront so special?

Wealthfront integrates investing and savings products to help young professionals build long-term wealth in any market condition. The company pioneered the robo industry, and we now have diversified investing and low-cost margin loans, as well as high-yield cash accounts that offer 4.05% APY and $2 million of FDIC insurance through Wealthfront's partner banks.

What prompted Wealthfront to add Stock Investing Accounts?

Most clients buy stock in a company that they are excited about. Another observation we made, prior to creating Wealthfront’s Stock Investing Accounts, is that there is a ton of data that shows clients have $40 billion or so sitting in external brokerage accounts. Through Wealthfront, clients can use the money better. We thought there was value to be added. So, this is not a trading platform. Rather, it’s about buy and hold, long-term investing.

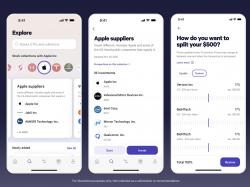

What’s the experience of this new feature like?

Across the app’s top, you’ll see stock tickers that you can swipe between. You can search for specific stocks like Tesla Inc (NASDAQ:TSLA), too, and look up their prices and performance, company descriptions, and some other data points. That said, we really want to help with investors’ discovery of stocks they may not know about or uncover new ideas and strategies. For example, we have collections of stocks we present to you for a certain category such as electric cars. If you’re super bullish because you think electricity is the future, we will give you options you may expect like Tesla and some startups not everybody has heard of including Lucid Group Inc (NASDAQ:LCID) and Rivian Automotive Inc (NASDAQ:RIVN). That’s really a big selling point. We’re helping you discover new ideas and participate in collections created by our investment research team.

What’s often a problem for investors just getting started?

Lack of guidance about how to make more informed and strategic investment decisions. One of the pain points we’ve seen is that people often have one stock in mind that they want to buy but don’t know how to find additional investments that could be worthwhile. We address this. In a lot of ways, Wealthfront Stock Investing is like using Spotify Technology SA’s (NYSE:SPOT) Discover feature to find new music. Because you like Tesla, we’ll show you some other companies you may not be familiar with, too. We’re focused on getting more stocks in your portfolio because our investment team finds that reduces the risk of loss. For instance, if you buy one stock, the chance of losing money is around 10%. If you buy five stocks, the chance of losing money is under 1%.

Are there many collections to choose from?

Yes. If you want lower volatility and risk, which is something people are increasingly thinking about right now, we will help you make a more intelligent choice, doing the research for you. We also provide you with options to access markets like crypto, without buying cryptocurrency. Dividend blue chip stocks are popular right now, as well. People want a solid and reliable dividend-paying company. They don’t want the hot growth stock they loved a year ago. But, you don’t have to have all your money in one collection or stock. You can invest with just a dollar because we have fractional shares, and you can also choose how to allocate those dollars. So, if you want to equal-weight or custom-weight, that’s all up to you.

How do you create these packages or portfolios people can invest in?

We assess what clients are thinking about or should be thinking about, and then we create collections based on that. Our investment research team decides which equities make sense as part of that based on a variety of factors.

Are the transactions instantaneous?

We do limit trading activities. This isn't made for day traders. It's really made for long-term investors. Our clients tend to invest in about three securities a month. They're not really making a lot of purchases. They are buying and holding. We're not taking payments for order flow or PFOF as part of this, too. We're making money based on the money that sits uninvested in your cash account.

How does that execution work?

We aim to get that done within 30 minutes. We're interested in speeding up that over time. We’ll bundle up client orders into different batches and, as we scale, that speeds up.

Can you talk about protecting customer accounts when there’s volatility or failures?

We launched Wealthfront Cash with $1 million of FDIC insurance by sweeping money into partner banks. We’ve increased that to $2 million over the past six months or so, and we're also looking at increasing that to $3 million. Now that's per account holder. It's $2 million for a personal account. $4 million for joint account.

What are the different types of accounts you can open through Wealthfront?

The most popular account we have is taxable. We have personal, joint, and trust accounts, too. So, IRAs we do, including SEP IRAs. With the taxable account, you get tax loss harvesting. When the markets went down by a fair amount last year, we harvested over $1.5 billion of losses. If you look at pretty reasonable projections of tax rates, our clients probably got more than half a billion dollars of value out of the work we did. What people find surprising is that we can harvest losses on the way up, as well. We estimate that over 96% of our clients get greater value from tax harvesting than what they paid us in fees.

What is the rough timeline of all the different types of product introductions?

Our advisory product was introduced in 2011. Wealthfront Cash was released in February 2019. And then the Stock Investing Account was introduced at the beginning of the month.

Where else can you add value?

I think we’re excited to add some value to our Wealthfront Cash clients with interest rates in the 4 or 5% range. We haven’t seen that in a while. We’re trying to lay the groundwork for major product categories our clients need. With interest rates high, some investors may opt to earn more yield on their cash and sit out when there’s more perceived risk in the market.

Posted In: AAPL LCID RIVN SPOT TSLA