Cryptyde's Debt Overview

Author: Benzinga Insights | March 03, 2023 02:31pm

Over the past three months, shares of Cryptyde Inc. (NASDAQ:TYDE) moved lower by 32.17%. Before having a look at the importance of debt, let's look at how much debt Cryptyde has.

Cryptyde Debt

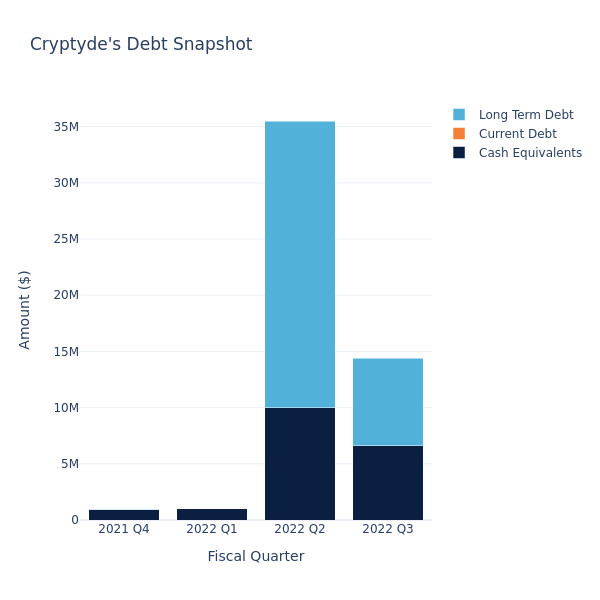

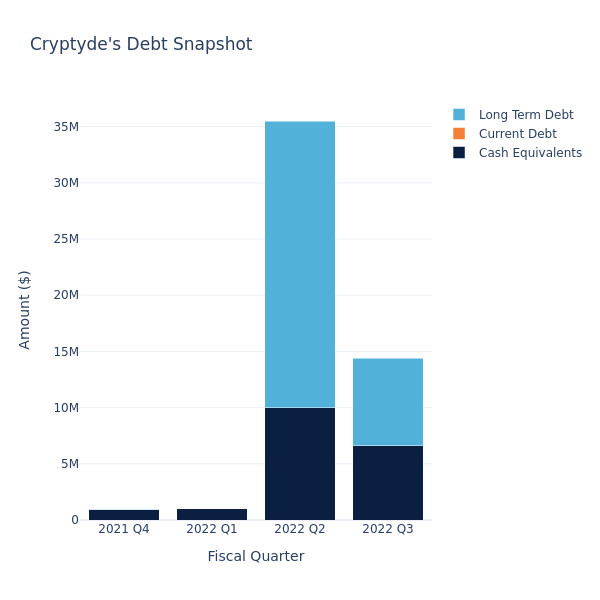

According to the Cryptyde's most recent balance sheet as reported on November 14, 2022, total debt is at $7.75 million, with $7.75 million in long-term debt and $0 in current debt. Adjusting for $6.63 million in cash-equivalents, the company has a net debt of $1.12 million.

Let's define some of the terms we used in the paragraph above. Current debt is the portion of a company's debt which is due within 1 year, while long-term debt is the portion due in more than 1 year. Cash equivalents includes cash and any liquid securities with maturity periods of 90 days or less. Total debt equals current debt plus long-term debt minus cash equivalents.

Investors look at the debt-ratio to understand how much financial leverage a company has. Cryptyde has $23.20 million in total assets, therefore making the debt-ratio 0.33. Generally speaking, a debt-ratio more than 1 means that a large portion of debt is funded by assets. As the debt-ratio increases, so the does the risk of defaulting on loans, if interest rates were to increase. Different industries have different thresholds of tolerance for debt-ratios. For example, a debt ratio of 25% might be higher for one industry, but normal for another.

Why Debt Is Important

Debt is an important factor in the capital structure of a company, and can help it attain growth. Debt usually has a relatively lower financing cost than equity, which makes it an attractive option for executives.

However, due to interest-payment obligations, cash-flow of a company can be impacted. Having financial leverage also allows companies to use additional capital for business operations, allowing equity owners to retain excess profit, generated by the debt capital.

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics - including debt-to-equity ratio. Click here to learn more.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TYDE