As Terra (LUNA) And Its Stablecoin Went Into Flames Last Week, Rival Project Dissed By Founder Do Kwon Struck 29% Gains

Author: Shivdeep Dhaliwal | May 16, 2022 07:54am

The governance token of MakerDAO and Maker Protocol, Maker (MKR), emerged as the top gainer last week. The two protocols, based on Ethereum (CRYPTO: ETH), allow for the issuance and management of the DAI (DAI) stablecoin.

Top Gainer of Week Ending May 16, 2022 (Data via CoinMarketCap)

| Cryptocurrency |

7-Day % Change (+/-) |

All-Time High Value/Date Reached |

% Change (+/-) Since All-Time High |

| Maker (MKR) |

+29.4% |

$6,339.02 On Apr 17, 2021 |

-75.7% |

See Also: How To Get Free NFTs

Maker Shines As Terra USD (UST) Loses Its Peg

Maker appreciated last week as TerraUSD (UST) lost its peg to the dollar. The loss of the peg subsequently led to the erosion of the market price of Terra (LUNA) as well.

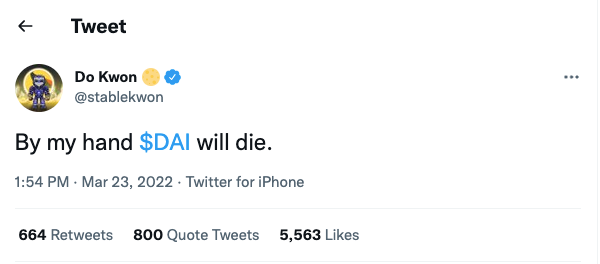

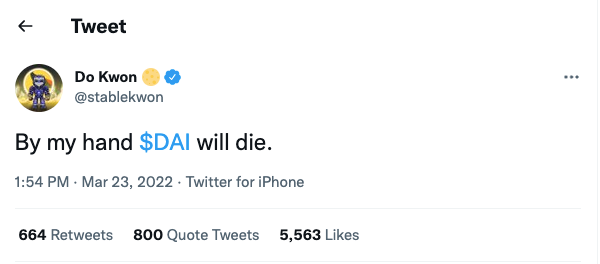

On March 23, Luna co-creator Do Kwon had tweeted that DAI would die by his hand.

Screenshot of Do Kwon's DAI Will Die Tweet — Courtesy Twitter

Screenshot of Do Kwon's DAI Will Die Tweet — Courtesy Twitter

The tweet by the Luna Co-creator has not aged well and was being mocked by users on the Jack Dorsey-led social media platform.

While DAI traded at $1 at press time, UST was down 14.6% over 24 hours at $0.17.

MKR ended the week 29.4% higher at $1,516.36 and was up nearly 0.3% over 24 hours preceding press time. The token's weekly gains exceeded those of Bitcoin (CRYPTO: BTC) and Dogecoin (CRYPTO: DOGE).

Ethereum co-creator Vitalik Buterin said before the collapse of UST that DAI was among the only three stablecoins “that we really need.”

Maker On The Web

Maker said on Twitter over the weekend that they executed 90 liquidation auctions this week, allowing the protocol to cover 12.2 million DAI in risky debt.

The project behind DAI said that there are 2.2 billion USDC and 488 million USDP ready to “work as permissionless liquidity” for the stablecoin.

“Liquidity is very important when it comes to supporting the peg during stressful times,” said Maker in a Twitter thread.

Read Next: Where Is Terra's (LUNA) Bitcoin Reserve Now?

Posted In: $BTC $DOGE $ETH

Screenshot of Do Kwon's DAI Will Die Tweet — Courtesy Twitter

Screenshot of Do Kwon's DAI Will Die Tweet — Courtesy Twitter