3 Carbon Capture ETFs To Consider

Author: Mark Putrino | April 26, 2021 01:05pm

Carbon capture is a process that captures carbon dioxide emissions. The carbon is either reused or stored so it won’t enter the atmosphere.

Investors are buying stocks of carbon capture companies because they think these companies will benefit from the "Green New Deal."

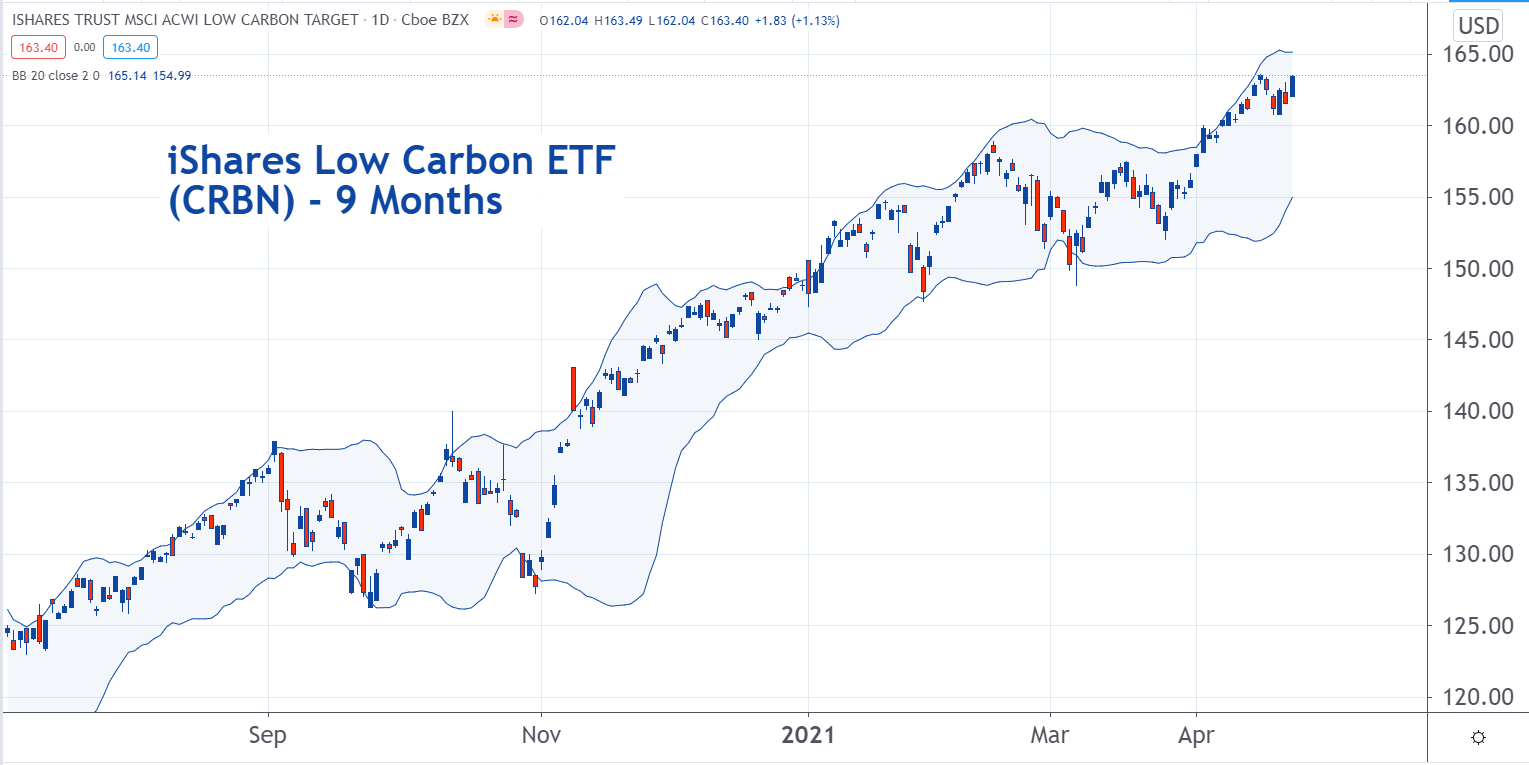

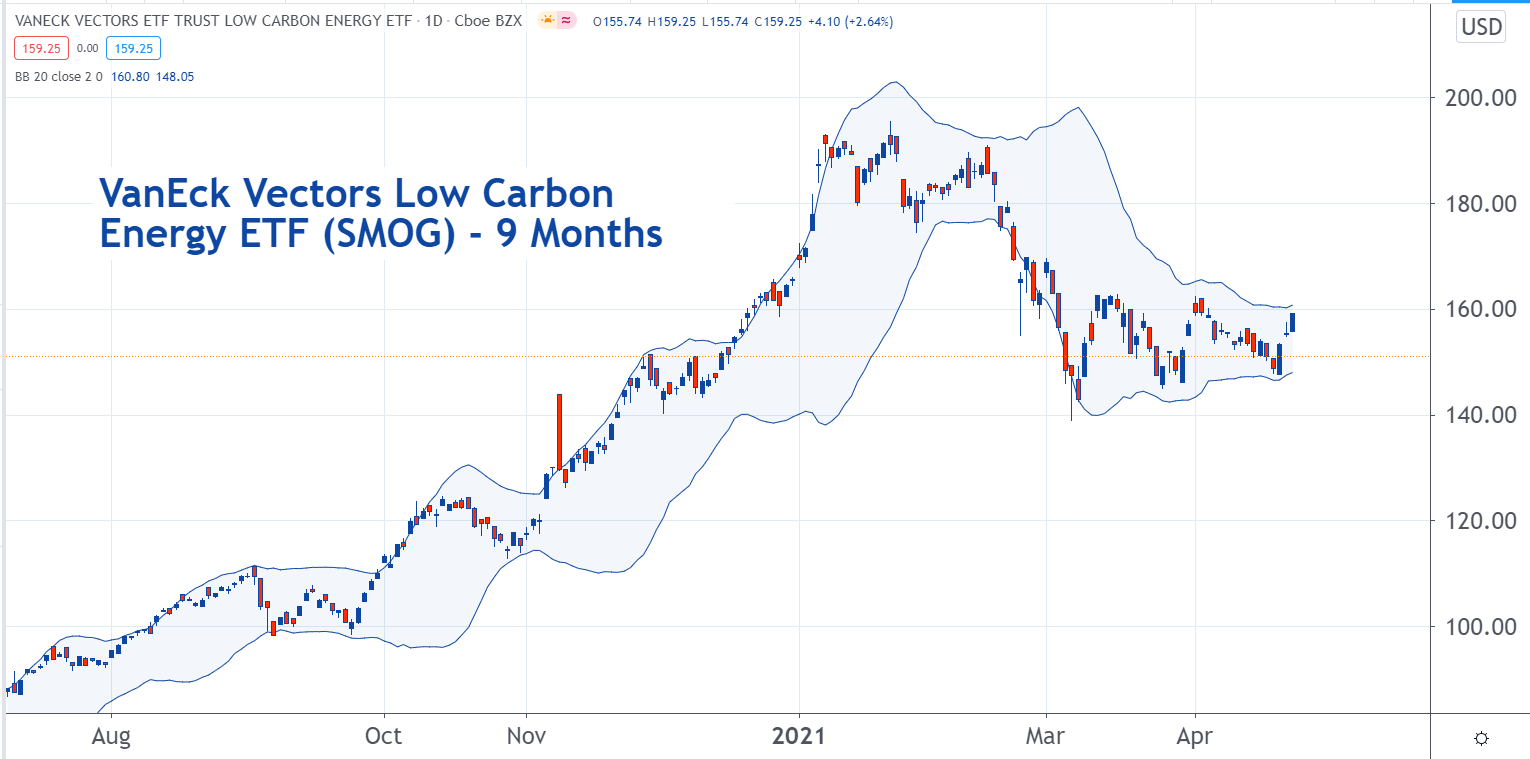

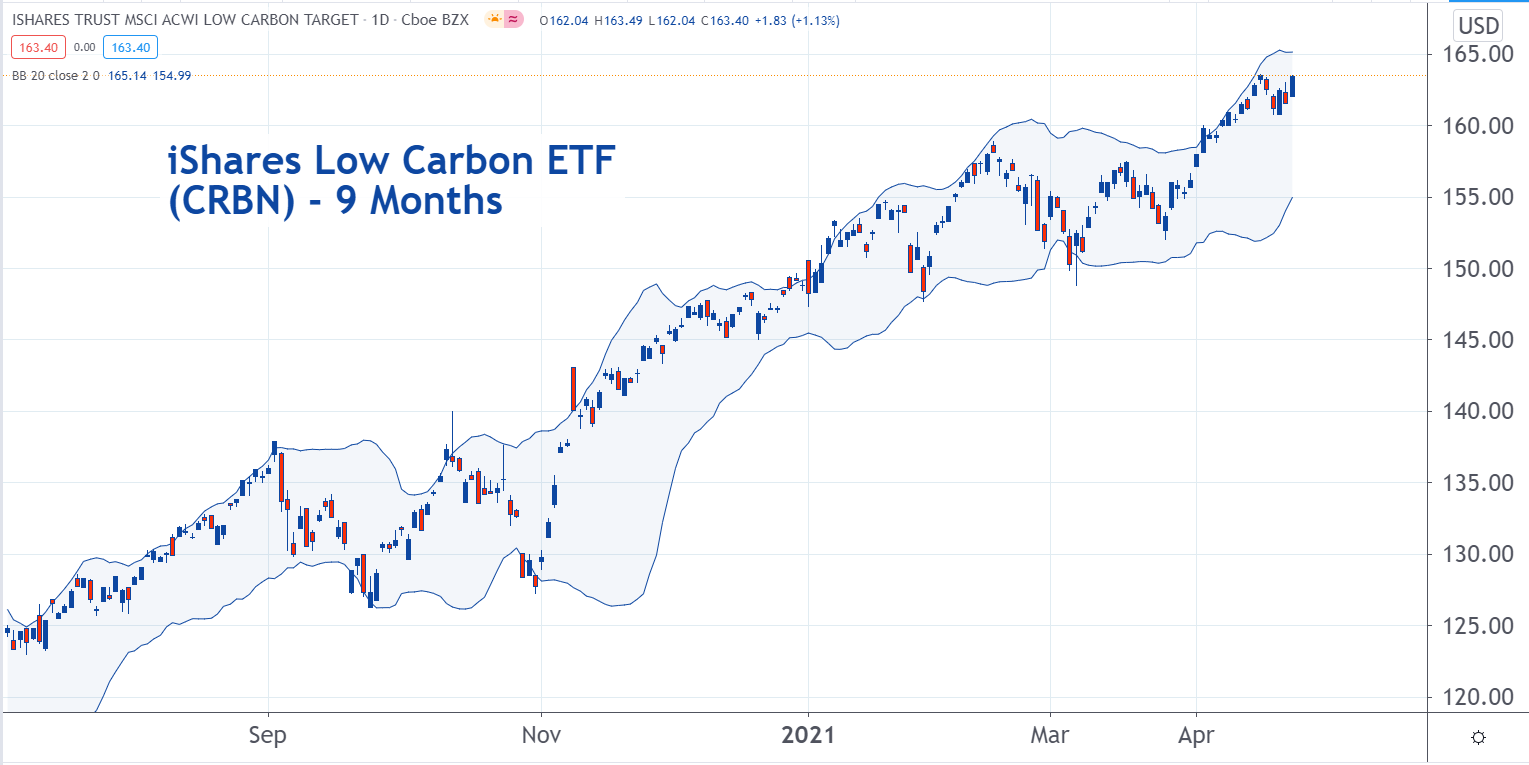

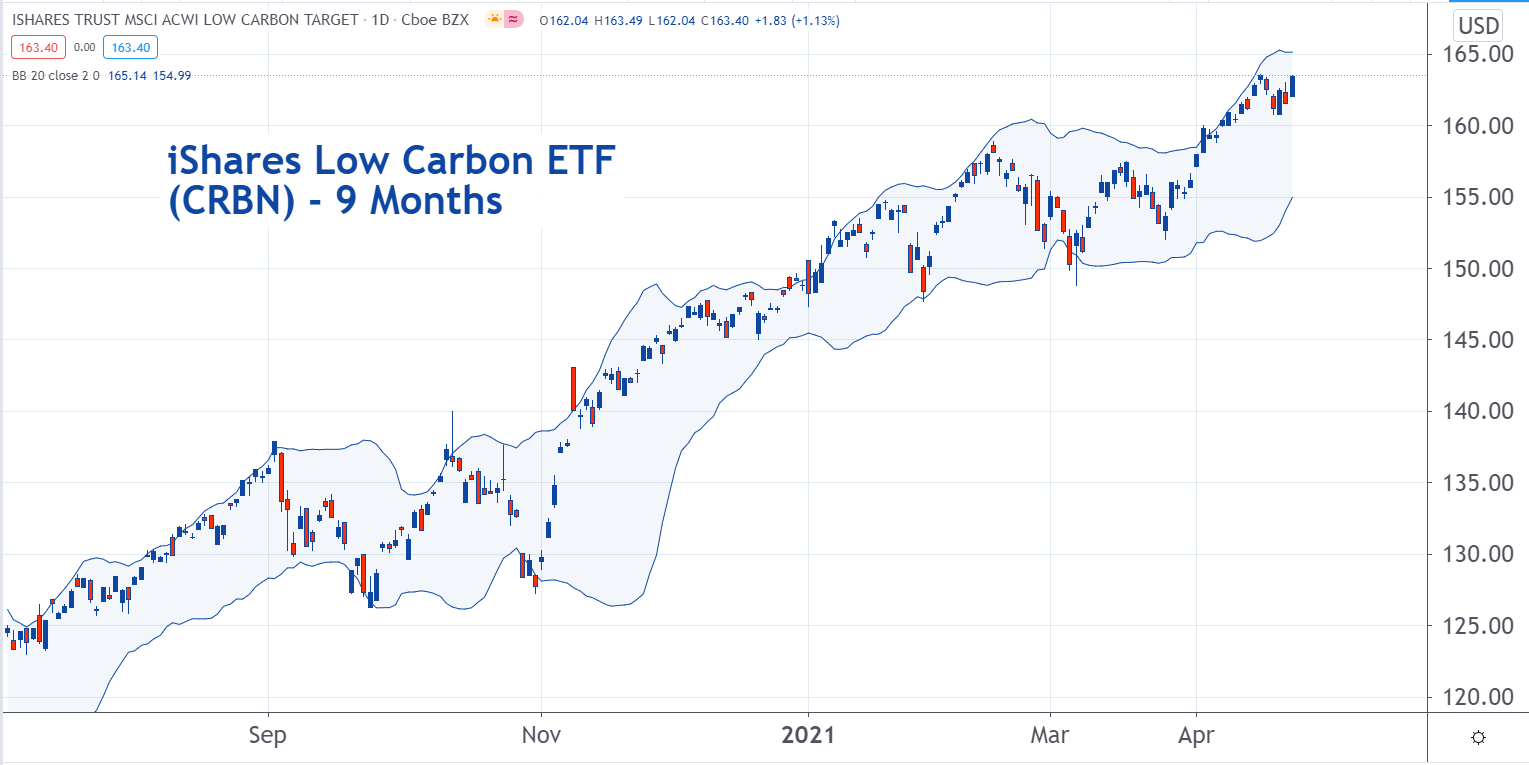

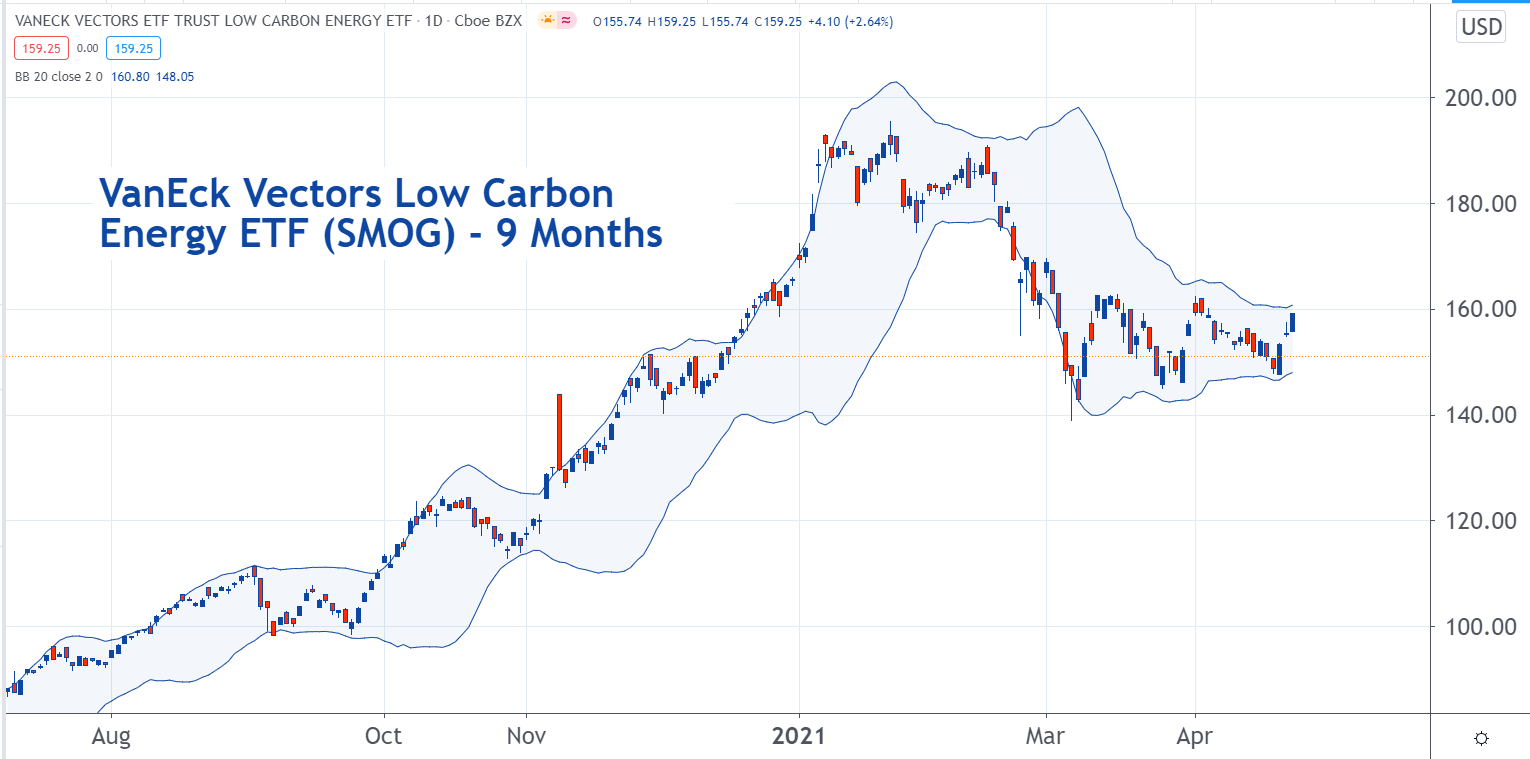

Investors interested in this part of the market but who are seeking some diversity should consider carbon capture ETFs. These include the KraneShares Global Carbon ETF (NYSE:KRBN), the VanEck Vectors Low Carbon Energy ETF (NYSE:SMOG), and the iShares MSCI ACWI Low Carbon Target ETF (NYSE:CRBN).

KRBN has net assets of $38.7 million. The average daily volume is about 300,000. The expense ratio is 0.79%.

SMOG is larger than KRBN. It has net assets of about $305 million. The 0.62% expense ratio is also lower.

CRBN is the largest, and cheapest, of these ETFs. It may be the best option of the three. The net assets are $770 million and the expense ratio is 0.20%.

Posted In: CRBN KRBN SMOG